Axis Bank Revises FD Rates Effective From Today, Get Up To 7.20% Return Now

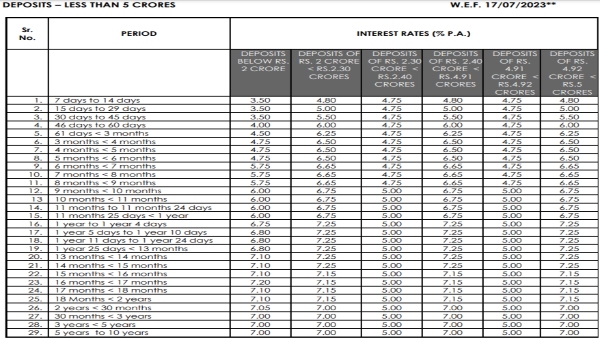

The private sector lender Axis Bank has revised its interest rates on fixed deposits (FDs) of less than Rs 2 Cr effective from today. Following the revision, the bank is now offering interest rates ranging from 3.50% to 7.00% for the general public and 6.00% to 7.75% for senior citizens. The general public will receive a maximum return of 7.20% on a deposit tenor of 16 to 17 months, while elderly individuals would receive a maximum return of 7.95%. As per the website of the bank, the new FD rates are effective as of 17/07/2023.

Axis Bank FD Rates

The bank now offers a 3.50% interest rate on fixed deposits that mature within the next 7 days to 45 days, while Axis Bank also offers a 4% interest rate on deposits maturing in the next 46 days to 60 days. The current interest rates offered by Axis Bank are 4.50% for deposits placed between 61 days and 3 months and 4.75% for deposits established between 3 months and 6 months. Deposits that mature in 6 to 9 months will now earn interest at a rate of 5.75%, while those that mature in 9 to 12 months will now earn interest at a rate of 6%.

The bank currently offers an interest rate of 6.75% on fixed deposits maturing in one year to one year and four days, while Axis Bank also offers an interest rate of 6.80% on deposits maturing in one year and five days to thirteen months. The current interest rates offered by Axis Bank are 7.10% for deposits with a tenor of 13 months to 16 months and 7.20% for deposits with a tenor of 16 months to 17 months. The interest rate on deposits will now be 7.10% for those maturing in 17 months to 2 years and 7.05% for those maturing in 2 years to 30 months.

Axis Bank is now offering an interest rate of 7.00% on fixed deposits tenure of 30 months to 10 years.

With Axis Bank, you can open a fixed deposit online and deposit a minimum of Rs 5,000 for a flexible term ranging from seven days to ten years. Senior citizens searching for consistent income might choose the monthly interest payment option. There is no TDS if the total interest income from all of your FDs is less than Rs 40,000 for the general public and Rs 50,000 for senior citizens. If a PAN is submitted to the bank, TDS of 10% is applied. TDS is 20% if a PAN is not deposited in the bank. All types of FD interest are taxed in accordance with your income tax bracket and are included in your income tax.

Click it and Unblock the Notifications

Click it and Unblock the Notifications