Alert! Axis Bank’s FD Rates Get A Surprise Revision With Up to 6.6% Return; Here’s What You Need To Know

For its fixed deposit customers, Axis Bank has released an important announcement. The bank has implemented revised interest rates for its domestic fixed deposits as of November 21, 2025. These rates vary by deposit amount and period and apply to both regular individuals and senior citizens. This article provides you with the latest Axis Bank rate card for deposits under Rs 3 Cr, whether you're locking in funds for a few years or maintaining money for a few weeks.

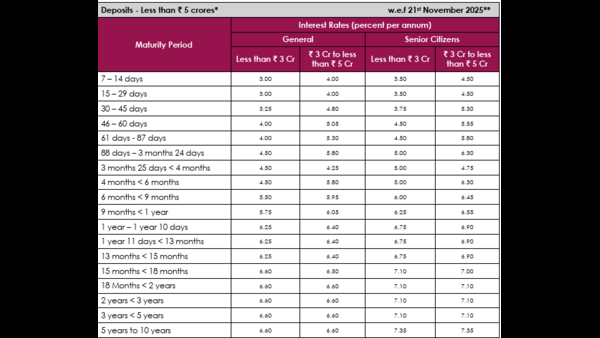

Axis Bank FD Rates

With effect from November 21, 2025, Axis Bank has updated its domestic fixed deposit interest rates for deposits under Rs 3 crore, providing distinct rates for general and senior citizen depositors over a range of maturity periods.

Interest rates for regular customers with deposits under Rs 3 crore range from 3.00% to 6.60% while deposits between Rs 3 crore and less than Rs 5 crore earn between 4.00% and 8.00% per annum.

With rates ranging from 3.50% to 7.35% for deposits under Rs 3 crore and 4.50% to 8.00% for deposits between Rs 3 crore and less than Rs 5 crore, elderly individuals receive an additional benefit.

For various slabs, short-term deposits of 7-14 days and 15-29 days return 3.00% to 4.50%, 30-45 days return 3.25%-4.50%, and 46-60 days offer 4.00%-5.50%. Deposits from 3 months 25 days to less than 6 months earn 4.50%-6.30%, while medium tenures such as 61-87 days and 88 days to 3 months 24 days provide 4.00%-5.80%.

Rates will go as high as 5.50%-6.30% for six months to less than nine months and to 5.75%-6.25% for nine months to less than a year. With 6.25%-8.00%, the 1 year to 1 year 10 days category offers one of the highest returns, while the 1 year 11 days to less than 13 months and 18 months to less than 2 years categories give 6.25%-7.20%.

Longer maturities provide higher returns: 2 years to less than 3 years earn 6.60%-7.10%, 3 years to less than 5 years earn 6.60%-7.10%, and the highest tenure of 5 years to 10 years pays 6.60%-7.35% for older individuals.

Click it and Unblock the Notifications

Click it and Unblock the Notifications