US Fed Ends 2025 With 75 Bps Rate Cuts: The Good, Bad & Ugly Of 2026, How Different Will Be New Year

The US Federal Reserve has cut key fund rates by 25 basis points for the third time in a row. Although US President Donald Trump did not shy away from spatting his displeasure for the current rate cut. Trump and Fed Chair Jerome Powell are in an intense cold war! The president hoped for a 50 basis point rate and wishes the lowest rates for American citizens in the world, while Powell plays a much more cautious flute. Either way, the FOMC has ended 2025 with just a 75-basis-point rate cut, taking key federal fund rates to 3.50% to 3.75%. How different will 2026 be? Let's understand the good, the bad, and the ugly!

US Fed Rate Cut:

The FOMC decided to lower the target range for the federal funds rate by 1/4 percentage point to 3-1/2 to 3‑3/4 percent. FOMC continues to seek maximum employment and inflation at the rate of 2% over the longer run.

The latest rate cut signals three factors! The US economy remains elevated, the US inflation trajectory is uncertain due to tariffs, and the US labour market is stubbornly soft.

"The US FOMC's decision to deliver a 25 bps rate cut in Dec'25 was on widely anticipated lines. The incremental deterioration in the labour market and uncertainty on inflation aided the markets to accurately predict the policy action, despite limited signals from the central bank," said Hitesh Suvarna, analyst at JM Financial.

What is more surprising is that the market predicted the policy rate cut even when the Fed time after time gave limited signals for the same.

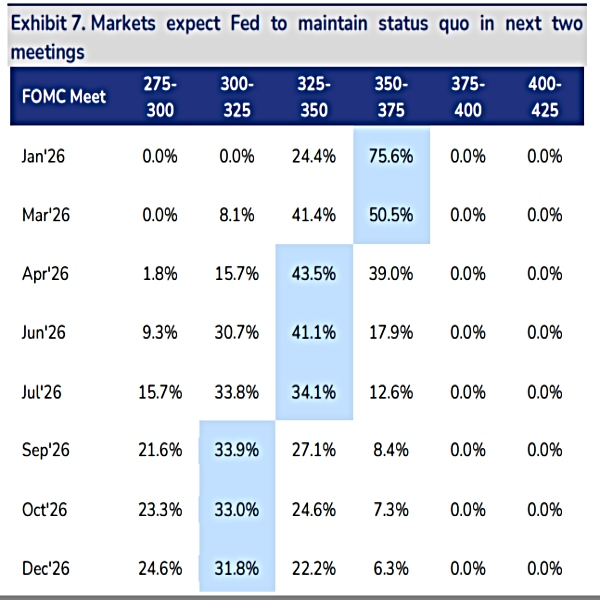

Once again, the Fed's Powell is expecting one rate cut in 2026, and experts already believe there is more than meets the eye!

1. Dovish Tilt Amid Dissent:

The December 2025 policy showed a mixed trend among FOMC members. For instance, the 25 basis points rate cut received 9:3 votes from the committee. Among them, Stephen Miran called for a steeper (50 bps) rate cut, while two members, Austan Goolsbee and Jeffrey Schmid, favored a status quo on policy rates.

Powell indicated that the dissent within the committee was on which aspect of the dual mandate needs to be prioritized.

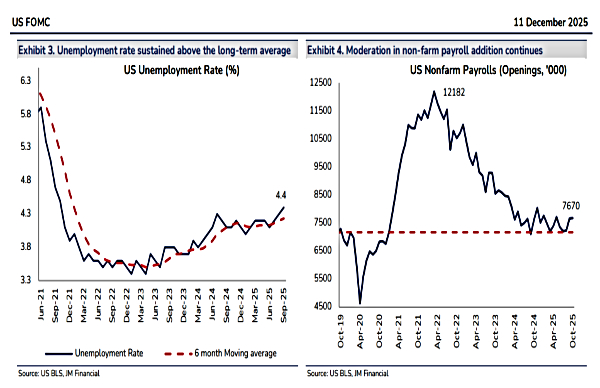

2. US labour Market Softness

According to Ankita Pathak, Macro Strategist and Global Equities Fund Advisor at Ionic Asset, labour market conditions continue to show signs of softness, with job gains slowing and the unemployment rate rising noticeably from the last year. While reduced immigration and lower labour force participation may be adding some strain, labour demand has clearly moderated. Overall economic growth remains moderate, with pockets of stress seen in sectors like housing, while consumer spending and business fixed investment remain solid.

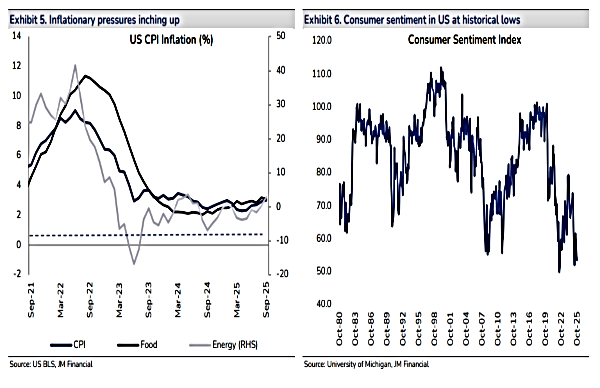

3. Inflation Enters 2026 Above 2%

US inflation continues to be above the 2% target of the Fed due to higher tariffs, which have forced goods prices to climb despite services being at the edge of disinflation.

4. SEP Paints a Positive Picture:

The Fed's Summary of Economic Projections (SEP) signals an improving growth trajectory. The Fed expects GDP growth to rise in 2026. The median GDP projection is 2.3%, and the central tendency projection is 2.1-2.5%. So this is an improvement from the earlier 1.7% target on GDP in 2025.

Meanwhile, the unemployment rate is expected to be the elephant in the room, with the Fed keeping its target unchanged at 4.4% in 2026, while 4.2% each is seen in 2027 and 2028.

Another key positive factor is that Fed has reduced its inflation target to 2.4% in 2026 and 2.2% in 2027 compared to 2.9% target in 2025. The Fed could achieve the 2% inflation objective by 2028.

"Though the upside risks to inflation still remain, largely due to higher tariffs, these shifts are expected to be short-lived, thereby emphasizing more on labour markets. In addition to a rate cut, the Fed also decided to start buying short-term treasury securities (mainly treasury bills) in order to stabilize money markets and to maintain ample supply of reserves over time," said Pathak.

Hence, experts are predicting more than just 1 rate cut from Fed in 2026.

More Rate Cuts In 2026!

Although the SEP indicates only one rate cut in 2026, the JM analyst said, "We believe that the change in Fed Chairman in 2QCY26 will sentimentally revive policy easing expectations."

As of now, Powell hinted at a data-dependent approach in the upcoming meeting, which is reflected in market expectations as well. However, analyst said, "Any signs of further deterioration in the labour market (unemployment rate >4.6%) will open the doors for further policy easing."

Along similar lines, Pathak added, the rate decision was on expected lines, but divided votes within the committee hint of a potentially tricky path ahead. Although, what could matter even more now is who steps in as the next Chair of the US Fed.

Further, with President Trump likely to favor a candidate inclined towards deeper rate cuts, the market could be staring at a more dovish tilt in the months ahead. And with labour-market softness continuing, the macro backdrop itself may prompt further monetary easing, regardless of who takes the position.

"We believe the rate cut could be potentially more than 25 bps in 2026, which should support US markets as it did this year, even when AI bubble fear periodically spooked the markets. A continued rate cut cycle may mean equity markets can have more legs in the near term. Also, Fed easing could likely benefit EMs as well," said the Ionic Wealth expert lastly.

On the other hand, given expected growth resilience and elevated inflation, analysts at Emkay Global in their note said that they feel Powell's remarks raise the bar for future cuts. The additional cut(s) in 2026 is now well tied to how shaky the labour market is ahead. But the cut cycle is mostly over. Hence, Emkay's analysts reckon the US labour market may remain soft till the tariff pass-through is complete.

Click it and Unblock the Notifications

Click it and Unblock the Notifications