Oct 07, 2025, 3:32 pm IST

Closing Bell: Sensex Closes 115 Points Higher, Nifty Above 25,110; Broadmarket Indices End In Green

Closing Bell: Sensex Closes 115 Points Higher, Nifty Above 25,110; Broadmarket Indices End In Green

Oct 07, 2025, 2:50 pm IST

Stock Market Live: World Bank Revises India FY26 GDP Forecast

The World Bank has adjusted its economic growth forecast for India, predicting a 6.5% growth rate for FY26, up from the previous 6.3%. However, it has slightly reduced the FY27 projection to 6.3%, attributing this change to higher-than-expected US tariffs. Despite these adjustments, India is expected to maintain its position as the fastest-growing major economy globally, driven by strong consumption growth.

Oct 07, 2025, 2:40 pm IST

Stock Market Live: Will Q2 Bring Cheer For The Media Industry? Check Review

Stock Market Live: "While headwinds in Kiddopia persist, consolidation of Curve Games, Fusebox, and Smaash is likely to support the growth trajectory for NAZARA IN. As for IMAGICAA IN, we expect footfalls to remain flat YoY to 0.25mn in a seasonally weak quarter with an EBITDA loss of Rs60mn," noted PL Capital in its report.

Oct 07, 2025, 2:22 pm IST

Stock Market Live Updates: Sense Up 400 Pts, Nifty Above 25,100, Airtel, JioFinance, HCLTech Top Gainers

Stock Market Live Updates: Sense Up 400 Pts, Nifty Above 25,100, Airtel, JioFinance, HCLTech Top Gainers

Oct 07, 2025, 2:05 pm IST

RMC Switchgears sees over 110% Year-on-Year Growth in H1 Sales for FY 2025–26

RMC Switchgears Limited announced its unaudited sales for the first half of the financial year 2025–26 (April to September) at ₹221 crore, compared with ₹105 crore in the corresponding period of FY2024–25, representing a yearon-year growth of over 110%. This robust performance was primarily driven by strong traction in the Solar EPC segment, which contributed approximately ₹114 crore to the top line, followed by Electrical EPC and Electrical Products, which contributed ₹57 crore and ₹50 crore, respectively.

Oct 07, 2025, 1:55 pm IST

Paytm Launches India’s First AI Soundbox for Payments

Paytm today announced the launch of Paytm AI Soundbox, India’s first AI business device for small and medium businesses, helping them operate more efficiently and leverage the power of AI in their everyday operations. The launch was unveiled at the Global Fintech Festival (GFF) today, where Paytm showcased how artificial intelligence can simplify and strengthen everyday business operations for merchants. The device includes an AI assistant that interacts with merchants in 11 local languages, providing real time insights and answers modeled on their payments and business performance.

Oct 07, 2025, 1:22 pm IST

Gini & Jony partners with Unicommerce to boost its online business

Homegrown kidswear brand Gini & Jony has partnered with Unicommerce, one of India’s leading ecommerce and retail enablement platforms, to streamline its online operations and scale its digital presence across India. Gini & Jony, known for its stylish and comfortable range of kids’ apparel is available across 50 exclusive brand outlets, at 250+ retail points, its brand website and on multiple online marketplaces. The brand has implemented Unicommerce’s multi-channel order and warehouse management systems, to enable faster fulfilment, real-time inventory tracking, and seamless order processing for orders received across its brand website and multiple marketplaces.

Oct 07, 2025, 12:26 pm IST

Intellect launches PF Credit

Intellect Design Arena Ltd , today announced the launch of PF Credit, a cutting-edge suite of AI-first lending offerings poised to reimagine the loan management landscape. With a strong commitment to innovation and efficiency, PF Credit harnesses intelligent, modular digital experts to enhance the entire loan lifecycle, from loan origination to collections and servicing.

Oct 07, 2025, 12:26 pm IST

Sarveshwar Foods Bags Significant ₹ 266 million Export Order from Delaware USA’s Agri Services & Trade LLC

Sarveshwar Foods Limited, one of India’s leading agro and organic FMCG companies, today announced the securing of a significant export order worth ₹ 266 million from Delaware USA’s Agri Services & Trade LLC, Singapore through it’s Wholly Owned Subsidiary Green Point Pte. Ltd, Singapore. This marks the third significant export order received by the Company for exports over the past two months. The cumulaƟve value of the earlier two export orders stands at ₹960 million, taking the total export order value to ₹1,226 million (INR One Thousand Two Hundred Twenty-Six Million only) within this short span.

Oct 07, 2025, 11:53 am IST

Sector Update: Consumer Retail | Underlying demand trends remain weak; hopes pinned on 3Q

“We expect 14% YoY aggregate revenue growth in 2QFY26 for our consumer discretionary coverage universe, while EBITDA growth is expected to be higher at 21% YoY due to (i) custom duty losses in the base quarter for jewellery companies and (ii) weak margin base in footwear companies. Discretionary segment is expected to outperform staples, which is expected to see mid-single digit growth and flat EBITDA growth. Segments like apparel have seen benefit from early arrival of Navratri, while QSR has been negatively impacted. Growth is primarily driven by (i) Jewellery, led by a sharp 43% YoY increase in gold prices, (ii) healthy store addition and SSSG in F&G segment, and (iii) double-digit growth in the apparel segment due to a low base. Footwear and QSR segments’ revenue momentum is led by store additions as SSSG/volume growth remains weak. Value fashion players continue to report robust growth in 2Q with low to high-double-digit SSSG, largely led by early arrival of festivities. Vedant Fashions, Go Fashion and Bata aren’t expected to witness any meaningful change in demand momentum in 1Q. Going ahead, we expect healthy demand in the discretionary segment owing to (i) government’s initiative of reducing GST rates, (ii) severe winter helping apparel companies and (iii) higher disposable income to help stoke demand for low-ticket discretionary items. Vishal Mega Mart, Titan, Style Baazar and Metro Brands remain our key picks,” said Gaurav Jogani of JM Financial Institutional Securities.

Oct 07, 2025, 11:19 am IST

Sector Update: Oil and Gas | 2Q preview: Steady quarter for RIL; muted quarter for O&G companies

“In 2QFY26, we expect RIL’s EBITDA to be up 3.6% QoQ, led by 3.1% QoQ throughput-led-growth in O2C EBITDA, 3.5% QoQ (and 12.7% YoY) growth in Retail EBITDA and 2.5% QoQ growth in Digital EBITDA (robust subs gains and steady ARPU growth aided by one extra day QoQ). Oil India/ONGC is likely to witness slightly higher crude and gas realisation and crude sales volume QoQ. Hence, Oil India EBITDA could be up 2.3% QoQ but ONGC EBITDA may decline 2.2% QoQ on higher opex. Further, OMCs’ 2QFY26 EBITDA may decline 16-37% QoQ on sharp moderation in auto fuel GMM, though supported by moderation in LPG under-recovery, robust diesel cracks and lower inventory loss QoQ (not assuming INR 300bn LPG compensation recognition in 2QFY26). GAIL’s EBITDA is likely to decline 7.4% QoQ on normalised gas transmission revenue and weak LPG earnings; GSPL’s PAT is likely to be higher on seasonal jump in dividend income while PLNG’s PAT is also expected to recover QoQ on higher regas volume. IGL’s EBITDA could grow 9.3% QoQ on a low base led by volume growth and slightly better margin while MGL’s EBITDA may decline 23% QoQ on a high base (due to one-off income in 1QFY26); GGas’ EBITDA is likely to decline 17% QoQ led by weak industrial PNG volume/margin in Morbi,” said Dayanand Mittal of JM Financial Institutional Securities.

Oct 07, 2025, 10:30 am IST

Currency Update

In contrast to Monday's closing price of 88.79, the Indian rupee began Tuesday stronger at 88.72 per dollar.

Oct 07, 2025, 10:27 am IST

Opening Bell

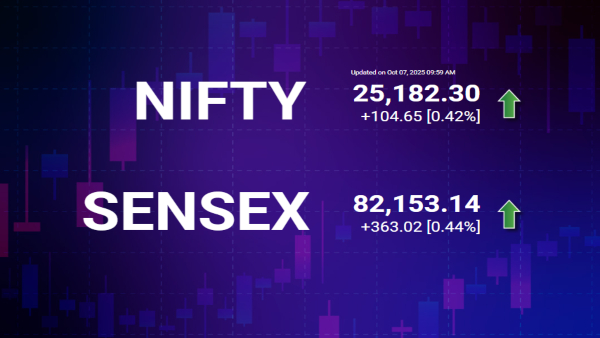

Indian equity markets opened on a positive note on October 7, 2025, with both benchmark indices trading higher. The Nifty 50 advanced 104.65 points or 0.42% to 25,182.30, while the Sensex surged 363.02 points or 0.44% to 82,153.14, reflecting broad-based buying across sectors.

Oct 07, 2025, 10:24 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

The ongoing mild rally in the market has the potential to gain momentum. The FII selling in India is slowly declining since the sharp appreciation in other markets has pushed up their valuations and the valuation differential between India and other markets has come down. Yesterday FII selling figure was only Rs 313 crores and this was totally eclipsed by the massive DII buying of Rs 5036 crores. The steady inflows into mutual funds, particularly the SIP inflows, is a strong support to the market. The combined effect of the Budget income tax cut, GST cuts and low interest rate regime can impart resilience to India’s GDP growth, and corporate earnings in FY27 can smartly pick up to about 15%. The market will start discounting this soon. Time for investors to turn positive.

Since there is huge short position in the market any positive news can trigger short-covering, further aiding the rally.

Oct 07, 2025, 10:01 am IST

Stock Market Live Updates: LG IPO Subscription Opens Today

The Rs 11,607-crore LG Electronics IPO opens for subscription today, October 7, and will close on October 9. The price band is set at Rs 1,080–Rs 1,140 per share, valuing the company at around Rs 77,400 crore (upper band). The issue is a pure offer for sale (OFS) of 10.18 crore shares.

Oct 07, 2025, 9:35 am IST

Stock Market Live Updates: Morgan Stanley Maintains 'Overweight' Rating on Trent

Morgan Stanley has retained its 'Overweight' rating on Trent Ltd, signaling continued confidence in the stock's long-term potential. However, the global brokerage has revised its target price downward to Rs 5,892.

Oct 07, 2025, 9:08 am IST

Stock Market Live Updates: Benchmark Indices Firm in Pre-Opening

Benchmark indices are trading firm in the pre-opening session, with the Sensex rising 250.50 points (0.31%) to 82,040.62 and the Nifty gaining 16.15 points (0.06%) to 25,093.80.

Oct 07, 2025, 8:56 am IST

Stock Market Live Updates: Oil Prices Steady Today

Oil prices held steady on Tuesday morning. A smaller-than-expected production increase from OPEC+ was balanced by growing concerns over weakening global demand and the potential for a supply surplus.

Oct 07, 2025, 8:37 am IST

Stock Market Live Updates: Trump Imposes 25% Tariff on Imported Medium and Heavy-Duty Trucks

U.S. President Donald Trump announced on Monday that all medium- and heavy-duty trucks imported into the United States will be subject to a 25% tariff starting November 1.

Click it and Unblock the Notifications

Click it and Unblock the Notifications