Stock Market Live Updates: As of 2:00 pm on August 25, stock market traded higher with strong gains in IT stocks. The Sensex climbed 455.32 points (0.56%) to 81,762.17, while the Nifty surged 134.80 points (0.54%) to 25,004.90, crossing the key 25,000 mark. On the Nifty 50, tech majors led the rally with Infosys up 3.24%, TCS gaining 2.90%, HCL Tech rising 2.79%, Wipro advancing 2.24%, and Tech Mahindra adding 1.80%. On the downside, FMCG and healthcare counters saw mild profit booking, with Nestle down 0.80%, Apollo Hospitals slipping 0.88%, Asian Paints losing 0.93%, Adani Enterprises falling 0.62%, and Bharat Electronics easing 0.52%.

Earlier, The Indian stock market opened on a positive note on Monday as Nifty and Sensex traded in green. While Nifty 50 opened 79 points higher, BSE Sensex was up around 194 points and opened at 81,501.

Earlier, Gift Nifty had indicated a positive opening of the stock market today. The indication has come after BSE and NSE witnessed high volatility in the past five trading sessions.

Investors are likely to react on the US Fed Chair Jerome Powell's recent speech where he has hinted of rate cuts in the coming months.

LIVE Feed

Aug 25, 2025, 3:50 pm IST

Stock Market Live Updates: Sensex and Nifty Close Higher; Benchmark Indices Extend Gains

The Indian stock market closed on a positive note today, with both benchmark indices registering notable gains. The S&P BSE Sensex rose by 329.06 points, ending the trading session at a new high of 81,635.91, reflecting strong investor sentiment across key sectors. Similarly, the NSE Nifty50 advanced by 97.65 points, settling just below the 25,000 mark at 24,967.75.

Aug 25, 2025, 2:39 pm IST

Market Live Updates: Hyundai Motor Shares Up Over 4%

Stock price of Hyundai Motor India surged by more than 4% after rating agency CRISIL re-affirmed its long-term rating on the company to AAA, while outlook is kept stable. In the filing, the company said that the latest CRISIL rating reaffirmation underscores its highest degree of safety w.r.t timely servicing of financial obligations.

Aug 25, 2025, 2:10 pm IST

Mahindra Susten appoints Avinash Rao as MD & CEO

Mahindra Susten, the cleantech arm of the Mahindra Group and a leading independent power producer (IPP) in India, today announced the appointment of Avinash Rao as its new Managing Director & Chief Executive Officer, effective September 24, 2025.

Aug 25, 2025, 1:24 pm IST

Vikran Engineering IPO GMP Rallies 21% Before Opening

Vikran Engineering IPO will open for public subscription tomorrow, and investors are already very keen on the issue. This EPC company is seeing a huge interest in the grey market, as the IPO is trading at a healthy premium well above its issue price. Vikran Engineering IPO is expected to gather strong demand once it opens for subscription tomorrow, August 26th

Aug 25, 2025, 1:21 pm IST

IREDA signs Performance MoU with MNRE

Indian Renewable Energy Development Agency Limited (IREDA) today signed a performancebased Memorandum of Understanding (MoU) with Ministry of New and Renewable Energy (MNRE), Government of India. The MoU was signed by Shri Santosh Kumar Sarangi, Secretary, MNRE and Shri Pradip Kumar Das, Chairman & Managing Director, IREDA at Atal Akshay Urja Bhawan, New Delhi, in the presence of senior officials from MNRE and IREDA. Under the MoU, the Government of India has set a Revenue from Operations target of ₹8,200 crores for FY 2025-26.

Aug 25, 2025, 12:38 pm IST

Nxtra by Airtel releases Sustainability Report for FY 2024-25

Nxtra Data Limited, a subsidiary of Bharti Airtel today, unveiled its Sustainability Report for FY 2024-25. The Report details the company’s progress in building digital infrastructure that is intelligent, scalable and sustainable.Contracted a massive 482,800 MWh of renewable energy sourcing 3X higher than baseline year of 2021 Reduced average Power Usage Effectiveness (PUE) by 10% as compared to FY 2021 as baseline

Aug 25, 2025, 12:38 pm IST

Swan Energy Rebrands as Swan Corp

Swan Energy Limited has officially rebranded as Swan Corp Limited, unveiling a new corporate identity that reflects its evolution into a diversified industrial conglomerate. The rebrand marks a strategic pivot into key growth sectors, including manufacturing, defence, energy, and real estate

Aug 25, 2025, 12:17 pm IST

If GST Rate Cut, Inelastic to Demand and Minimal Impact on Top-Line

“Prices are likely to remain soft during the monsoon season, while any price hike announcements/attempts ahead of the GST rate cut have limited chances of implementation or sustainability due to close monitoring by the CCI. The GST rate cut is primarily intended to provide comfort to consumers, though companies may attempt to benefit from it. However, consumer acceptance and CCI scrutiny are likely to be hurdles. A GST rate cut from 28% to 18% implies an impact of ~Rs30/bag on billing price, which will not hamper companies’ top line. Moreover, the rate cut is inelastic to cement demand. The only likely shift will be consumers opting for better quality and branded products at the same billing price (ex-GST). Demand remains weak and is expected to be softer than Q2FY25 due to heavy rains, sluggish demand, and intensifying competition. A marginal uptick in demand may be expected from Q3FY26 onwards. On the cost front, stable diesel prices and softer coal prices are likely to provide some respite, though elevated pet-coke prices may offset these gains. Companies with higher usage of green energy will continue to enjoy cost tailwinds,” Yes Securities said in a note.

Aug 25, 2025, 11:51 am IST

Daily Market Outlook- Axis Securities

On Friday, the Nifty slipped 214 points to close at 24,870, forming a sizable bearish candle with a lower high-low on the daily chart and ended below the prior session’s low, signalling further weakness.

Bank Nifty settled at 55,149, down 606 points. The index also formed a sharp bearish candle and breached the previous session’s low, reinforcing the weak undertone.

Our trend score analysis of the Nifty and Bank Nifty suggests a bearish outlook for both benchmarks.

Aug 25, 2025, 11:31 am IST

Nifty Prediction Today By Anand James, Chief Market Strategist, Geojit Investments Limited

The anticipated volatility having unfolded without penetrating 24850 on Friday, we will open today expecting renewed attempts to push higher, However, inability to float above 25115 after initial positivity, or a direct fall below 24740 could spark a 23860 plunge. This though is not expected today. However, a free move up is less expected either.

Aug 25, 2025, 11:30 am IST

Today’s crypto market update

“Ethereum reached a new all-time high today, while Bitcoin held firm at key support levels, leaving traders closely watching for signs of either a breakout or a potential pullback.

At the macro level, market sentiment is being shaped by heightened discussion around the U.S. Federal Reserve’s upcoming September meeting. The recent surge in optimism regarding potential rate cuts has lifted risk appetite, though excessive euphoria could also signal a short-term top.

In the DeFi sector, Aave’s token experienced sharp volatility following rumors of an altered token allocation from World Liberty Financial. While prices partially recovered, the episode highlighted the market’s sensitivity to unverified reports and the growing importance of reliable communication within decentralized ecosystems,” said Mr. Himanshu Maradiya, Founder and Chairman, CIFDAQ.

Aug 25, 2025, 11:28 am IST

Paras Defence Shares In Focus

Leading defence and space engineering company Paras Defence and Space Technologies Limited said Friday that it has been awarded a prestigious order worth about Rs 45.32 crore from Bharat Electronics Limited (BEL). In order to boost India's air defence applications, the contract calls for the provision of Signal and Data Processing Systems and Multi-Sensor Fusion Systems. Delivery of the systems is expected to occur no later than 29 months.

Aug 25, 2025, 11:26 am IST

Muthoot Finance Shares In Focus

In order to expand into more than 250 Indian towns, Muthoot Finance, the country's largest gold loan NBFC, has invested Rs 200 crore in Muthoot Homefin (India) Ltd (MHIL), a wholly-owned housing finance subsidiary.

Aug 25, 2025, 10:01 am IST

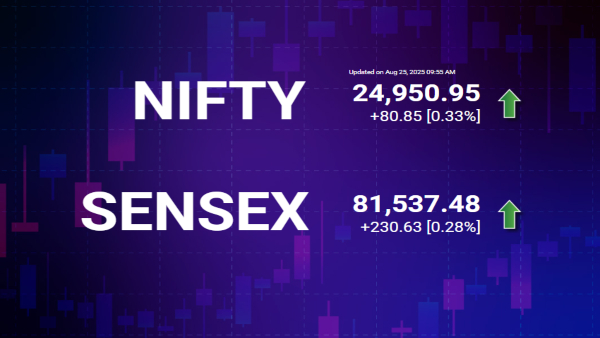

Stock Market Live: How Nifty, Sensex Have Performed So far?

Stock Market Live: Sensex has surged around 230 points, whereas Nifty 50 is trading 80 points higher/

Aug 25, 2025, 9:45 am IST

Stock Market Live: Motilal Oswal's Technical Stock Pick Of The Day

Stock Market Live: The brokerage has given a buy rating for Torrent Pharma stock, with a target price of Rs 3,950 per share.

Aug 25, 2025, 9:42 am IST

Stock Market Live: Nifty, Sensex Technical Outlook For The Day

Stock Market Live: "NIFTY (Bearish - CMP : 24870) : Nifty immediate support is at 24700 then 24600 zones while resistance at 25150 then 25250 zones. Now it has to cross and hold above 25000 zones for an up move towards 25150 then 25250 zones while supports have shifted lower to 24700 then 24600 zones.

BANK NIFTY (Bearish - CMP : 55149) : Bank Nifty support is at 55000 then 54500 zones while resistance at 55555 then 55750 zones. Now till it holds below 55555 zones some weakness could be seen towards 55000 then 54500 levels while on the upside hurdle is seen at 55555 then 55750 zones," according to Motilal Oswal

Aug 25, 2025, 9:36 am IST

Stock Market Live: Which Stocks Are Top Gainers, Top Losers

Stock Market Live: Wipro, Infosys, TCS, Hindalco, HCL Tech, Tech Mahindra, etc are among the top gainers on Nifty. Whereas, Nestle India, Bharti Airtel, Eternal, ICICI Bank, ITC, Hindustan Unilever, etc were among the top laggards.

Aug 25, 2025, 9:12 am IST

Stock Market Live: Stock Market Recap

Stock Market Live: "Nifty ended 0.85% lower at 24,070, snapping its six-day winning streak as investors turned cautious ahead of Federal Reserve Chair Jerome Powell's policy remarks at the Jackson Hole symposium. Profit booking also weighed on markets, amid caution ahead of the approaching secondary tariff agreement deadline. Broader indices followed suit, with the Nifty Midcap100 down 0.1% and Smallcap100 down 0.3%. On the sectoral front, the pressure was led by Nifty Metal (-1.25%) and Nifty PSU Bank (-1.12%). On the other hand, hospital stocks remain in focus, with the sector maintaining stable momentum in Q1FY26. Revenue grew 16.5% YoY while EBITDA rose 20.5%, supported by capacity additions and improved efficiencies. With listed players planning to add 14,000 beds over FY25-27 (a 35% jump from the current 39,000 capacity) and aggregate occupancy at 59%, the sector offers room for sustained growth."

Aug 25, 2025, 9:12 am IST

Stock Market Live: Sensex Nifty Higher During Pre-Market Open

Stock Market Live: Sensex Nifty Higher During premarket opening

Providing a comprehensive recap of the stock market last week, Siddhartha Khemka of Motilal Oswal noted, "Nifty ended 0.85% lower at 24,070, snapping its six-day winning streak as investors turned cautious ahead of Federal Reserve Chair Jerome Powell's policy remarks at the Jackson Hole symposium. Profit booking also weighed on markets, amid caution ahead of the approaching secondary tariff agreement deadline. Broader indices followed suit, with the Nifty Midcap100 down 0.1% and Smallcap100 down 0.3%. On the sectoral front, the pressure was led by Nifty Metal (-1.25%) and Nifty PSU Bank (-1.12%). On the other hand, hospital stocks remain in focus, with the sector maintaining stable momentum in Q1FY26. Revenue grew 16.5% YoY while EBITDA rose 20.5%, supported by capacity additions and improved efficiencies. With listed players planning to add 14,000 beds over FY25-27 (a 35% jump from the current 39,000 capacity) and aggregate occupancy at 59%, the sector offers room for sustained growth."

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Monday, August 25, 2025, 9:06 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications