85-Years Old Private Bank Hikes Fixed Deposit (FD) Rates By 40 Bps: Details Inside

Founded in 1938, Jammu and Kashmir Bank (J&K Bank) is one of India's oldest private sector banks and a scheduled commercial bank. The bank has its corporate headquarters located in Srinagar and is listed on both the NSE and the BSE. The bank has made interest rate revisions on its fixed deposits (FDs) of less than Rs 2 Cr. Following the revision the bank has hiked FD rates by 40 bps effective from November 11, 2023.

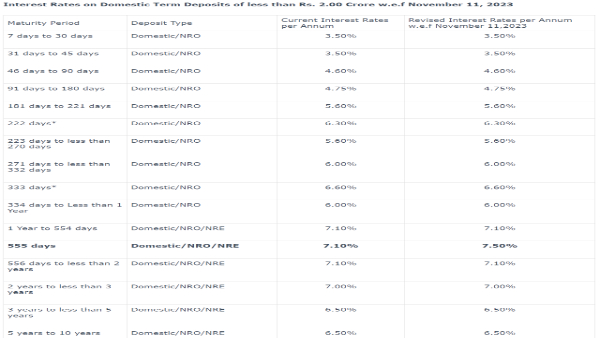

J&K Bank FD Rates

The bank will still give a 3.50% interest rate on domestic term deposits that mature between 7 to 45 days, while J&K Bank will continue to offer a 4.60% interest rate on deposits maturing in 46 to 90 days. For deposits made between 91 and 180 days, J&K Bank will pay an interest rate of 4.75%; for deposits made between 181 and 221 days, the interest rate will be 5.60%. Deposits maturing in 223 days to less than 270 days will earn an interest rate of 5.60%, while those that mature within 222 days will provide an interest rate of 6.30%.

The bank will continue to give an interest rate of 6.00% on FDs that mature in 271 days to less than 332 days, while Jammu and Kashmir Bank (J&K Bank) will continue to offer an interest rate of 6.60% on those maturing in 333 days. The interest rate that Jammu and Kashmir Bank (J&K Bank) is offering is 6.00% for deposits with a tenor of 334 days to less than a year, and 7.10% for deposits with a tenor of 1 year to 554 days. Deposits maturing in 555 days will now fetch 40 bps higher return of 7.50% which was 7.10% earlier while those maturing in 556 days to less than 2 years will continue to offer an interest rate of 7.10%.

The bank is paying an interest rate of 7.00% on FDs maturing in 2 years to less than 3 years, and J&K Bank is paying an interest rate of 6.50% on FDs that mature in 3 years to less than 5 years. The bank will keep paying interest at a rate of 6.50% on deposits made between five and ten years from now. Senior Citizens over 60 who have domestic term deposits will continue to get a 0.50 per cent additional rate on all maturities. For deposits under Rs. 2.00 crore, the aforementioned rates apply to both new deposits and the renewal of maturing accounts.

The second quarter of 2023 saw a 56.5% YoY rise in the net profit of Jammu and Kashmir Bank Ltd, which came to Rs 381.1 crore. Jammu and Kashmir Bank reported a net profit of Rs 243.5 crore during the same period the previous year, according to a regulatory filing from the bank. In comparison to the same quarter in FY23, when it was Rs 1,204.2 crore, net interest income (NII) grew by 10.8% to Rs 1,333.8 crore in Q2FY24.

Compared to 5.77% in the June quarter of 2023, the gross non-performing asset (GNPA) was 5.26% in the September quarter. In comparison to 1.39% in Q1FY24, the net NPA was 1.04% in Q2FY24. The bank's net non-performing assets (NPA) was Rs 917.4 crore as opposed to Rs 1,176.9 crore quarter-on-quarter, and its gross non-performing assets (NPA) were Rs 4,826.7 crore in Q2FY24 vs Rs 5,103.7 crore in Q1FY24.

Click it and Unblock the Notifications

Click it and Unblock the Notifications