Breakout Stocks To Buy: From CIL To Bajaj Auto - 3 Buy Call Recommendations By Motilal Oswal

Based on technical analysis, the broking & distribution firm Motilal Oswal Financial Services Ltd.'s technical and derivatives team recommended three stocks to buy this week. According to the brokerage, the stocks in the bucket include Dixon Technology, Bajaj Auto, and Coal India, all of which have shown breakouts and potential upside on their chart patterns.

Coal India

BUY COAL INDIA AT CMP: Rs 491, STOP-LOSS: Rs 470, TARGET: Rs 530

Coal India is in overall uptrend and forming higher lows on monthly scale from past eight months. On weekly scale the stock gave consolidation breakout and holding well at higher zones. On daily scale the stock has retested the same and inched higher. It is trading above its short term moving averages and supports are gradually shifting higher. Momentum indicator Relative Strength Index (RSI) is positively placed which may support the ongoing up move. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 470 levels on closing basis for a new high target towards 530 zones.

Bajaj Auto

BUY BAJAJ AUTO AT CMP: Rs 9085, STOP-LOSS: Rs 8800, TARGET: Rs 9600

Bajaj Auto is in overall uptrend and consolidating at higher zones on weekly scale from past nine weeks. On daily scale the stock gave trend line breakout and respecting to its 50DEMA from past many sessions. RSI oscillator is placed in the bullish territory which will take the price to higher levels. Stock has been huge outperformer within Auto space and likely to scale new record highs. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 8800 levels on closing basis for a new high target towards 9600 zones.

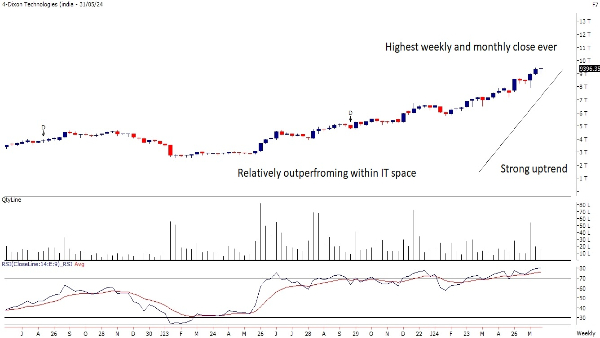

Dixon Technology

BUY DIXON TECHNOLOGY AT CMP: Rs 9396, STOP-LOSS: Rs 9050, TARGET: Rs 10000

Dixon is in overall uptrend and forming higher highs - higher lows structure on monthly scale. On weekly scale it formed an Inside bar but structure of higher lows is intact and managed to give highest week close. On daily scale the stock gave small consolidation breakout above 9200 zones and trading above its short term moving averages. Momentum indicator Relative Strength Index (RSI) is also holding at higher zones which indicates overall strength in the stock. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 9050 levels on closing basis for a new life time high target towards 10000 zones.

Market Outlook

"There is bit of uncertainty as investors are concerned about the slowdown of reforms that had been initiated under the BJP-led government. This uncertainty has triggered a correction in the markets as investors reassess the outlook under the new political landscape. We would like to believe that the development agenda that spurred the performance of equity is likely to persist, irrespective of the party in power. Some of the reforms implemented are integral to the long-term growth and efficiency of these companies / country and are unlikely to be undone easily. Consequently, once the initial shock subsides and market sentiment steadies, the markets are anticipated to regain stability, with its performance aligning more closely with its underlying fundamentals," said Vinit Sambre, Head - Equities at DSP Mutual Fund.

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications