As of 12 PM, the Sensex was trading at 83,470.59, up 28.09 points or 0.03%, while the Nifty hovered at 25,453.90, down 7.40 points or 0.03%. The broader market remained mixed with midcap stocks under pressure, even as frontline indices were trading in red zone.

Earlier, The Indian stock market opened on a weak note Tuesday, with benchmark indices showing signs of early pressure, reflecting the cautious mood in global equities. This comes after an overnight announcement by former U.S. President Donald Trump, who revealed a new set of tariff measures targeting 14 different trading partners.

GIFT Nifty futures are trading 41 points lower, hovering around the 25,498 mark, suggesting a subdued start for benchmark indices like the Nifty 50 and Sensex. Market sentiment globally appeared mixed, as investors assessed the potential impact of Trump's sweeping tariff policy on international trade dynamics and corporate earnings.

US Stock Market After New Tariffs Announcement

Following Donald Trump's announcement of new tariffs, U.S. equity markets closed sharply lower on Monday. The Dow Jones Industrial Average dropped 0.94%, the S&P 500 declined by 0.79%, and the Nasdaq Composite slid 0.92%, as investors reacted to the potential economic implications of the trade measures.

Asian Markets Performance Recap

In the Asia-Pacific region, markets displayed a mixed but largely positive trend after an uncertain start. Japan's Nikkei 225 edged up by 0.21%, while South Korea's Kospi rose a strong 1.13%. Meanwhile, Hong Kong's Hang Seng index inched up by 0.17%, reflecting modest gains across the region.

LIVE Feed

Jul 08, 2025, 3:34 pm IST

Closing Bell: Nifty Closes At 25,522.5, Sensex Jumps 250 Points; Kotak, Eternal, Asian Paints Top Gainers

Closing Bell: Nifty Closes At 25,522.5, Sensex Jumps 250 Points; Kotak, Eternal, Asian Paints Top Gainers

Jul 08, 2025, 3:21 pm IST

Stock Market Live: Niftyh 50 Recovers And Reclaim 25,500 Mark

Stock Market Live: Nifty 50 recovers and reclaims 25,500 mark during the closing hours of the Indian stock market today.

Jul 08, 2025, 3:18 pm IST

Stock Market Live: Bank Sector Stocks Hold Ground

Stock Market Live: Several banking sector stocks held ground on Tuesday, despite lukewarm performance of the Indian stock market today. Nifty Bank was trading 0.54% higher at 2,223.40 points with Kotak Bank, SBIN, HDFC Bank, AU Bank, etc were trading higher. However, Nifty Bank PSU stocks were under pressure as the thematic index was trading in red today.

Jul 08, 2025, 2:27 pm IST

Stock Market Live: Textile Stocks Rally Post Trump Update

Stock Market Live: KPR Mills, Gokaldas Exports, Welspun Living, and other textile sector stocks are rallying on Tuesday, hours after the United States President Donald Trump announced that impose 35% tariffs on Bangladesh's imports.

Jul 08, 2025, 2:18 pm IST

Stock Market Live: Which Stocks Are Top Losers?

Stock Market Live: Titan, Dr Reddy's, Bajaj Auto, Trent, Cipla, Maruti, Axis Bank, Hindalco, Hindustan Unilever are among the top Nifty 50 losers.

Jul 08, 2025, 2:17 pm IST

Stock Market Live: Which Stocks Are Top Gainers?

Stock Market Live: Kotak Bank, Eternal, Grasim, NTPC, Asian Paints, BEL, UltraCEMCO, Infosys, JSW Steel were among the top gainers during the trading session on Tuesday.

Jul 08, 2025, 2:11 pm IST

Stock Market Live Updates July 8: Sensex at 83,512, Nifty Below 25,450; Kotak, Eternal,Grasim,NTPC Top Gainers

Stock Market Live Updates July 8: Sensex at 83,512, Nifty Below 25,450; Kotak, Eternal,Grasim,NTPC Top Gainers

Jul 08, 2025, 12:09 pm IST

BSE Shares Slide Over 6% Amid SEBI Action on Jane Street

Shares of BSE Ltd, Asia's oldest stock exchange, fell sharply on Tuesday, 8 July, declining over 6% in morning trade as investor sentiment remained weak. The stock has come under sustained selling pressure due to ongoing regulatory concerns and questions around its valuation.

Jul 08, 2025, 11:23 am IST

Titan Shares Fall 5% Despite 20% YoY Rise In Q1FY26 Consumer Business

Titan shares slipped over 5% this morning after the company released its Q1 FY26 business update, despite reporting over 20% growth in its Consumer business. Major segments like Jewellery, Eyecare, and Watches showed a mixed performance during the quarter.

Jul 08, 2025, 11:21 am IST

Nectar Lifesciences Announces Strategic Sale of API and Formulations Business to Ceph Lifesciences for Rs. 1,270 Cr

Nectar Lifesciences Limited, a pharmaceutical company, today announced the signing of a definitive Business Transfer Agreement (BTA) for the sale of its core business division—comprising the manufacture, distribution, and marketing of active pharmaceutical ingredients (APIs) and formulations—to Ceph Lifesciences Private Limited, for a consideration of ₹1,270 crore (INR 12,70,00,00,000), on a slump sale basis. Additionally, the Company has entered into an Asset Purchase Agreement (APA) for the sale of its menthol business assets to Ceph Lifesciences for ₹20 crore, marking a comprehensive restructuring move aligned with its future strategy.

Jul 08, 2025, 11:20 am IST

Satin Creditcare Network Appoints Two New Independent Directors

Satin Creditcare Network Limited (SCNL), has announced the appointment of two distinguished professionals, Mr. Ashok Kumar Sharma and Mr. Anupam Kunal Gangaher, as Independent Directors to its Board. Their appointments are for a period of three (3) consecutive years, effective June 27, 2025, and are subject to shareholder approval at the upcoming Annual General Meeting.

Jul 08, 2025, 11:19 am IST

Edelweiss Financial Services Limited announces ₹ 3,000 million Public Issue of Secured Redeemable NCDs

Edelweiss Financial Services Limited,, today announced the public issue of Secured Redeemable Non-Convertible Debentures of the face value of Rs.1,000 each for an amount up to ₹ 1,500 million (“Base Issue Size”), with a green shoe option of up to ₹ 1,500 million, cumulatively aggregating up to ₹ 3,000 million (“Issue Limit”). The Issue has 12 series of NCDs carrying fixed coupons and having a tenure of 24 months, 36 months, 60 months, and 120 months with annual, monthly and cumulative interest options. Effective annual interest yield on the NCDs ranges from 9.00% p.a. to 10.49% p.a. The Issue is scheduled to open on Tuesday, July 8, 2025 and close on Monday, July 21, 2025.

Jul 08, 2025, 10:19 am IST

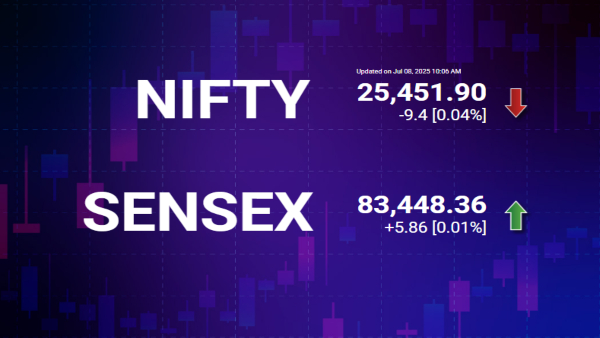

Sensex/ Nifty Update

Sensex trading at 83,417.62, down 24.88 points (0.03%), and the Nifty at 25,446.50, slipping 14.80 points (0.06%) as of 10 AM.

Jul 08, 2025, 9:46 am IST

Stock Market Live Updates: US Dollar Down Today

Stock Market Live Updates: US Dollar Down Today

Jul 08, 2025, 9:21 am IST

Stock Market LIVE Updates: Sensex Slips Over 100 Points, Trades Below 83,400 in Early Session

The Indian stock market opened on a weak note Tuesday, with benchmark indices showing signs of early pressure. The BSE Sensex declined over 100 points shortly after the opening bell and was seen trading below the 83,400 mark.

Jul 08, 2025, 8:43 am IST

Stock Market Live Updates: Brigade Enterprises and Prestige Group Announce Rs 900 Crore and Rs 2,700 Crore Hospitality IPOs

Bengaluru-based Brigade Enterprises has filed for a Rs 900 crore public issue for its hospitality arm, Brigade Hotel Ventures. Similarly, Prestige Group plans to raise Rs 2,700 crore by listing Prestige Hospitality Ventures, including a potential Rs 340 crore pre-IPO placement.

Jul 08, 2025, 8:25 am IST

Stock Market Live Updates: Jane Street Denies Market Manipulation Allegations by SEBI, Plans to Contest Findings

Jane Street expressed strong disappointment over India’s financial regulator accusing the U.S. trading firm of market manipulation. In an internal email to employees, the company called the accusations "extremely inflammatory" and stated it is preparing a formal response to contest the claims.

Jul 08, 2025, 8:03 am IST

Stock Market Live Updates: Trump Slaps New Tariffs on 14 Nations, With Rates Up to 40% Starting August 1

U.S. President Donald Trump announced a new set of blanket tariffs on imports from 14 countries, set to take effect from August 1. The measures include 25% tariffs on goods from Japan, South Korea, Malaysia, Kazakhstan, and Tunisia; 30% on South Africa and Bosnia; 32% on Indonesia; 35% on Bangladesh; 36% on Cambodia and Thailand; and the highest rate of 40% on imports from Laos and Myanmar. These tariffs are in addition to previously announced sector-specific duties.

Share This Article

Story first published: Tuesday, July 8, 2025, 7:59 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications