113-Years-Old Public Sector Bank Revises Fixed Deposit (FD) Interest Rates

Central Bank of India, which opened its doors in 1911, was the nation's first fully Indian-owned and operated commercial bank. Because of its extensive network that spans all 28 states as well as seven of India's eight union territories, Central Bank of India is a very notable public sector bank, with a network of 4493 branches, 1 extension counter, and 10 satellite offices spread throughout many locations around the nation as of March 2023. The bank has revised its interest rates on fixed deposits of less than Rs 2 Cr and following the revision, retail investors will earn as high as 7% and senior citizens can earn 7.50% on 2 to 3 years tenure.

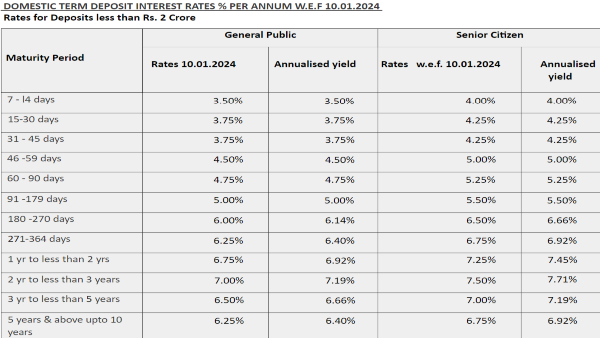

Central Bank of India FD Rates

On domestic term deposits maturing in 7 - l4 days, the bank is offering an interest rate of 3.50% and for those maturing in 15-45 days, Central Bank of India is now offering an interest rate of 3.75%. Central Bank of India is now offering interest rates of 4.50% for 46-59 day deposit terms and 4.75% for 60-90 day terms. The interest rate on deposits that mature in 91-179 days will now be 5.00%, while the interest rate on deposits maturing in 180-270 days will now be 6.00%.

On deposits maturing in 271-364 days, the bank is now guaranteeing a return of 6.25% and for those maturing in 1 year to less than 2 years, Central Bank of India is now giving an interest rate of 6.75%. Central Bank of India is now providing interest rates of 7.00% for deposits made between two and less than three years, and 6.50% for those made between three and less than five years. Deposits that mature in five years or more, up to ten years, will now earn 6.25% interest.

"An additional interest rate of 0.50% p.a. over and above the normal rate of interest for any of our Time Deposit Schemes & also for Tax Saver Depositors Scheme will be given as incentive for deposits of Senior Citizens who are above 60 years of age. The deposits under non-callable scheme will attract additional rate of interest as below:Senior Citizen - 0.50%, Super Senior Citizen-1% (A super senior citizen is an individual resident who is 80 years or above), Staff- 1%, Senior Citizen Staff- 1.50%, Ex staff super senior citizen - 2.00%," mentioned Central Bank of India on its official website.

Both new deposits and deposit renewals will be subject to the revised interest rates.

"We wish to inform you that a Meeting of the Board of Directors of the Bank will be held on Friday, 19th January 2024, inter-alia to consider and take on record the unaudited standalone and consolidated financial results of the Bank for the Third quarter/Nine months ended 31st December 2023," said Central Bank of India in a regulatory filing.

Click it and Unblock the Notifications

Click it and Unblock the Notifications