DCB Bank Hikes Savings Account & Fixed Deposit Interest Rates Effective From Today

Ahead of the Reserve Bank Governor-led, six-member Monetary Policy Committee (MPC) meeting scheduled for October 4-6, 2023, DCB Bank surprisingly raised its interest rates on savings accounts and fixed deposits (FD) of less than Rs 2 Cr on Wednesday. Following today's announcement, DCB customers with savings accounts will earn a maximum of 8.00%, while those with fixed deposits can earn a maximum of 7.90%. The revised rates for savings accounts and FDs are effective as of September 27 according to the bank's official website.

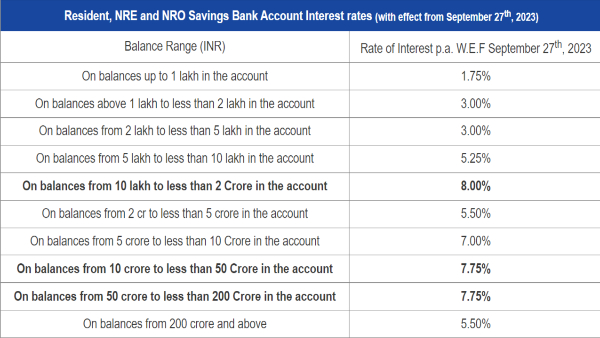

DCB Bank Savings Account Interest Rates

The bank is paying an interest rate of 1.75% on savings account balances up to 1 lakh, and DCB Bank is offering an interest rate of 3.00% on balances between 1 lakh and less than 5 lakh. For account balances between 5 lakh and less than 10 lakh and between 10 lakh and less than 2 crore, DCB Bank is giving an interest rate of 5.25% and 8.00%, respectively. The bank offers an interest rate of 5.50% on savings account balances between Rs 2 crore and Rs 5 crore, while DCB Bank offers an interest rate of 7.00% on balances between Rs 5 crore and Rs 10 crore.

On balances from 10 crore to less than 200 Crore in the account, savings account customers of DCB Bank will get an interest rate of 7.75% and on savings account balance of Rs 200 crore and above, the bank is paying an interest rate of 5.50%.

DCB Bank FD Rates

The bank is presently giving an interest rate of 3.75% on FDs that mature in the next 7 to 45 days, and DCB Bank is paying an interest rate of 4.00% on FDs that mature in the next 46 to 90 days. For deposits maturing in 91 days to less than six months, DCB Bank pays an interest rate of 4.75%, and for deposits maturing in six months to less than ten months, 6.25%. Deposits with maturities between 10 and 12 months will earn interest at a rate of 7.25%, while those with maturities longer than 12 months will earn interest at a rate of 7.15%.

On FDs maturing in 12 months 1 day to 12 months 10 days, the bank is paying an interest rate of 7.75% and on those maturing in 12 months 11 days to less than 18 months 5 days, DCB Bank is now offering an interest rate of 7.15%. DCB Bank is now offering an interest rate of 7.50% on a deposit tenor of 18 months 6 days to less than 700 days and 7.55% on 700 days to less than 25 months tenure. Deposits maturing in 25 months to 38 months will now fetch an interest rate of 7.90% and those maturing in more than 38 months to less than 61 months will fetch an interest rate of 7.40%.

Senior citizens will get an additional interest rate that is 50 basis points higher than the standard rate for all tenures.

7 days to 45 days: 3.75%

46 days to 90 days: 4.00%

91 days to less than 6 months: 4.75%

6 months to less than 10 months: 6.25%

10 months to less than 12 months: 7.25%

12 months: 7.15%

12 months 1 day to 12 month 10 days: 7.75%

12 months 11 days to less than 18 months 5 days: 7.15%

18 months 6 days to less than 700 days: 7.50%

700 days to less than 25 months: 7.55%

25 months to 26 months: 7.90%

More than 26 months to less than 37 months: 7.60%

More than 37 months to 38 months: 7.90%

More than 38 months to less than 61 months: 7.40%

61 months: 7.65%

More than 61 months to 120 months: 7.25%

Source: Bank Website

Click it and Unblock the Notifications

Click it and Unblock the Notifications