Canara Bank Revises Fixed Deposit (FD) Interest Rates: Details Inside

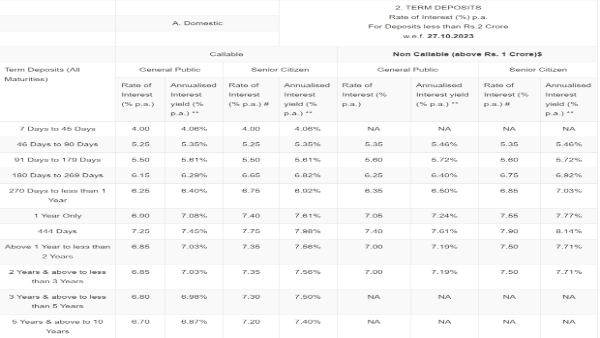

The interest rates on fixed deposits of less than Rs 2 Cr have been revised by public sector lender Canara Bank. After the modification, senior citizens can earn up to 7.75% on a tenure of 444 days, while the general public can earn up to 7.25%. Canara Bank now offers interest rates on deposits that last from seven days to ten years, ranging from 4.00% to 6.70%. The latest FD rates offered by Canara Bank were in effect as of October 27, 2023, according to the bank's official website.

Canara Bank FD Rates

The bank offers a 4% interest rate on deposits maturing in 7 to 45 days, and Canara Bank offers a 5.25% interest rate on deposits maturing in 46 to 90 days. For deposits made between 91 and 179 days, Canara Bank is giving an interest rate of 5.50%; for deposits made between 180 and 269 days, the rate is 6.15%. The interest rate on deposits maturing in 270 days to less than a year is 6.25%, while the interest rate on deposits maturing in a year only is 6.90%.

The bank is paying a maximum return of 7.25% on FDs that mature in 444 days, and Canara Bank is offering an interest rate of 6.85% on those maturing from above 1 year to less than 3 years. FDs maturing in 3 years and above but less than 5 years are going to earn an interest rate of 6.80%, whilst Canara Bank FDs that mature in 5 years and above but less than 10 years will generate an interest rate of 6.70%.

Canara Bank will keep its pledge to provide senior citizens with an additional 0.50 percent interest rate on deposits under Rs. 2 crores and with a tenor of 180 days or more. Under the Canara-444 product exclusively, an additional rate of interest of 0.60% is available to Super Senior Citizens aged 80 and above. This translates to 7.85% for callable deposits and 8% for non-callable deposits.

Premature or partial withdrawal or extension of domestic or NRO term deposits less than Rs. 2 crore would result in a penalty of 1.00%. "Penalty is waived for premature extension of Domestic / NRO term deposits of less than Rs.2 Crore during the tenure, where extension is for a period longer than the period originally agreed to," mentioned Canara Bank on its website.

While operating profits climbed by 10.30% (yoy) to Rs 7,616 Cr, Canara Bank recorded a net profit of Rs 3,606 Cr for the quarter ended September 30, 2023, compared to Rs 2,525 Cr for September 2022. Net interest income jumped by 19.76% to Rs 8,903 Cr, while net interest margin improved by 19 basis points to 3.02% in Q2FY24.

According to Canara Bank, its Gross NPA Ratio dropped by 161 basis points to 4.76% in Q2FY24, while its Net NPA Ratio plummeted by 78 basis points to 1.41%. As of September 2023, the bank's provision coverage ratio (PCR) has increased by 337 basis points to 88.73%. The bank reports that its return on assets climbed to 1.01% in Q2FY24 from 0.71% in Q2FY23 and its return on equity improved to 22.51% in Q2FY24 from 17.37% in Q2FY23.

Click it and Unblock the Notifications

Click it and Unblock the Notifications