Stock Market Live Updates: Stock market ended on a positively for the second day this week. The BSE Sensex closed 335.97 points higher, or 0.40%, at 83,871.32, while the NSE Nifty 50 advanced 120.60 points, or 0.47%, to settle at 25,694.95.

The Indian stock market opened flat on Tuesday, with Nifty 50 trading

Gift Nifty on Tuesday indicated a positive start for Nifty and Sensex. Both the benchmarks closed with gains in the earlier session as investors showcased confidence in the Indian stock market.

As per the early cues US stock market also ended in green, whereas Asian stock market indices were trading in green early Tuesday.

"Global cues also supported the move, as progress toward avoiding a U.S. government shutdown boosted investor confidence. By the close, the Sensex gained 319 points or 0.38% to end at 83,535.35, while the Nifty rose 82 points or 0.32% to 25,574.30. Most sectors saw buying interest, led by IT and pharma, along with strength in metal and energy stocks. Realty and FMCG, however, closed slightly lower. The Nifty Midcap index added 0.5%, and the Small-cap index was up 0.35%," stated Bajaj Broking in its commentary.

LIVE Feed

Nov 11, 2025, 3:22 pm IST

Top Nifty performers for the day.

InterGlobe Aviation (IndiGo) led the rally with a sharp rise of 3.48%.Bharat Electronics Ltd (BEL) followed with a 2.48% gain as defense sector stocks remained in focus after recent order wins. HCL Technologies also added 1.90%. Meanwhile, Bajaj Auto advanced 1.32%, while Eternal climbed 1.43%, rounding off the list of

Nov 11, 2025, 2:54 pm IST

Most Active Stocks Today

Among the most active stocks on the Nifty 50 today were Bharti Airtel, Bajaj Finance, Infosys, Bharat Electronics, Bajaj Finserv, ICICI Bank, and Reliance Industries. Heavy trading volumes were seen in financial and telecom counters, with Bharti Airtel and BEL leading the gainers, while Bajaj Finance and Bajaj Finserv saw sharp declines,

Nov 11, 2025, 2:26 pm IST

Result Update: Anthem Biosciences | Moderate 2Q; near-term weakness induces ADD rating

“Anthem Biosciences delivered a moderate 2QFY26 with rev./EBITDA/PAT growing 5%/12%/ 7% and EBITDA margins expanding 432bps YoY to 41.5%. Growth was driven by the CRDMO segment (+8.5% YoY) supported by commercial molecule ramp-up (56% of rev.), and resilient CRO traction despite funding challenges in biotech. Specialty Ingredients (-13% YoY) declined due to capacity prioritization but is expected to recover in 2HFY26 with Unit II expansion now complete. Unit II’s final 76kL block is now operational, while Unit III fermentation capacity will commission by year-end, adding INR 6bn in revenue visibility. With nine potential blockbusters, marquee clients such as AbbVie, Novartis, and Pfizer, and six commercial programs whose end-market sales are expected to double by CY29, Anthem’s growth visibility remains strong. We forecast FY25–28 revenue/EBITDA/PAT CAGR of 22%/22%/24%, supported by INR 13–14bn of internally funded capex. While Anthem is projected to be amongst the fastest growing CRDMO over FY25-28, near-term earnings moderation and elevated valuations limit upside. We value the stock at 40x Sep’27E EBITDA, at par with Divi’s, to arrive at a TP of INR 798. Maintain ADD,” commented Amey Chalke of JM Financial Institutional Securities.

Nov 11, 2025, 1:53 pm IST

Result Update: ONGC | Earnings miss on higher opex and slightly lower sales realisation

“ONGC’s 2QFY26 standalone EBITDA, at INR 177bn, was 2-3% lower than JMFe/consensus of INR 183bn/INR 181bn on higher opex of INR 69.1bn vs. JMFe of INR 60bn (vs. INR 55.8bn in 1QFY26) led by forex loss of INR 11.7bn (vs. forex gain of INR 0.3bn in 1QFY26); further, crude and gas realisation was a tad lower than JMFe but crude & gas sales volume was slightly better. However, PAT, at INR 98.5bn, was significantly above JMFe/consensus of INR 88.3bn/INR 92.3bn, led by higher other income of INR 34.2bn (vs. JMFe of INR 25bn) and aided by lower dry well w/offs of INR 11bn (vs. JMFe of INR 12bn). We maintain BUY (revised TP of INR 295 – based on 6x FY28 PE vs. global peers trading at 8-10x) based on our assumption of: a) Brent at USD 70/bbl vs. CMP discounting ~USD 60/bbl of net crude realisation; and b) cumulative output growth of ~6% over FY26-28, driven by KG DW 98/2 block and Western offshore blocks. ONGC is also a robust dividend play (4-5%). At CMP, it trades at 5.7x FY28E consolidated EPS and 0.7x FY28E BV,” commented Dayanand Mittal of JM Financial Institutional Securities.

Nov 11, 2025, 1:24 pm IST

Rating Upgrade: Fine Organic Industries | Volume growth possible only from FY28E

“Fine Organic’s (FOIL) 2QFY26 earnings print was unexciting, as the company experienced a dip in volumes amidst tariffs. A sharp rise in raw material prices is likely to have resulted in inventory gains and trading benefits in its subsidiaries. The company currently does not have any headroom for volume growth until 2HFY28, when its new facilities (SEZ unit at JNPA and expansion in the US) are expected to be commissioned. Moreover, depreciation from these large capex projects will begin impacting the P&L from FY27. As a result, the company is likely to see an EPS decline in FY27 and deliver a dismal ~2% EPS CAGR over FY26E–28E, even after building in a ~9% EBITDA CAGR over the same period. We roll forward to Dec’27E earnings and upgrade the stock to REDUCE (from SELL earlier), with a Dec’26 target price of INR 4,225 (based on 30x Dec’27E EPS), as we now expect the stock to experience time correction rather than price correction from here on until volume growth resumes,” said Krishan Parwani of JM Financial Institutional Securities.

Nov 11, 2025, 1:08 pm IST

Rating Downgrade: Bajaj Finance | In-line quarter; MSME stress weighs on growth

“Bajaj Finance (BAF) reported an inline PAT (~23%/4% YoY/QoQ, -1% JMFe) driving RoA/RoE of ~4.0%/18.9%. NII grew 22% YoY, 5% QoQ led by 25bps improvement in cost of funds and AUM growth of +24% YoY, +5% QoQ. Flattish other income due to muted recoveries led to PPoP growth of ~21%/5% YoY/QoQ (-1% JMFe). Credit cost remained flat and elevated at 2.0% as GS3 moved up 21bps QoQ to 1.2% led mainly by MSME and captive 2/3W segments. In regard to this, company remains conservative on disbursals in these segments and revised its AUM growth guidance from earlier 24-25% to 22-23% for FY26E. Further, management guided for flat NIMs from here on as cost benefits will be passed on to customers. Fee income growth guidance of ~13%-15% and credit cost of ~1.85%-1.95 in FY26E was maintained. Considering the revision in mgmt. growth guidance, we revised our EPS estimates down by ~2%-3% for FY26/27E. We roll forward our estimates to FY28E and value the stock at ~4.7x/24x Sep-27E BVPS/EPS to entail a revised TP of 1,140. We downgrade the stock to ADD,” said Ajit Kumar of JM Financial Institutional Securities.

Nov 11, 2025, 12:54 pm IST

Stock Market Live Updates: Cera Sanitaryware Q2 net profit down 17%

Cera Sanitaryware has a decline in net profit for the second. The company's earnings have decreased by 17%, amounting to Rs 56.6 crore compared to Rs 68 crore in the same period last year. This drop highlights challenges faced by the company in maintaining its profit margins.

Nov 11, 2025, 12:37 pm IST

Stock Market Live Updates: Morgan Stanley keeps 'overweight' rating on Bajaj Finance

Morgan Stanley has maintained its 'overweight' stance on Bajaj Finance, setting a target price of Rs 1,195. This decision reflects the firm's confidence in Bajaj Finance's growth potential and market position. The financial services company has consistently shown strong performance metrics, which have contributed to this positive outlook.

Nov 11, 2025, 12:21 pm IST

Stock Market Live Updates: Jefferies maintained a ‘buy’ rating on Syrma SGS Technology

Jefferies has maintained its 'buy' recommendation for Syrma SGS Technology, setting a target price of Rs 800. This decision reflects Jefferies' confidence in the company's potential for growth and profitability. Investors might find this information useful when considering their investment strategies.

Nov 11, 2025, 12:09 pm IST

Stock Market Live Updates: RateGain Travel Reports ₹51 Crore Net Profit in Q2 FY25, Down 2.3% Year-on-Year

RateGain Travel Q2 FY25 results show a slight 2.3% dip in net profit to ₹51 crore compared to ₹52.2 crore last year, amid stable business growth.

Nov 11, 2025, 11:44 am IST

Sensex Live Today: Jindal Stainless Reports Impressive 32% Profit Growth

Jindal Stainless has reported a significant rise in its financial performance. The company's profit surged by 32 percent, reaching Rs 806.9 crore compared to Rs 611.3 crore from the previous year. This impressive growth highlights the company's strong financial health and operational efficiency.

Nov 11, 2025, 11:27 am IST

Stock Market Live Updates: Granules India's Hyderabad Facility Gets USFDA Green Light!

Granules India's subsidiary has received approval from the US Food and Drug Administration (USFDA) for its Hyderabad facility. This development is significant for the company as it enhances its manufacturing capabilities in India.

Nov 11, 2025, 11:16 am IST

Market Live Updates: Is PhysicsWallah IPO Worth Your Investment? Find Out Now!

The initial public offering (IPO) of PhysicsWallah commenced its public bidding phase on November 11. The IPO, valued at Rs 3,480 crore, has seen a subscription rate of 2 percent on its first day. As per the National Stock Exchange (NSE) data at 10:50 am, there were bids for 41.52 lakh shares compared to the offered 18.62 crore shares.

Nov 11, 2025, 11:01 am IST

Triveni Turbine Q2 Performance: Marginal Growth in Profit and Revenue

Triveni Turbine reported a modest increase in its consolidated financial performance for the second quarter. The company's profit rose slightly by 0.3 percent, reaching Rs 91.2 crore compared to Rs 90.9 crore in the same period last year. Meanwhile, revenue showed a marginal improvement of 1 percent, climbing to Rs 506.2 crore from Rs 501.1 crore year-on-year. This steady, albeit modest, growth reflects the company's consistent operational performance amid a challenging market environment.

Nov 11, 2025, 10:46 am IST

Dr. Reddy’s Biologics Head Resigns; Shares Edge Up

Jayanth Sridhar, Global Head of Biologics at Dr. Reddy’s Laboratories, will resign effective January 31, 2026, to explore opportunities outside the company. Following the news, the stock rose 0.28% to Rs 1,201.85, trading between Rs 1,199 and Rs 1,207.60 on low volumes. The share is currently 14.43% below its 52-week high of Rs 1,404.60, with a market capitalization of Rs 1,00,308.05 crore.

Nov 11, 2025, 10:28 am IST

Bajaj Finance Under Pressure Despite Strong Growth

Bajaj Finance reported 24% AUM growth and 23% PAT growth, outperforming many large banks. However, rising NPAs and scale-related challenges are visible. To maintain RoA and EPS growth, the company has tightened costs, including rationalising its points of presence. Bernstein maintains an ‘underperform’ rating with a target of Rs 640.

Nov 11, 2025, 10:16 am IST

Britannia Industries Shares See Significant Dip Amid Market Volatility

As of 11th November 2025 at 10:14 AM, Britannia Industries Ltd. shares were trading at ₹5,815, reflecting a sharp decline of ₹318.50 or 5.19% for the day. The stock’s intraday range fluctuated between ₹5,723 and ₹5,950, while its 52-week performance ranged from ₹4,506 to ₹6,336. The trading volume was robust at over 1 million shares, indicating active investor participation. Britannia, a leading FMCG player in the consumer food sector, currently holds an mScore of 71/100, reflecting moderate market sentiment.As of 11th November 2025 at 10:14 AM, Britannia Industries Ltd. shares were trading at ₹5,815, reflecting a sharp decline of ₹318.50 or 5.19% for the day. The stock’s intraday range fluctuated between ₹5,723 and ₹5,950, while its 52-week performance ranged from ₹4,506 to ₹6,336. The trading volume was robust at over 1 million shares, indicating active investor participation. Britannia, a leading FMCG player in the consumer food sector, currently holds an mScore of 71/100, reflecting moderate market sentiment.

Nov 11, 2025, 10:01 am IST

CarTrade Explores Deal to Merge CarDekho & BikeDekho

CarTrade Tech is reportedly in discussions with Girnar Software for a potential consolidation of India’s automotive classifieds businesses, CarDekho and BikeDekho. The talks are strictly limited to automotive classifieds and exclude financing, insurance, or other non-automotive segments. No binding agreement has been signed yet. On the stock front, CarTrade Tech was trading at Rs 2,999.90, up 0.57%, with a 52-week high of Rs 3,182.35 and a market capitalization of Rs 14,337.65 crore.

Nov 11, 2025, 9:48 am IST

tock Market Live Updates

Rupees vs Dollar

Nov 11, 2025, 9:46 am IST

Stock Market Live Updates

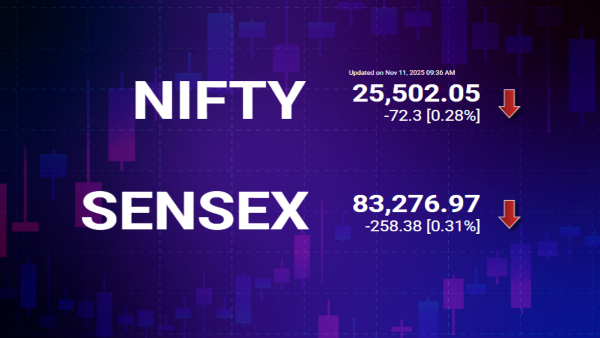

Sensex and Nifty Live Updates

Nov 11, 2025, 9:35 am IST

Bajaj Finserv Dips Over 5% Amid Heavy Trading

Bajaj Finserv fell 5.75% to Rs 1,998.50, hitting an intraday high of Rs 2,093.05 and low of Rs 1,996.30. Volumes surged to 39,369 shares, up 127% from the five-day average. The stock is trading 8.94% below its 52-week high of Rs 2,194.65 and 28.5% above its 52-week low of Rs 1,555.25, with a market cap of Rs 3,19,322.97 crore.

Nov 11, 2025, 9:20 am IST

Stock Market Live Updates: Sensex Opens Flat, Nifty Above 25,600; HCL Tech, BEL, ICICI Bank, Infy Top Gainers

Stock Market Live Updates: Sensex Opens Flat, Nifty Above 25,600; HCL Tech, BEL, ICICI Bank, Infy Top Gainers

Nov 11, 2025, 8:32 am IST

Stock Market Live: Q2 Results Today

Stock Market Live: Godrej, RVNL, Rites, Tata Power, Amanta Healthcare, Atlanta Electricals, etc will announce their Q2 results today

Nov 11, 2025, 8:30 am IST

Stock Market Live: Which Stocks To To Buy Today?

Stock Market Live: Here is a list of stocks that can be tracked by investors for valuable gains.

Nov 11, 2025, 8:28 am IST

Stock Market Live Updates: What Is The Nifty 50 Outlook For Today?

Stock Market Live Updates: “Buying demand was seen emerging from the key support area of 25,200-25,400 being the confluence of the 50 days EMA, previous breakout area and 50% retracement of previous up move (24587-26104). Index is seen rebounding from the oversold territory as the daily stochastic has generated a buy signal signaling moving above its three periods average thus supports the positive bias,” stated Bajaj Broking in its commentary.

Nov 11, 2025, 8:25 am IST

Stock Market Live: Gift Nifty Indicates Positive Opening Of Indian Stock Market Today

Stock Market Live: Gift Nifty Indicates Positive Opening Of Indian Stock Market Today

For Nifty 50's outlook, the brokerage added, "Nifty has formed a bull candle on the daily chart with a higher high and higher low signaling follow up buying to previous session pullback from the 50 days EMA. Going ahead, we expect index to hold above the support area of 25,200-25,400 and gradually head towards the immediate resistance of 25,850 and then towards the recent 52 weeks high of 26,100 in the coming weeks."

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Tuesday, November 11, 2025, 8:25 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications