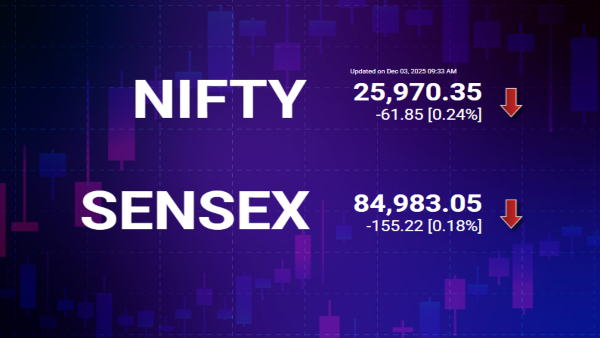

Indian equity indices ended largely flat on December 3 amid volatile trading. The Sensex closed 31.46 points lower at 85,106.81, down 0.04%, while the Nifty slipped 46.20 points to 25,986.00, down 0.18%.

The Indian stock market began today's session on a cautious note as multiple key domestic and global factors come into play. The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) meeting begins today, and investors are likely to adopt a wait-and-watch approach ahead of the central bank's policy cues on inflation, growth outlook, and interest rates.

In addition, the market will closely track India's November Services PMI and Composite PMI final data, which are important indicators of economic activity and business sentiment.

Adding to this, a steady flow of activity in the primary market and positive signals from global equities may help provide some support to investor confidence. However, early trends suggest a muted opening. As of 8:00 AM, GIFT Nifty futures were trading 20 points lower at 26,193, pointing to a flat-to-negative start for benchmark indices Nifty50 and Sensex.

Stock Market Recap

This cautious setup follows a weak close in the previous session. On Tuesday, the BSE Sensex slipped 503.63 points, or 0.59%, to end at 85,138.27, while the NSE Nifty50 declined 143.55 points, or 0.55%, to settle at 26,032.20.

LIVE Feed

Dec 03, 2025, 3:21 pm IST

Tata 1mg and OneBanc partner to plug India’s Rs. 30,000 crore white-collar health drag

Tata 1mg and OneBanc have entered a strategic partnership to reshape India’s corporate healthcare landscape, an opportunity exceeding Rs. 12,000 crore annually across diagnostics, OPD, and preventive wellness.For employees, this translates into convenience, continuity, and savings. For corporations, it delivers measurable productivity gains, reduced absence, lower claim volatility, and stronger retention. For healthcare brands, it opens context-aware access to verified salaried users, the most credible segment within India’s 600-million-strong workforce. India’s urban white-collar workforce faces a rising tide of lifestyle risks.

Dec 03, 2025, 3:17 pm IST

Ola Electric Crashes 25% in a Month, Slides to All-Time Low—What’s Spooking Investors?

Ola Electric Mobility’s share price hit a fresh all-time low of ₹38.18, slipping 5% on the BSE in intraday trade amid heavy volumes. The two- and three-wheeler manufacturer’s stock has now broken below its earlier low of ₹39.58, recorded on July 14, 2025, underscoring persistent selling pressure and weak investor sentiment.

Dec 03, 2025, 3:06 pm IST

Markets@3: Sensex, Nifty Rebound From Lows as Buying Emerges

The Sensex slipped 49.46 points, or 0.06 percent, to 85,088.81, while the Nifty fell 53 points, or 0.20 percent, to 25,979.20. Market breadth remained weak, with 1,291 stocks advancing, 2,497 declining, and 130 remaining unchanged.

Dec 03, 2025, 2:54 pm IST

First-Day Listing Buzz: Meesho IPO Gathers Slightly Over Full Demand

QIB – 0.16 times

NII - 1.27 times

Retail – 3.17 times

Overall – 1.02 times

Dec 03, 2025, 2:43 pm IST

JSW Steel Shares Slide as Sharp Q3 Profit Drop Rattles Investor Confidence

JSW Steel’s shares came under pressure after the company announced a joint venture with Japan’s JFE Steel for BPSL. The market reacted cautiously to the development, with investors assessing the potential financial commitments and strategic implications of the partnership. While the JV aims to strengthen JSW Steel’s technological capabilities and expand its value-added product portfolio, the immediate sentiment reflected concerns over near-term costs and integration risks, leading to a dip in the stock price.

Dec 03, 2025, 2:31 pm IST

Stock Market Live: Godrej Consumer Share Price Target

Stock Market Live Updates: Emkay Research has given buy rating for Godrej Consumer Products with a target price of Rs 1,400 per share. "Internationally, Indonesia’s revenue growth is likely to be marred

by competition, which will impact pricing. In the Africa cluster, growth is likely to be

healthy in Q3; from Q4, on a normalized base, growth is likely to decelerate to high

single digits. After positioning the air care category, we see margins in the Africa

cluster improving to 15-16%," noted the brokerage.

Dec 03, 2025, 2:30 pm IST

Stock Market Live: IPCA Lab Share Price Recommendation

"We initiate with BUY and an SoTP-based Dec-26E TP of Rs1,700 (implied target P/E of ~29x; in line with Ipca’s 3-year average trading range). Refer to the section titled ‘Why should I read this note?’ on the next page – we claim differentiation on three counts," noted Emkay Research in report/.

Dec 03, 2025, 2:28 pm IST

Stock Market Live: SEBI May Hike Expiry Day Margins For stock Derivatives. What This Means For Investors?

"SEBI’s intent to introduce longer-tenor derivatives is a structural reform aimed at shifting India’s F&O market from short-term speculation to genuine hedging and capital protection. Today, over-reliance on weekly expiries has created a market dominated by noise rather than risk management. Longer-duration contracts, such as quarterly, semi-annual, or annual, can deepen institutional participation, improve price discovery, and reduce expiry-day volatility. The transition will require careful design and liquidity support, but the direction is unambiguously positive: it aligns India with global best practices and tilts derivatives back toward their original purpose — stability, not speculation," stated Rahul Gupta, Chief Business Officer, Ashika Group

Dec 03, 2025, 1:13 pm IST

Stock Market Live Updates: Sensex Falls 240 Pts, Nifty Struggles In Reclaiming 26K, Wipro, Infy Top Gainers

Stock Market Live Updates: Sensex Falls 240 Pts, Nifty Struggles In Reclaiming 26K, Wipro, Infy Top Gainers

Dec 03, 2025, 12:59 pm IST

Sensex Today: Citi Maintains Buy on Reliance, Target Surges to Rs 1,805

Global brokerage Citi has revised key estimates for telecom and energy heavyweights, signalling a stronger outlook for both Bharti and Jio. The firm has also reaffirmed its preference in the India oil & gas universe, which remains closely watched by domestic investors.

Dec 03, 2025, 12:48 pm IST

Stock Market Updates: Meet Harsha Upadhyaya, CIO Driving Innovation at Kotak Mahindra Asset Management

Domestic and foreign investors are pulling Indian equities in opposite directions, creating a constant tussle in flows. Domestic Institutional Investors or DIIs are backing local markets with steady money, while Foreign Institutional Investors or FIIs are more guarded, watching relative valuations, earnings momentum abroad, and global themes such as artificial intelligence.

Dec 03, 2025, 12:38 pm IST

IPO Market Live Updates: Aequs IPO Fully Subscribed

Aequs received strong buying from RIIs and NIIs. At the time of writing, the IPO fully subscribed by 1.27x with bids of 5,33,16,240 equity shares against the offered size of 4,20,26,913 equity shares. The portion for retail and NIIs oversubscribed by 5.19x an 1.11x respectively. Also, the employees category oversubscribed by 3.50x. However, just like Meesho, Aequs also struggled to bag demand from QIBs who only bid for 10,080 equity shares in Aequs against the reserved size of 2,26,10,608 equity shares.

Dec 03, 2025, 12:37 pm IST

IPO Live Updates: Meesho IPO Subscription Status

As per data on NSE, Meesho saw bids of 14,35,90,860 equity shares, which accounted 52% of its total size of 27,79,38,446 equity shares. The retail individual investors (RIIs) category oversubscribed by 1.92x, while the portion reserved for non-institutional investors (NIIs) saw 60% subscription against offered size. However, qualified institutional buyers (QIB) bid just 3,09,150 equity shares against the offered size of 15,03,69,511 equity shares, indicating a slow start from this category.

Dec 03, 2025, 12:26 pm IST

Sensex Today: Colgate Palmolive hits 52-week low as Sensex slips in 19-week decline

Colgate Palmolive (India) was trading at Rs 2,111.00, lower by Rs 47.70 or 2.21 percent. The decline came after the previous close of Rs 2,158.70, when the stock had gained Rs 6.70. In the last session, Colgate Palmolive (India) had ended 0.31 percent higher at Rs 2,158.70.

Dec 03, 2025, 12:12 pm IST

Sensex Today Insights: Jefferies Signals on Pharma Stocks

Brokerage analysis of Indian CDMO companies shows refreshed project pipelines, with many firms now securing sizeable new mandates. Stronger order books also helped selected contract players feature among NIFTY Pharma intra-day gainers.

Within this Indian CDMO universe, Sai has recorded the biggest recent wins, which may contribute about 10–20 percent of FY28 CDMO revenue. These bookings are seen as crucial for medium-term earnings visibility.

Dec 03, 2025, 12:02 pm IST

Sensex Live Today: Sonata Software Stock Soars as Sensex Today Hits 16-Week High

Sonata Software is trading at Rs 368.15 on the exchanges, gaining Rs 18.10 or 5.17 percent from the last close. The counter has seen heavy interest, with intraday moves between Rs 351.65 and Rs 371.55 indicating active participation from traders.

Turnover in Sonata Software is also much higher than usual. Current volumes stand at 154,401 shares, sharply above the five-day average level of 37,300 shares.

Dec 03, 2025, 11:47 am IST

Stock Market Updates: Meesho IPO Opens, Brokerages Urge Subscriptions Amid Growth vs Profitability Debate

Meesho's public offering saw strong demand as the issue opened. It was supported by keen interest from institutional investors. The company had already raised Rs 2,439 crore from anchor investors earlier.

Investor bids reached nearly Rs 80,000 crore, about 33 times the shares on offer. This response highlighted heavy oversubscription.

Dec 03, 2025, 11:28 am IST

Stock Market Updates: Indonesia Tightens IPO Orders to Reduce Share Price Volatility

Indonesia’s Financial Services Authority, known as OJK, has introduced a new ceiling on investor participation in initial public offerings. Under the updated rule, individual buyers are restricted from taking overly large positions in newly listed companies.

Dec 03, 2025, 11:09 am IST

Stock Market Live Updates: Sensex and Nifty Slide in Early Trade

Equity benchmarks slipped during the session, with the Sensex losing 268.26 points, or 0.32 percent, to close at 84,870.01. The Nifty also ended weaker, dropping 107.25 points, or 0.41 percent, to settle at 25,924.95 on the exchange.

Dec 03, 2025, 10:54 am IST

Jindal Stainless ranks among global top 5% in DJSI scores;

Jindal Stainless has achieved

a landmark milestone in global sustainability rankings, securing an ESG score of 78 in the Dow Jones

Sustainability Index (DJSI) Corporate Sustainability Assessment (CSA) for FY25. This recognition places

Jindal Stainless among the top 5% of steel companies globally and ranks it fourth in the steel sector and

1

st in the stainless steel sector worldwide in the DJSI-modelled scores as of November FY25. The score

represents a significant rise from 60 in FY24, underscoring the company’s accelerated transition towards

sustainability-driven growth, transparency, and long-term value creation.

Dec 03, 2025, 10:31 am IST

Blue Cloud Softech Solutions Ltd Secures Major Data Annotation Project from Stratos Forge Inc

Blue Cloud Softech Solutions Limited

has today announced that it has received a major Data Annotation and AI Training

Services order from Stratos Forge Inc, headquartered at 317 George Street, Suite

320, New Brunswick, NJ 089013, USA. This follows the successful completion of a

substantial pilot engagement valued at Rs.18.00 Crores (approx.), where BCSSL

delivered an exceptional annotation accuracy of 96.68% across the agreed

metrics.

Dec 03, 2025, 10:11 am IST

Rupee At Record Low

.

Dec 03, 2025, 10:10 am IST

Sensex/Nifty

.

Dec 03, 2025, 9:43 am IST

Max Estates launches Estate 361

Max Estates has launched its newest residential community, Estate 361 in Sector 36A, Gurugram.

The community is rooted in its LiveWell philosophy, centred around a vibrant forest ecosystem

designed to rejuvenate daily living. Estate 361 embodies “many habits, one habitat”, a place where

everyday routines, and personal rhythms all find space within one balanced, forest-led community.

Dec 03, 2025, 9:29 am IST

Stock Market Live Updates: RBI Retains SBI, HDFC Bank and ICICI Bank as Domestic Systemically Important Banks

The Reserve Bank of India on Tuesday announced that State Bank of India (SBI), HDFC Bank and ICICI Bank will continue to remain classified as Domestic Systemically Important Banks (D-SIBs). As a result, these lenders must maintain additional Common Equity Tier 1 (CET1) capital over and above the existing capital conservation buffer, with SBI required to hold an extra 0.8%, HDFC Bank 0.4% and ICICI Bank 0.2%.

Dec 03, 2025, 9:25 am IST

Stock Market Live Updates: Indian Rupee Breaches 90-Mark Against US Dollar, Hits Fresh All-Time Low

The Indian rupee slipped past 90-per-US-dollar level on Wednesday, extending its recent losing streak as weak trade and portfolio flows, coupled with uncertainty over a pending trade deal with Washington, continued to weigh on the currency. The rupee dropped to a new all-time low of 90.13 per US dollar, surpassing Tuesday’s record of 89.9475, and was last trading 0.3% lower for the day.

Dec 03, 2025, 9:01 am IST

Stock Market Live Updates: Meesho Targets Rs 4,250 Crore Fresh Issue in IPO; Rs 1,171.2 Crore OFS Planned

E-commerce platform Meesho is set to raise Rs 4,250 crore through a fresh issue of shares to strengthen its cloud infrastructure and support capital expenditure needs, while an additional Rs 1,171.2 crore will be raised via an offer for sale. Notably, the company has earmarked Rs 480 crore—over 11% of the fresh proceeds for employee salaries within its technology development subsidiary. Following the IPO, the promoter group’s stake is projected to fall from 18.5% to 16.3%.

Dec 03, 2025, 8:45 am IST

Stock Market Live Updates: RBI Set to Begin December Monetary Policy Meeting Today

The Reserve Bank of India (RBI) is poised to commence its final Monetary Policy Committee (MPC) meeting of the year on December 3.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Wednesday, December 3, 2025, 8:41 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications