US Fed Meeting: Rate Cut or Not, FOMC In A Muddle As AI Threatens Job Market

Being the apex bank of the world's largest economy, the US Federal Reserve's policy decisions matter to not just economies and markets but also common citizens. Once again, the Jerome Powell-led FOMC will announce the key rates decision on October 29, and the market is factoring in a dovish stance along with policy easing. However, the Fed's current situation is beyond just keeping inflation in check. The central bank is in a fog of rising joblessness in the US, alongside the slowest hiring since 2013 as AI threatens the job market.

Before we get into heavy stuff, it is important to note the main objective of the FOMC is to achieve an inflation rate of 2% in the longer run and reach maximum employment.

Both main targets are out of reach of the Fed.

In a mid-October public appearance, Fed's chair Jerome Powell said, "There is no risk-free path for policy as we navigate the tension between our employment and inflation goals. In this less dynamic and somewhat softer labor market, the downside risks to employment appear to have risen."

Key Factors To Fuel Fed's Policy Decision:

1. Inflation Above 2%:

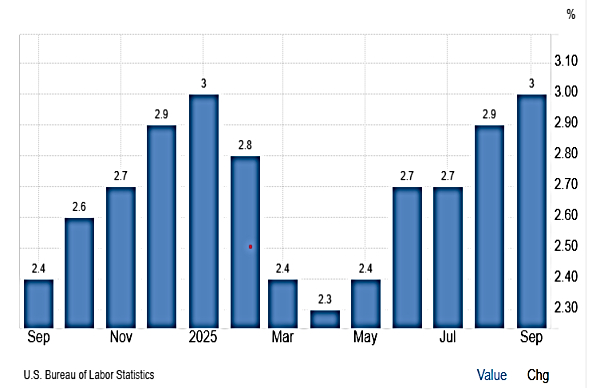

The latest US consumer price index (CPI) inflation jumped to 3% in September 2025, mildly below market estimates but the highest print since January 2025.

2. US Joblessness Intensifies:

The unemployment rate is rising to the roof. In August 2025, the joblessness rate shot up to 4.3% from 4.2% of the previous month, which is the highest since October 2021.

3. US Fewer Jobs Addition:

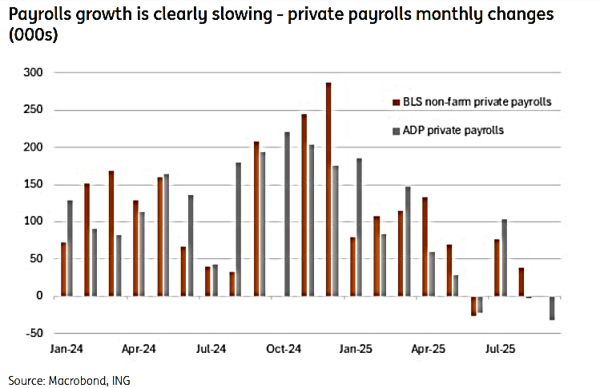

The economy added 911K fewer jobs in the 12 months through March 2025, which is the biggest slope since 2000, as per the BLS's preliminary benchmark revision. Almost all sectors added fewer jobs.

The condition in the job market has worsened with the intense layoffs in the technology sector due to AI adoption. Also, the Labor Department data indicated the seekers are getting hired at the slowest rate since 2013.

Hence, Fed is on high alert!

"There is no getting around the fact that the Fed is taking inflation less seriously than earlier this year. Price stability is taking the backseat to the labor market and economic support," said Stephen Kates, CFP, Bankrate Rate Financial Analyst.

According to the Bankrate note, that dilemma puts the Fed in a tough spot. What's good for the labor market can be bad for inflation-and vice versa. Lower rates could reignite demand heading into the holiday shopping season and also make it easier for companies to pass along higher costs from tariffs. Keeping rates high, though, could deter companies from creating more jobs.

So why is the market factoring in a rate cut on October 29?

"Given decent economic growth, elevated inflation, low unemployment and equity markets at all-time highs, you could be forgiven for questioning why the market is fully discounting a 25bp interest rate cut on Wednesday, with another 25bp cut priced in for December," said an ING report.

Experts at ING in their note explained although above-target inflation is a cause of concern, and stubbornly high tariffs continue to pose a threat, but it's fair to say tariff-induced price hikes are not coming through as aggressively as feared.

The more urgent problem is the deteriorating jobs market. As per ING's expert, there is a clear chance that the "low hire, low fire" economy becomes a "no hire, let's fire" story. This jeopardizes the "maximizing employment" goal of the dual mandate, which could in turn prompt a weaker economy and risk the central bank undershooting its 2% inflation target over the medium to longer term.

The Fed cut rates in the September FOMC policy, taking key federal rates to 4%-4.25% after a nine-month pause. Experts at ING believe the Fed could cut rates by 25 bps in October and another 25 bps in December.

Also, J.P. Morgan Global Research expects two more cuts in 2025, and one in 2026.

Click it and Unblock the Notifications

Click it and Unblock the Notifications