TCS Vs Infosys Vs HCL Vs Wipro: Will H-1B Visa Fee Hike To $1,00,000 Really Hurt Indian Tech Giants?

There is panic and tension among investors as they pulled back their money from Indian IT stocks on September 22, 2025. The reason is the latest hike in H-1B visa fees to an eye-popping $100,000.

This new H-1B rule is said to be doomsday for immigrant workers globally who are looking to work in the US. Indian IT companies also have significant exposure, with TCS being the second-largest holder of H-1B visas in 2025 so far. However, could this really impact the tech sector in India?

Here are the scenarios: H1-B visa fees of $100,000 are applicable to new applicants and not the existing ones; they could potentially impact margins of tech companies but are not a great threat to their long-term growth. American workers are in for a big win, but it's not a bummer for immigrant workers.

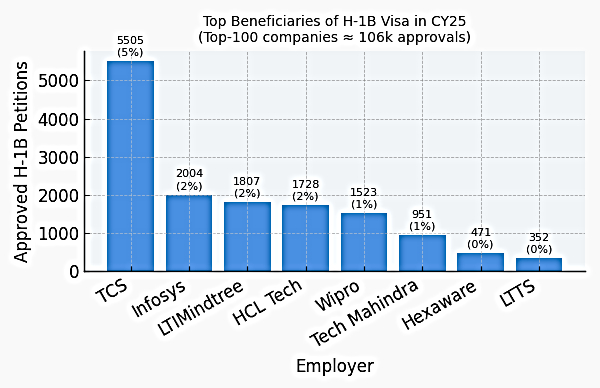

Among the top 100 companies with H-1B visa approvals, TCS is the largest Indian IT beneficiary of this program, with 5,505 H-1B holders year-to-date. The Tata giant is followed by peers like Infosys with 2,004 H-1B visas, LTIMindtree with 1,728 H-1B visas, HCL Tech with 1,728 visas, and Wipro with 1,523 visas. The least exposure is in Tech Mahindra, Hexaware and L&T Technologies Services.

How Will the H-1B Visa Fees Of $100,000 Work?

The $100,000 H-1B visa fee has come into effect from September 21.

"While the $100k fee is not an annual fee but a one-time fee that applies only to the petition and is applicable only to new visas, not renewals or current visa holders, said Sumit Pokharna, VP Fundamental Research, Kotak Securities to GoodReturns.

Few checkpoints are:

- $1,00,000 fees is one-time, meaning it is not an annual recurring fees.

- Those who already hold H-1B visa and are currently outside the USA, will not be charged with the new fees and can re-enter seamlessly. This will not apply on renewal of visas as well.

- The H-1B visa does not prohibit immigrant workers from leaving or re-entering the US. The existing H-1B visa can travel as normal.

- The fee is imposed on only new visas.

- The rule will be applied in the next upcoming lottery cycle.

"We expect to see its impact in the next upcoming lottery cycle from 2HFY27, and the full impact will be seen in FY28. The impact could be lower with a few offsets, including higher use of nearshore and offshore locations," said Pokharna.

What Options Indian IT Companies have?

Decoding the impact, analysts at Emkay Global Research in their note explained that it is a one-time fee per filing rather than an annual charge, the direct cost burden is expected to remain contained for employers.

Also, the analysts pointed out Indian tech players have already reduced their reliance on H-1B visas in recent years, using them largely for convenience or to bridge the gap in skills availability.

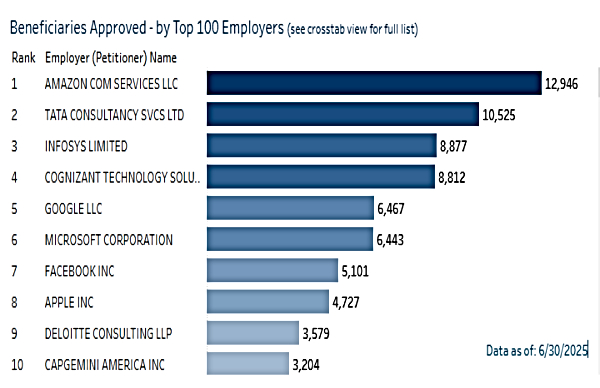

For instance, from the current H-1B visa holders, TCS has recorded a steep decline from 10,525 visa holders in 2021. While Infosys at that time had 8,877 visa holders. In fact, TCS and Infosys were the second- and third-largest H-1B visa holders in 2021. Wipro, which is currently in top 25 list, was in the top 15 list in 2021 with 2,931 visa holders.

Hence, it is evident that Indian IT players have shifted their focus from H-1B visas significantly.

Secondly, since the new $100,000 will apply in the next visa lottery cycle, Emkay analysts believe there is enough time to prepare by i) increasing local hiring, ii) using L1 visas, iii) limiting the use of H1-B visas and, in necessary cases, trying to factor the increase in visa costs in contracts, iv) shifting work offshore, etc, thereby limiting the overall impact. Also, potential legal challenges could delay implementation and the resultant impact.

So the real question is by how much can H-1B visa fees impact the IT sector in India?

"New petitions have reduced substantially for IT Services players. Incremental petitions could now drop to a trickle, in our view, for specific skill-sets where clients are willing to pay. This will make it margin neutral. Margins could, however, have a second-order impact, through wage inflation in sub-con/local talent pool," analysts at JM Financial said.

According to them, potential offsets are higher offshoring and price renegotiations. That said, IT Services players, to comply with the spirit of the proclamation, should further increase the share of local talent.

JM's analysts are estimating that the top-10 IT Services players have 1.2-4.1% of their total employee base on H-1B. In a scenario of increased local hiring without offsets, we estimate that margin impact could be 15-50bps. In a more likely scenario of higher offshoring, the above impact could be completely negated. Financially, therefore, the impact is neutral. Importantly, with one of the biggest regulatory overhangs now behind, this event is net positive.

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications