4 Plastic Pipe Stock Ideas From Prabhudas Lilladher

Prabhudas Lilladher did a coverage on plastic pipes sector, which is a part of home buildings materials. Home building materials include plastic pipes, tiles, wood panel, sanitaryware and faucets, this market is estimated to touch Rs 2.7tn by FY26 from Rs 1.3tn in FY22.

As per the report, home buildings market, was impacted during the calendar year CY13-20 due to slowdown in real estate, while GST implementation, demonetization and Covid-19 pandemic affected over FY16-21, which resulted in single digit growth CAGR of approximately 6% during same period.

Plastic pipes industry is one of the important pillars of development, currently the market is valued at approximately Rs 400 billion with organized players accounting for approximately 67% of the market. By end use, 50-55% of the industry's demand is accounted by plumbing pipes used in residential and commercial real estate, 35% by agriculture and 5-10% by infrastructure and industrial projects. Between FY09-21 industry grew at 10%-12% CAGR.

Brokerage report has anticipated that the demand for plastic pipes will expand at 12%-14% CAGR between FY21-25 and more than Rs 600bn by FY25E led by a sharp increase in government spending on irrigation, water supply and sanitation projects, urban infrastructure and replacement demand.

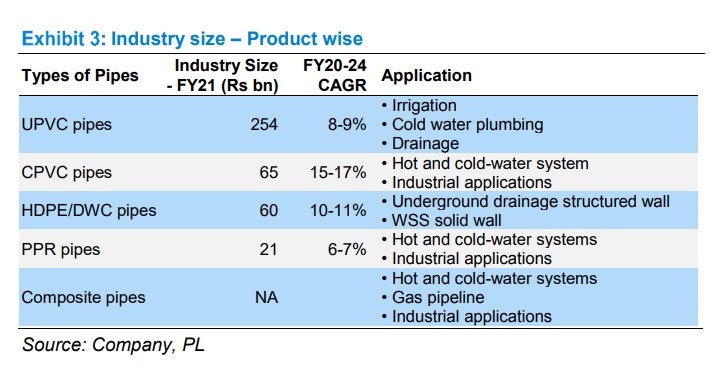

Different pipe products are available for various applications.

Based on the anticipated demand industry's growth, the brokerage has recommended investors to buy shares of four companies; Astral Limited, Finolex Industries, Prince Pipes & Fittings and Supreme Industries.

Buy stock of Astral, with a target price of Rs 2160 per share

Astral Limited is a complete home building materials company, it is the domestic market leader in in niche CPVC pipes & fittings market. From being a growth-focused company it has successfully diversified from being a pipes and fittings manufacturer to home building products player. Innovations, proven track record and execution prowess helped Astral to not only entrench its position in domestic market, but also enhance presence in newer markets. We expect its plastic business (pipes & fittings and tanks) to be at ~70% of its sales by FY25E from ~79% in FY16, given diversification in business.

Brokerage feels that Astral is a consistent quality performer that it is a compounding story. "Given its strong market-share gains in core plastic piping business ( approximately 200bps over FY20-22), strong brand positioning, new product launches to continuously increase addressable markets, strong cash flow (FCF of Rs 2 billion in FY22) besides net debt-free balance sheet with improved working capital ( roughly 21days) and robust growth in adhesive business (19.3% CAGR over FY17-22). We estimate Sales, EBITDA and PAT to grow at CAGR of 14.6%, 22.4% and 31.2% over FY23-25E. We value the stock on DCF to arrive at a target price of Rs 2,160. Initiate 'BUY'"

Buy stock of Finolex Industries Limited, with a target price of Rs 224 per share

Finolex industries is a leader in providing pipes for agriculture and only backwater player in PVC business. The company' agriculture pipes segment is approximatley 65% of it's PVC pipes volume and , well known for its strong brand, product quality and aggressive pricing compared to competitors and the only backward integrated player in PVC piping business and thus, is a major beneficiary of stabilisation in PVC resin prices.

According to the brokerage report, "Over FY22-25E, we expect company's RoCE (excluding cash and investment) and earnings to improve with stabilisation in margins and improvement in volume growth. The company also has a healthy dividend pay-out ratio, which should improve further owing to expected special dividend on account of second tranche of Pune land deal. Over FY17-22, FNXP delivered healthy financials with sales, EBITDA and PAT CAGR of 12.3%, 12.7% and 23.7% and average EBITDA margin of 20.7%. We expect sales, EBITDA and PAT CAGR of 7.7%, 31.9% and 25.6% over FY23-25E and arrive at price target of Rs 224 on SOTP (valuing business at 21x FY25 EPS). Initiate 'BUY'."

Buy shares of Prince Pipes and Fittings, with a target price of Rs 693 per share

As per Prabhudas Lilladher, the Prince Pipes and Fittings is well placed to capitalize on huge opportunities in plastic pipes space. It is one of India's largest pipe & fittings manufacturer, with an overall capacity of 315K MTPA spread across 7 facilities and has a wide distribution network of 1500+ channel partners with roduct portfolio of over 7,200+ SKUs.

"Over FY17-22 the company reported healthy revenue, EBITDA and Net profit CAGR of 16.3%, 20.6% and 27.4% along with improving operating margins (expanded by 260 bps over same period) and robust return ratios (avg. RoCE of 23.4% over same period). Given majority of near term capex to complete by FY23, we believe the company's performance should further improve through focus on increasing asset turns, debt repayment and better FCF generation. The stock is currently trading at 27x/22x FY24E/FY25 earnings. Initiate 'BUY' rating and target price of Rs 693."

Buy stock of Supreme Industries, with a target price of Rs 3,177 per share

Prabhudas Lilladher explains, "We initiate coverage on Supreme Industries with a 'BUY' rating and target price of Rs 3,170 valuing it at 34x FY25E earnings. We believe it is structurally placed to capture the plastic processing industry demands given; diverse product portfolio in piping systems, packaging products, industrial components and furniture, 27 manufacturing locations across India, with wide pan India distributors network of 4053 channel partners, reported sales volumes of around 0.4-0.5mn MT annually and strong industry leading performance over past years in terms of earnings growth (CAGR of 16% over FY10-22), impressive return ratios ( approximatley 29% average RoCE of last ten years), dividend pay-outs with maintain balance sheet strength (debt-free and controlled working capital cycle of 45days) and efficient governance. Over FY16-22 the company reported healthy Revenue, EBITDA and PAT CAGR of 17%, 18% and 28% and we expect 11.2%, 23.9% and 21.5% for FY23-25E, with improvement in EBITDA margin by 300bps."

| Company Name | Current market price (Rs/share) | Market Capitalisation (Rs in crore) |

|---|---|---|

| Astral Limited | 1912.20 | 38,522.93 |

| Finolex Industries Limited | 168.45 | 10,451.93 |

| Prince Pipes and Fittings Ltd | 577.20 | 6,381.59 |

| Supreme Industries Limited | 2738.25 | 34,783.13 |

Disclaimer:

The stocks have been picked from the brokerage report of Prabhudas Lilladher, Greynium Information Technologies and the Author, and the respective Brokerage house are not liable for any losses caused as a result of decisions based on the article. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications