War To Become Largest Cryptocurrency: Is Ethereum The Next Bitcoin?

Amidst the gaining traction of thousands of altcoins and meme coins, Bitcoin and Ethereum have by far continued to dominate the entire cryptocurrency world. Bitcoin came first and continues to dominate the market for nearly 2 decades. But Ethereum, which is a little over a decade old, is the only digital coin that has come closer to comparison with BTC.

As of now, together Bitcoin and Ethereum dominate the cryptocurrency market by 71%. The other 29% is accounted for by other coins. Although Bitcoin dominates the market with a whopping 57.3% weightage, Ethereum holds about 13.7%.

Meanwhile, Bitcoin trades around the $115,000 level and has a market cap of nearly $2.3 trillion. On the other hand, Ethereum is just above $4,500 with a market cap of $545.2 billion. Bitcoin's m-cap is over four times that of Ethereum.

In Indian rupees, one Bitcoin is above Rs 1.01 crore, while one Ethereum is more than Rs 3.98 lakh.

However, there has been a major shift in power when it comes to appetite for cryptocurrency exchange-traded funds (ETFs). Investors are shifting from Bitcoin ETF to Ethereum ETF.

While Bitcoin is seen as a store of value, a haven just like gold. Ethereum, on the contrary, is the backbone of Web3. Many global brokers, including Goldman Sachs, have seen Ethereum as more credible to overtake Bitcoin since long ago. But can Ethereum really become the next Bitcoin?

"Ethereum has long been seen as the most credible contender to overtake Bitcoin-a hypothetical event known as "the flippening." While Bitcoin remains the largest cryptocurrency by market cap, Ethereum's growth in real-world utility through smart contracts, DeFi, and NFTs has gained the attention of major analysts like Goldman Sachs, who argue ETH may one day surpass BTC in value. Ethereum's ability to support decentralized applications gives it broader use potential compared to Bitcoin's focus as a store of value," said Sathvik Vishwanath, Co-founder and CEO of Unocoin to GoodReturns.

Bitcoin Vs Ethereum:

Data from TradingViewreveals that Bitcoin has gained nearly 23% year-to-date, while in 1 year, the performance is up by nearly 91%. In the past five years, Bitcoin surged over 973.5%.

Coming to Ethereum, this crypto has outperformed Bitcoin in 2025 so far, and in 5-year performance, by surging over 35% and over 1113%.

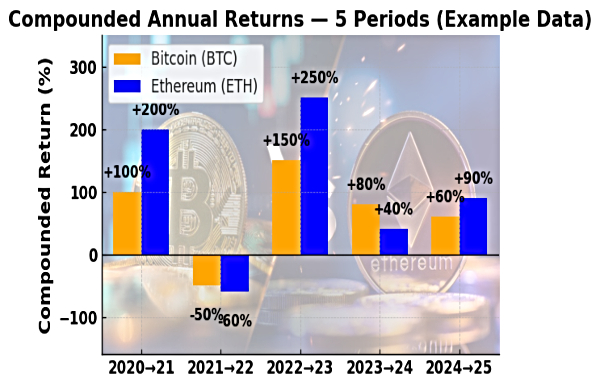

Additionally, Ethereum has outperformed Bitcoin 3 times between the 2020-21 to 2024-25 fiscal year in terms of compounded annual returns.

As per Vishwanath, currently, ETH's market cap is still significantly behind BTC's, but it regularly outpaces Bitcoin in terms of active addresses and transaction volume. Upgrades like EIP-1559 and Ethereum 2.0 aim to improve scalability and reduce token supply, potentially driving long-term price appreciation.

Bitcoin Vs Ethereum ETF:

Last month, the US spot Ethereum surged by over $2 billion, above Bitcoin. On August 25, crypto enthusiast Ashish Gangrade pointed out that Ethereum had more monthly inflows than Bitcoin, and by a massive margin. His data revealed that ETH ETFs touched an inflow of $3.8 billion, while Bitcoin ETFs recorded an outflow of $751 million.

Further, as per the Crypto Economy report dated September 15, US spot Ethereum exchange-traded funds (ETFs) saw a net inflow of $729.1 million, marking the second-largest single-day inflow since the introduction of these products. BlackRock's ETHA has net inflows of $500.9 million, and Fidelity's FETH has $154.7 million. In the last three days, more than $2 billion flowed into Ethereum-related products, including the four other Ethereum ETFs that witnessed inflows. Week-to-date, inflows into Ethereum are valued at almost $2 billion, or around 7 times the Bitcoin ETF inflows.

Can Ethereum Overtake Bitcoin?

Decoding this, Himanshu Maradiya, Founder & Chairman of CIFDAQ, told GoodReturns, "The question of whether Ethereum is the 'next Bitcoin' is less about replacement and more about role. Bitcoin remains digital gold: a store of value, hedge, and the first mover in crypto."

"Ethereum, however, is the backbone of Web3 - powering smart contracts, DeFi, NFTs, and potentially an AI-driven on-chain economy," added Maradiya.

Overtaking Bitcoin, as per the CIFDAQ chairman, would require Ethereum not only to expand institutional adoption but also to prove its scalability, post-merge energy efficiency, and Layer-2 throughput.

The expert does see the possibility of Ethereum beating Bitcoin in terms of market value if its network connectivity continues, but he does believe Ethereum could surpass Bitcoin when it comes to 'sound money' narration.

Since Bitcoin is above $1,00,000, when can Ethereum see such eye-popping price level. When asked about when can Ethereum touch $50,000 mark, here's what experts said to us.

"Whether ETH hits $50,000 depends on several factors: broader crypto adoption, regulation, network upgrades, and macroeconomic conditions. While some bullish predictions suggest ETH could reach $50K within this decade, a conservative timeline places it post-2030," said Vishwanath.

Meanwhile, Bitcoin continues to solidify its role as digital gold, appealing to institutional investors and corporate treasuries. In the end, Vishwanath added, "both assets may coexist - with BTC as a hedge and ETH powering the decentralized internet."

"As for price trajectories, a $50,000 ETH isn't impossible - but it likely sits beyond this cycle. At that level, we'd be looking at a multi-trillion-dollar ETH economy, something plausible if global financial rails, gaming, and AI-infused applications settle on Ethereum infrastructure. In the near-to-mid term, Bitcoin's halving-driven cycle still places it as the market anchor, with Ethereum riding the wave but carving its own identity," added Maradiya.

Difference Between Bitcoin & Ethereum:

1. Bitcoin operates on proof of work (PoW) system, which is a consensus used to validate transactions and secure trading on this blockchain in a decentralized manner. While Ethereum operates on proof of stake (PoS) consensus, which is substantially less energy, as it uses randomly selected validators to confirm transactions.

2. Bitcoin's supply is limited to 21 million; on the other hand, Ethereum is equipped with an infinite supply, theoretically.

3. Lastly, the average transaction fee in Ethereum is nearly half, at 43 cents per transaction, compared to the average fee of 84 cents per transaction in Bitcoin.

Click it and Unblock the Notifications

Click it and Unblock the Notifications