TCS Q1 Results: Cons PAT Rises 6% To Rs 12,760 Cr; Dollar Revenue Declines- HITS & MISSES!

Tata Consultancy Services (TCS), the largest IT giant of India, has reported 5.98% growth in consolidated net profit to Rs 12,760 crore in the quarter ending June 2025, compared to Rs 12,040 crore profit in Q1FY25. The top-line front of TCS was a mixed performance, with constant currency revenue declining on a QoQ basis. CMT and the life sciences segment dragged revenue.

TCS Q1 Net Profit:

The company recorded a consolidated net profit of Rs 12,760 crore in Q1FY26. This was up by 5.98% from the net profit of Rs 12,040 crore in Q1FY25. While gains were mild by 4.38% from PAT of Rs 12,224 crore in Q4FY25.

TCS reported an operating margin of 24.5%, which increased by 30 basis points from the preceding quarter. The company's net cash from operations stood at Rs 12,804 crore, which is 100.3% of its net profit that is attributable to the owners.

TCS Q1 Revenue:

This Tata company's revenue was under pressure, which is on expected lines amidst BSNL headwinds. In Q1FY26, TCS reported consolidated revenue of Rs 63,437 crore, registering a growth of 1.3% from Rs 62,613 crore in Q1FY25. But, revenue dropped by 1.6% from Rs 64,479 crore revenue recorded in Q4FY25.

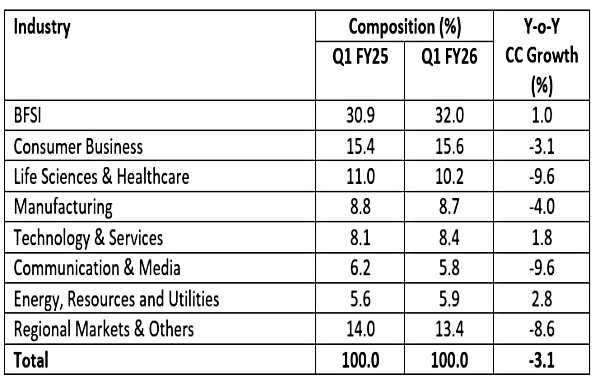

In constant currency, the revenue declined 3.1% YoY.

On segment-wise performance, CMT and life sciences & healthcare segment revenues were impacted in the quarter under review. In Q1FY26, TCS recorded revenue of Rs 9,436 crore in communications, media and technology business (CMT), which was down from Rs 11,022 crore in Q4FY25 and Rs 10,794 crore in Q1FY25. Also, revenue from the life sciences and healthcare segment dropped to Rs 6,422 crore in Q1FY26, from Rs 6,491 crore in Q4FY25 and Rs 6,909 crore in Q1FY25.

In percentage terms, BFSI revenue growth rose to 32%, an expansion of over 100 basis points from revenue growth of 30.9% in Q1FY25. However, revenue growth dipped by 3.1% in consumer business, 9.6% in life sciences & healthcare, 4% in manufacturing, and by 9,6% in communication & media.

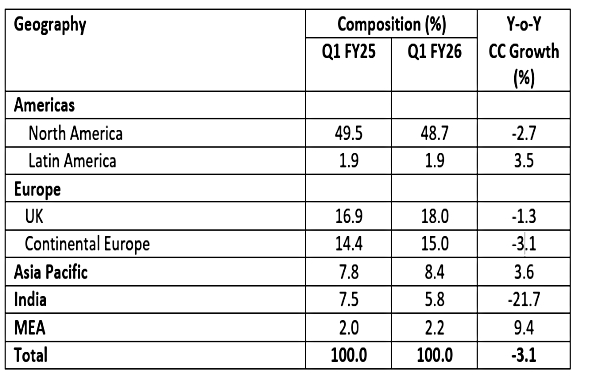

On a geographical basis, India's business declined by 21.7%, followed by a 2.7% decline in North America as tensions over the US tariff loom.

TCS Management Views:

"The continued global macro-economic and geo-political uncertainties caused a demand contraction. On the positive side, all the new services grew well. We saw robust deal closures during this quarter. We remain closely connected to our customers to help them navigate the challenges impacting their business, through cost optimization, vendor consolidation and AI-led business transformation," said K Krithivasan, Chief Executive Officer and Managing Director.

Further, Samir Seksaria, Chief Financial Officer, said, "We continued our investments in long term sustainable growth this quarter. We stayed agile and adapted to the dynamic environment, delivering steady margins. Our industry leading profitability alongside robust cash conversion, positions us well to make strategic investments for the future".

In this quarter, clients prioritized scaling AI across the enterprise, transforming contact centers, optimizing costs, and improving cyber defense capabilities. The growth for the quarter was led by AI & Data, TCS Interactive, and Cyber Security.

In its financial report, TCS said, "This quarter, the AI and Data unit delivered robust growth, with enterprises advancing from pilots to scaled GenAI deployments. Demand was led by AI-led transformation, SDLC/IT-Ops automation, and data-platform modernization. Our investments in WisdomNext, TCS' flagship AI platform are expanding with the addition of agentic AI capabilities. Strategic partnerships expanded, and our AI workforce with higher order skills exceeded 114,000, strengthening our leadership position in enterprise AI solutions."

As on June 30, 2025, the company applied for 8,987 patents, including 171 applied during the quarter, and has been granted 4,939 patents including 119 granted during the quarter.

TCS earnings per share (EPS) stood at Rs 35.27 by end of Q1FY26, higher from Rs 33.28 EPS in Q1FY25.

TCS Share Price:

This heavyweight IT stock will react to its Q1FY26 earnings on Friday. On Thursday, TCS shares closed at Rs 3382.30 apiece, marginally down on BSE, with a market cap of Rs 12,23,745.74 crore.

Rooted in the heritage of the Tata Group, TCS is focused on creating long term value for its clients, its investors, its employees, and the community at large. With a highly skilled workforce of over 607,000 consultants in 55 countries and 180 service delivery centres across the world, the company has been recognized as a top employer in six continents.

Click it and Unblock the Notifications

Click it and Unblock the Notifications