On Monday, the equity market recovered a bit from Friday's a sharp sell-off, with the Sensex closing at 81,896.15, up 677.55 points or 0.84%, while the Nifty 50 jumped 227.90 points to close at 24,946.50, marking a rise of 0.92%.

Bharat Electronics Ltd (BEL), HDFC Life and SBI Life were among the top gainers. While, Tata Motors was the nifty loser. Sector-wise, most indices ended in the green, with the Nifty IT index rising by 1.57%,

Stock market opened on a positive note today, with benchmark indices trading in the green. BSE Sensex rose by 231.39 points (0.29%) to reach 81,349.99, while the Nifty 50 gained 92.50 points (0.37%), touching 24,811.10 in early trade.

The equity market is expected to open higher today as GIFT Nifty was trading 0.20% higher at 24,760 in early morning trade, slightly above the previous close of 24,749. This modest gain points to a likely rebound in domestic benchmarks following a sharp sell-off last Friday, when the BSE Sensex declined by 0.70% and the Nifty 50 dropped 0.68% to close at 24,718.60.

The early optimism comes despite mixed cues from Asian markets, where Japan's Nikkei and South Korea's Kospi opened in the green, gaining close to 1% and 0.6% respectively, while the Hang Seng Index (HSI) slipped into negative territory. Chinese indices, including Shanghai and Shenzhen, remained mildly positive.

However, global investor sentiment continues to be cautious persistent geopolitical tensions, particularly in the Middle East. The upcoming U.S. Federal Reserve policy decision could further influence global market trends.

LIVE Feed

Jun 16, 2025, 3:30 pm IST

Monolithisch India IPO booked over 127 times led by NIIs on Day 3

As of around 3:14 p.m. today, the IPO, which opened for public subscription on June 12, received bids for 52,13,90,000 shares, compared to 41,03,000 shares available across all investor categories. Non-Institutional Investors (NIIs) alone placed bids for 27,77,59,000 shares.

Jun 16, 2025, 2:40 pm IST

Himalaya Food International received a bulk order for Brown Patties from a U.S.-based food manufacturer.

Himalaya Food International has secured a bulk order for Brown Patties from a major U.S.-based food manufacturer. The order includes 18 containers, each containing 2,500 cases of 16.5 lbs net weight, packed in Fiunder Street packaging. The total volume of the order is approximately 742,500 lbs (336,819.75 kgs).

Jun 16, 2025, 2:33 pm IST

Zydus Lifesciences Appoints New MD for Zydus Healthcare

Zydus Lifesciences has approved the appointment of s. Swati Dalal as the Additional Director and the Managing Director of Zydus Healthcare with effect from June 16, 2025 for a period of 5 (five) years

Jun 16, 2025, 2:29 pm IST

ITC completed the acquisition of a 100% equity stake in Sresta Natural Bioproducts, stock moves up

ITC shares rose over 1% to Rs 418.10 on the NSE after opening at Rs 414.95. The company completed its purchase of a 100% stake in Sresta Natural Bioproducts Pvt Ltd (SNBPL) for Rs 400 crore.

Jun 16, 2025, 2:06 pm IST

Stock Market Live: Omaxe Shares Rally 9% After Announcing Investment in Amritsar Township

Stock Market Live: Omaxe shares surged around 9% after the company announced that it will execute a significant township project in Amritsar. "Omaxe Ltd., one of India’s leading real estate developers, is deepening its presence in Punjab with the launch of its latest integrated township—New Amritsar, through its Subsidiaries. Located strategically on the GT Road just 12 minutes from the Golden Temple, Omaxe has acquired 260 acres of land for this township, and in the first phase, it is developing 127 acres with an investment of over Rs. 1000 crore," the company said in its press release.

Jun 16, 2025, 1:35 pm IST

Stock Market Live: Which Stocks Are Top Gainers And Top Losers?

Stock Market Live: Stock Market Live: HDFC Life, Tech Mahindra, SBI Life, Ultracemco, HCL Tech, TCS, Adani Enterprises, etc were among the top gainers on the Indian stock market today. Whereas, Tata Motors, Dr Reddy, Sun Pharma, Adani Ports, etc were among top losers on Indian stock markets.

Jun 16, 2025, 1:14 pm IST

Stock Market Live: WPI Inflation In May Dips To 0.39%

Stock Market Live: The wholesale price index-based inflation (WPI inflation) in India dipped to a 14-month low in May, coming in at 0.39%. Cooling down costs of food, fuel, and primary articles were among the top contributors to the WPI-based inflation, also known as headline inflation, according to data released by the Ministry of Commerce & Industry on Monday, June 16.

Jun 16, 2025, 12:25 pm IST

Stock Market Live: Belrise Industries Show 49% Surge in Profit; Stock Up 4%

Stock Market Live: Belrise Industries shares surged nearly 4%, hours after the company announced a 49% annual increase in its net profit in the March quarter.

Belrise Industries’ revenue from operations increased to Rs 2274 crore in Q4 FY25 from Rs 1526 crore in Q4 FY24, its consolidated financial statements sourced from the BSE show. Profit after tax increased 575% to Rs 110 crore in Q4FY25 from Rs 16 crore in Q4FY24.

For the full fiscal year (FY25), Belrise Industries’ revenue from operations increased 11% to Rs 8291 crore in FY25 from Rs 7484 crore in FY24. Profit increased 13% to Rs 355 crore in FY25 from Rs 314 crore in FY24.

Jun 16, 2025, 12:20 pm IST

Stock Market Live Updates: Nifty Above 24,900 , Sensex Up 580

Stock Market Live Updates: Nifty and Sensex continued their upward movement on Monday after remaining under pressure over the past five trading sessions. SBI Life, HDFC Life, Ciola, Trent, LT, remained among top gainers

Jun 16, 2025, 11:22 am IST

Nifty Today

The Nifty index maintained its upward trend on June 16, 2025, indicating robust market performance and favorable investor confidence. The benchmark index was up 182.75 points, or 0.74%, from the previous session as of 11:18 AM, trading at 24,901.35 points.

Jun 16, 2025, 11:21 am IST

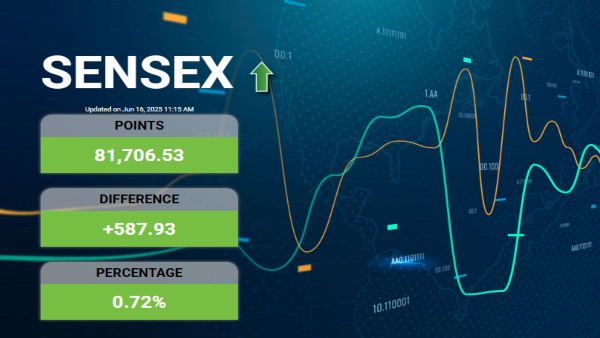

Sensex Today

The Sensex was trading strongly upward at 11:15 AM on June 10, 2025, rising 587.93 points to 81,706.53. This represents a 0.72% rise, suggesting strong investor confidence and purchasing power in several key sectors.

Jun 16, 2025, 11:19 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

The uncertainty stemming from the Israel-Iran conflict has created a risk-off in global markets. The safe haven buying is keeping gold firm but dollar continues to be weak. Interestingly there is no panic in equity markets. Markets will be severely impacted only if Iran closes the Strait of Hormuz triggering a huge spike in crude. This appears to be a low probability event now.

Past experience tells us that times of uncertainty and risk-off are buying opportunities for long-term investors. The difference this time is that the risk-off has not triggered big selling in equities making their valuations attractive. The market scenario characterised by sustained retail buying and fund flows into mutual funds will ensure valuations remaining high for an extended period of time. Therefore, long-term investors can use this risk-off scenario to buy relatively attractively valued stocks like financials.

Jun 16, 2025, 11:08 am IST

Stock Market Outlook Today By Akshay Chinchalkar, Head of Research, Axis Securities

The nifty ended 170 points down on Friday due to the Israel-Iran conflict, but well off its opening bell lows. Technically speaking, we have been highlighting that 24462 remains a critical support level that bulls have to defend - and even with Friday's early session drop, this level held. More importantly, the rebound led to the formation of a bullish "belt hold line" which is the same bullish pattern that caught the early April lows. The battle lines are clear - bulls need to keep 24462 intact and give us a daily close above 24826, while bears need to protect this resistance level to have any chance of pushing the market lower. Risk assets are in the green this morning, not by much, but the fact that the weekend escalation hasn't seen another opening slump is an indication that investors expect the crisis to de-escalate.

Jun 16, 2025, 10:39 am IST

Nifty Prediction Today By Sameet Chavan, Head Research, Technical and Derivative - Angel One

Friday’s session paints a mixed picture, the Nifty slipped below the key short-term 20-DEMA with a bearish gap-down, a level that has previously acted as strong support. This breach raises short-term caution. That said, the 24450 zone continues to hold strong, having offered support twice before and once again forming an open-low Marubozu candle on Friday, a bullish sign in isolation. A similar setup with an open-low candle post a gap-down on April 7 had triggered a sharp rally; however, drawing a direct comparison may not be appropriate given the differing macro triggers. We believe 24400–24450, aligning with the 50-DEMA, will be a critical support zone. 24550 is the first immediate support to watch. On the upside, filling the gap near 24825 and reclaiming the 25000 mark will be key for bulls. Given the prevailing volatility and geopolitical uncertainties, we maintain a cautious stance and advise a wait-and-watch approach. Traders should look to accumulate near the mentioned supports and consider trimming positions near resistance zones. Sectorally, Nifty IT outperformed, gaining over 3% for the week. While we maintain our positive bias, the sector remains sensitive to global developments, and hence a buy-on-dips approach is preferred. Nifty Pharma also showed strength and may continue to offer good trading opportunities in the coming week.

Jun 16, 2025, 10:13 am IST

Nifty Outlook Today By Anand James, Chief Market Strategist, Geojit Investments Limited

We are not confident that the bounce-off from the lower Bollinger band last Friday has the strength to continue. Favoured view expects upsides to be limited to 24832 and settle in the 24500 vicinity. If the consolidation and renewed upside attempts thereof do not succeed in clearing 24832 / 88 expect a drop to 24060.

Jun 16, 2025, 10:01 am IST

Rupee Opens Stong

The Indian Rupee saw an appreciation against the United States Dollar, with the exchange rate dropping to Rs. 86.17, marking a sharp decline of ₹1.73 or 1.97%.

Jun 16, 2025, 8:18 am IST

US Market In the Previous Week

U.S. markets closed sharply lower in the previous week as investors booked profits and turned cautious ahead of key macroeconomic events. The Dow Jones Industrial Average (DJIA) tumbled 769.83 points, or 1.79%, to settle at 42,197.79. The NASDAQ Composite slipped 1.30%, closing at 19,406.83, while the S&P 500 lost 68.29 points, or 1.13%, ending at 5,976.97.

This week, all eyes will be on the Fed’s interest rate outlook, global inflation data and developments in the Israel-Iran conflict could impact global risk appetite.

Jun 16, 2025, 8:18 am IST

Asian markets started the week on a mixed note

In China, the Shanghai Composite inched higher by 0.11%, opening at 3,380.79, while the Shenzhen Component also saw a modest gain of 0.29%. Japan’s Nikkei 225 surged nearly 1%. While In Hong Kong, the Hang Seng Index dipped 0.17%. South Korea’s KOSPI advanced 0.59%, starting the day at 2,911.82, and Australia’s ASX 200 made a small move upward of 0.08%.

Jun 16, 2025, 8:18 am IST

Friday’s Market Recap

Stock market ended sharply lower on Friday, June 13, as broad-based selling pressure weighed down major indices. The BSE Sensex plunged 573 points, or 0.70%, to close at 81,118.60, while the Nifty 50 dropped 169.6 points, or 0.68%, to settle at 24,718.60.

All 13 sectoral indices ended in the red due to bearish sentiment across the board. Public sector banks and FMCG stocks were the worst hit, with both sectors slipping over 1% during the session.Investors appeared to book profits after a recent rally.

Jun 16, 2025, 8:17 am IST

Welcome to the Stock Market Live Blog

Good morning, and welcome right here in our live blog! As Sensex and Nifty set the pace today, we’re here to guide you through every market move.stay with us for real-time updates, insights from the equity market

Share This Article

Story first published: Monday, June 16, 2025, 8:15 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications