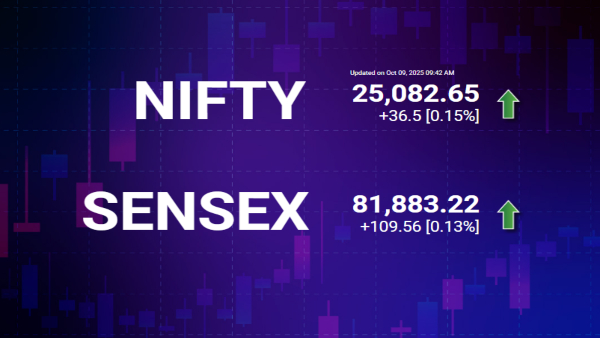

Indian equities opened on a flat-to-positive note on Thursday, supported by signs of easing geopolitical risks and a firm global setup. Sensex began today's trade session on a flat mode meanwhile Nifty opened above 25,000 Mark.

As of 8:22 AM, GIFT Nifty 50 futures were trading at 25,145.0, up 52.5 points or 0.21%, indicating a mildly upbeat start for domestic benchmarks.

Stock Market Recap

On Wednesday, Indian markets snapped their four-day winning streak as investors booked profits, particularly in the financial sector. The S&P BSE Sensex declined by 153 points (0.19%) to close at 81,773.66, while the NSE Nifty 50 slipped 62 points (0.25%) to settle at 25,046.15.

Losses in banking stocks outweighed gains in IT shares, as market participants turned cautious ahead of major Q2 earnings releases.

In the U.S., equities ended higher on Wednesday, lifted by strength in technology stocks. With limited economic data available due to a government shutdown, investors focused on the Federal Reserve's meeting minutes for clues on future interest rate moves.

Earnings Season Begins: Q2 Results in Focus Today

Back home, key companies including TCS, Tata Elxsi, and GM Breweries are set to announce their Q2 results today, which could influence sectoral sentiment and overall market direction.

LIVE Feed

Oct 09, 2025, 3:54 pm IST

Closing Bell: Stock Market Closing Summary

Closing Bell: "Despite mixed global cues, Indian markets opened the day on a subdued note but quickly gained strength, with Nifty trading positively throughout the session and closing near the day’s high. Sectorally, metals, IT, healthcare, pharma, and PSU banks led the rally, while media stocks posted a flat performance. Pharma shares received a particular boost as the Trump administration clarified it will not impose tariffs on generic drug imports from overseas. In the derivatives segment, a notable surge in open interest was observed in MCX, UNOMINDA, PRESTIGE, and AMBERPGEL, reflecting active participation and bullish sentiment in these counters," noted Ashika Institutional Equities.

Oct 09, 2025, 3:32 pm IST

Closing Bell: Sensex Ends 392 Pts Higher At 82,166, Nifty Settles At 25,181; Tata Steel, JSW Top Gainers

Closing Bell: Sensex Ends 392 Pts Higher At 82,166, Nifty Settles At 25,181; Tata Steel, JSW Top Gainers

Oct 09, 2025, 2:29 pm IST

Stock Market Live Updates: Sensex Surges 181 Points, Nifty Crosses 25,100 Mark, JSW Steel, HCL Tech, Tata Steel Top Gainers

Stock Market Live Updates: Sensex Surges 181 Points, Nifty Crosses 25,100 Mark, JSW Steel, HCL Tech, Tata Steel Top Gainers

Oct 09, 2025, 11:31 am IST

Bank Nifty Outlook Today By Amruta Shinde of Choice Broking

The Bank Nifty mirrored the broader market trend, closing lower and displaying a sideways-to-bearish bias. Support is seen around 55,800–55,700, and a decisive break below this range could accelerate weakness toward lower levels. On the upside, resistance is positioned near 56,200–56,300, and only a breakout above this zone may trigger a meaningful rally. For now, the index is likely to consolidate within the 55,700–56,300 range.

Oct 09, 2025, 11:31 am IST

Nifty Outlook Today By Amruta Shinde of Choice Broking

The Nifty 50 opened flat and traded sideways throughout the previous session, eventually closing in the red with a mild bearish candle. From a technical standpoint, a sustained move above 25,150 could open the door for an upside toward 25,200–25,250. On the downside, immediate support is placed around 24,950–24,900, which may serve as potential accumulation zones for long positions. Overall, the index is expected to remain range-bound between 24,900 and 25,200 in the near term.

Oct 09, 2025, 10:59 am IST

Sector Update: Strategy | Weak banks results could mar 2QFY26E PAT growth

“Over the past 12 months, the Nifty50 has gone up by a muted 1.3% due to India’s inflated valuations and uncertainty over US tariffs. While DIIs have been net buyers in both 1Q and 2Q FY26, FIIs who were net buyers in 1Q have turned net sellers in 2Q. For the JM Financial universe, we forecast PAT growth of 8.7% YoY in 2QFY26E. Ex-BFSI, we see growth at 13% YoY. Further, we expect Nifty 2QFY26E PAT to grow 4.4% YoY (ex-BFSI growth is expected to be 10.8% YoY). With Nifty50 PAT YoY growth of 10.5% in 1Q and 4.4% in 2Q the ask rate for 2HFY26 is 7.8%. Nifty50 PAT growth in 2QFY26E will be driven by: (1) IT Services (12% weight in Nifty50 earnings), expected to rise 9% YoY, (2) Metals & Mining (5% weight in Nifty50 earnings), expected to rise 49% YoY, (3) Utilities (4% weight in Nifty50 earnings) expected to rise 39% YoY, and (4) Telecom (3% weight in Nifty50 earnings), expected to rise 103% YoY. Weak BFSI performance (-3% PAT YoY) can be attributed to muted loan growth, margin compression, weak core fee income, lower treasury gains and elevated credit costs in both private and SoE banks,” said Venkatesh Balasubramaniam of JM Financial Institutional Securities.

Oct 09, 2025, 10:35 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

The results season starting today will be keenly watched by the market. IT stocks have witnessed some recovery from the bottom, but the headwinds for the segment continue to be strong. Banking stocks have largely remained range bound on muted earnings expectations. The NIM pressure and rising delinquencies in the unsecured loan segments will weigh on banking results generally. So, watch out for the out-performers in the segment. Overall Q2 earnings are likely to remain pedestrian and, therefore, the market will be looking more at the developments in the real market for goods like automobiles and consumer electronics. There are encouraging reports of robust demand for these goods and this will translate into good results from Q3 and beyond. Digital platform companies have been displaying resilience in recent days. The market is giving support to these segments on expectations of a long runway of sustained growth for these stocks.

Oct 09, 2025, 9:59 am IST

Stock Market Live Updates: Nifty Pharma Gains 1.3% in Morning Trade; Stocks Among Top Gainers

The Nifty Pharma index surged 1.3% in Thursday morning trading, led by strong buying interest in key stocks. Aurobindo Pharma, Lupin, and Granules India emerged as top gainers.

Oct 09, 2025, 9:51 am IST

Stock Market Live Updates: Sensex, Nifty Trades in Green

Sensex and nifty again back to green after trading flat in opening session.

Oct 09, 2025, 9:21 am IST

Stock Market Live Updates: Rupee Opens Stronger at 88.74 Against U.S. Dollar

The Indian rupee opened higher at 88.74 per dollar on Thursday, appreciating slightly from Wednesday’s close of 88.79

Oct 09, 2025, 9:08 am IST

Stock Market Live Updates: Markets Open Firm Ahead of Trade in Pre-opening

Benchmark indices are trading on a strong note in the pre-opening session. The Sensex is up 303.89 points or 0.37% at 82,077.55, while the Nifty has edged up by 6.50 points or 0.03% to 25,052.65.

Oct 09, 2025, 8:45 am IST

Stock Market Live Updates: TCS, Tata Elxsi, GM Breweries to Announce Q2 Results

Tata Consultancy Services Ltd. (TCS), Tata Elxsi Ltd., and GM Breweries Ltd. are among the key companies set to kick off the Q2 earnings season on October 9.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Thursday, October 9, 2025, 8:27 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications