Breakout Stocks To Buy: From BHEL To ONGC; Top 3 Picks of Motilal Oswal For The Week

Three stocks have been selected for buying this week by the technical & derivatives team of the broking & distribution company Motilal Oswal Financial Services Ltd. on the basis of recent technical breakouts. The brokerage company's research experts have initiated buy calls on ONGC, BHEL, and TVS Motor Company shares.

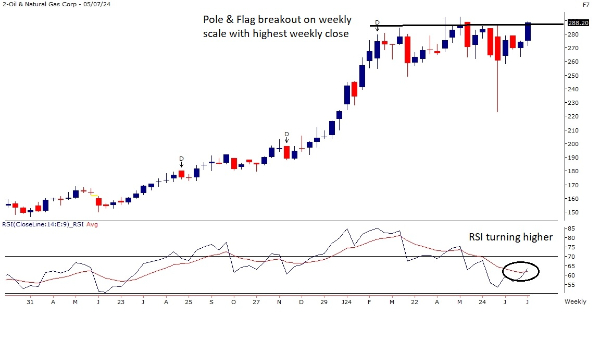

ONGC Share Price Target

BUY ONGC AT CMP: Rs 288, STOP-LOSS: Rs 278, TARGET: Rs 310

ONGC is on the verge of Pole & Flag breakout on the weekly scale after twenty weeks and formed a strong bullish candle. On a daily scale as well it gave consolidation breakout above 280 zones and formed a strong bullish candle and gave the highest daily close. It is taking support near its 50DEMA and momentum RSI oscillator gave a bullish crossover which suggests momentum to continue in coming sessions. Thus looking at the overall chart structure we are recommending to buy the stock with keeping stop loss below 278 levels on a closing basis for a new high target towards 310 zones.

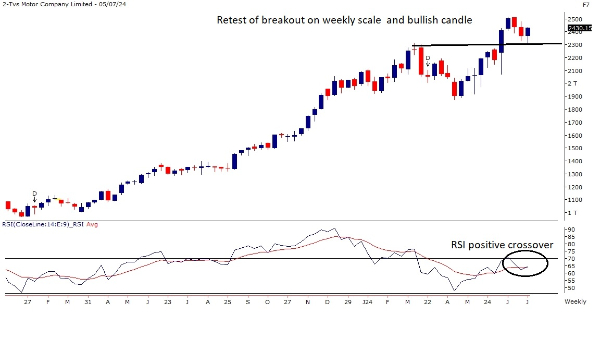

TVS Motor Company Share Price Target

BUY TVS MOTOR AT CMP: Rs 2430, STOP-LOSS: Rs 2360, TARGET: Rs 2600

TVS Motor is in an overall uptrend and forming higher lows on a monthly scale from the last three months. On a weekly scale, the stock retested the previous breakout zone and formed a bullish candle. On a daily scale, the stock negated the formation of lower top - lower bottom of the last fourteen sessions and formed a strong bullish candle. Momentum oscillator Relative Strength Index (RSI) is also on the verge of positive crossover which indicates momentum to pick up in coming sessions. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 2360 levels on a closing basis for a new life time high target towards 2600 zones.

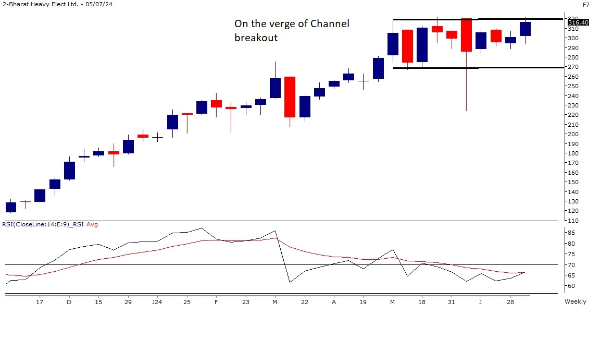

BHEL Share Price Target

BUY BHEL AT CMP: Rs 316, STOP-LOSS: Rs 303, TARGET: Rs 340

BHEL has been consolidating at higher band in between 295 to 320 zones for the past nine weeks and formed a strong bullish candle on a weekly scale. It is on the verge of channel breakout above 320 zones and small follow up could start the next leg of rally. Stock is trading above its short term moving averages and good buying interest is visible across PSU stocks which will support the ongoing up move. Thus looking at the overall chart structure we are recommending to buy the stock with keeping the stop loss below 303 levels on a closing basis for a new life time high target towards 340 zones.

Disclaimer

The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications