BOB Vs PNB: Check Latest Fixed Deposit (FD) Rates Revised From October

Plenty of financial institutions have started to offer attractive interest rates on their fixed deposit products in an effort to draw customers during the festive season. Punjab National Bank (PNB) and Bank of Baroda (BOB), two of the top PSU banks in India, are used as examples here. The interest rates on fixed deposits of less than Rs 3 Cr have been revised by both banks in a surprise move that will take effect in October.

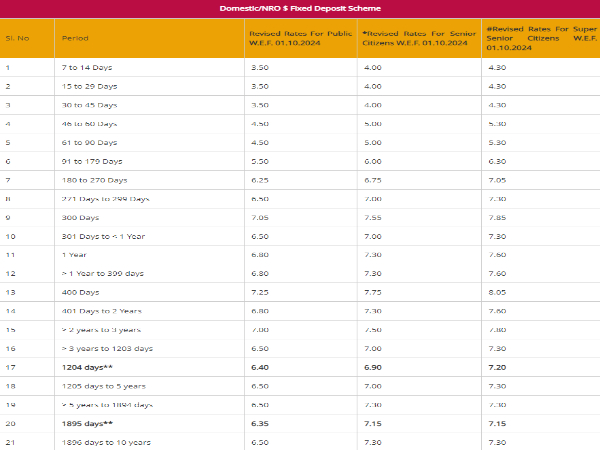

PNB FD Rates

The latest revised FD rates of Punjab National Bank (PNB) are effective as of 1st October 2024 as per the official website of the bank.

On fixed deposits of less than Rs 3 Cr the bank is paying an interest rate of 3.50% on a period of 7 to 45 days while on a tenure of 46 to 90 days, PNB is offering an interest rate of 4.50%. PNB is providing interest rates of 6.25% for a deposit term of 180 to 270 days and 5.50% for a deposit tenure of 91 to 179 days. Interest rates on PNB fixed deposits maturing in 271 to 299 days are 6.50%, while interest rates on deposits maturing in 300 days are 7.05%.

The bank is paying 6.50% interest on fixed deposits that mature between 301 days to 1 year, whereas PNB is offering 6.80% interest on deposits maturing in 1 year to 399 days. For a 400-day tenure, PNB is giving an interest rate of 7.25%; for a 401-day to 2-year duration, it is 6.80%. Fixed deposits at PNB that mature in two years to three years will earn interest at a rate of 7.00%, while those that mature in three years to 1203 days will now earn interest at a rate of 6.50%.

The bank is now paying an interest rate of 6.40% on fixed deposits maturing in 1204 days, and PNB is giving an interest rate of 6.50% on those coming to an end in 1205 days to 1894 days. For a fixed deposit term of 1895 days, PNB is giving an interest rate of 6.35%; for a term of 1896 days to 10 years, the rate is 6.5%.

"Two buckets of 1204 days & 1895 days have been specifically identified under the PNB Palaash scheme, to commemorate our Banks's foundation day, i.e. 12th of April, 1895," mentioned PNB on its website.

Super senior citizens, who are 80 years of age or older, will receive an additional rate of interest of 80 bps over applicable card rates across all maturity buckets on domestic deposits of less than Rs. 3 crore. Senior citizens, who are 60 years of age or older and under 80 years of age, will receive an additional rate of interest of 50 bps over applicable card rates for a tenure up to 5 years and 80 bps for a time frame over 5 years.

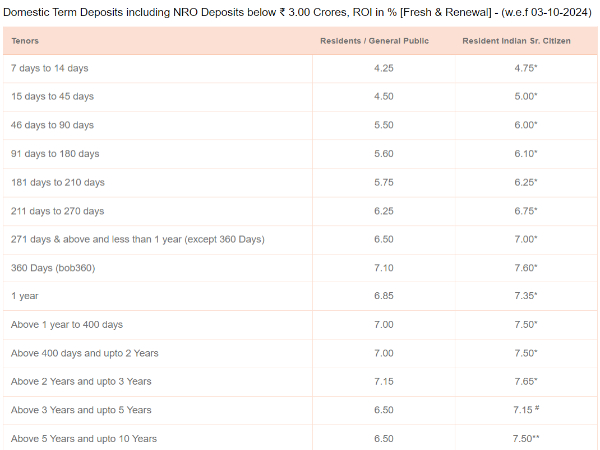

BOB FD Rates

The latest fixed deposit interest rates of Bank of Baroda stand revised as of 3rd October 2024 as per the bank's official website.

On fixed deposits of less than Rs 3 Cr, the bank is paying an interest rate of 4.25% on deposits maturing in 7 days to 14 days and 4.50% on the duration of 15 days to 45 days. For fixed deposit terms ranging from 46 to 90 days, BOB is giving an interest rate of 5.50%; for terms ranging from 91 to 180 days, the rate is 5.60%. Interest rates on BOB fixed deposits maturing in 181-210 days will be 5.75%, while interest rates on deposits maturing in 211-270 days will be 6.25%.

On fixed deposits maturing in 271 days & above and less than 1 year (except 360 Days), the bank is paying an interest rate of 6.50% whereas on those maturing in 360 days (bob360), Bank of Baroda will pay an interest rate of 7.10%. Bank of Baroda will pay an interest rate of 6.85% on tenure of 1 year and 7.00% on fixed deposit tenure of above 1 year to upto 2 years. Domestic term deposits at BOB maturing in above 2 years and upto 3 years will fetch an interest rate of 7.15% while those maturing from above 3 years and upto 10 years will fetch 6.50% interest.

Click it and Unblock the Notifications

Click it and Unblock the Notifications