Sep 22, 2025, 2:38 pm IST

Unicommerce Launches “GST Guidance Tool” to Simplify Compliance for E-commerce Sellers

Unicommerce, has launched its GST Guidance Tool, aimed at helping online sellers stay compliant with the GST revisions that have taken effect from today. With the government announcing significant changes to GST rates across product categories, e-commerce sellers now face the challenge of manually reviewing and updating tax rates for thousands of SKUs - a potentially error-prone and time-consuming process. Unicommerce’s new tool addresses this by providing instant insights on tax rate applicable across products.

Sep 22, 2025, 1:59 pm IST

Market Live Updates: Sterling & Wilson Shares Fall

The share price of Sterling & Wilson dropped nearly 1% after the arbitral tribunal rejected claims of its subsidiary Sterling Solar. The tribunal dismissed Sterling Solar's claim of Rs 486 crore and granted claim to Conti, LLC, USA with Rs 57 crore plus interest.

Sep 22, 2025, 1:29 pm IST

Market Live Updates: Hotel Stock Rally

The share price of Kamat Hotels gained nearly 5% after the company announced opening of its new properties namely “The Orchid Rishivan Hotel, Rishikesh” and “IRA by Orchid Hotel, Hyderabad.” Together, these launches add 117 new keys to KHIL’s growing portfolio and strengthen its footprint across North and South India.

Sep 22, 2025, 1:17 pm IST

Market Live Updates: 3 Adani Stocks Hit Upper Circuit

Three Adani stocks touched their 10% to 20% upper circuit on BSE, making them top gainers. These are Adani Power, Adani Total Gas, and Adani Green Energy. These stocks climbed after Sebi cleared Adani Group of all allegations by Hindenburg.

Sep 22, 2025, 11:50 am IST

Stock Market Live Updates: Ganesh Consumer Products IPO Off to Slow Start on Day 1

The Rs 89 crore IPO of Ganesh Consumer Products opened for subscription today, September 22, but witnessed a muted response in early hours. As of 11:19 AM, only 4% of the issue was subscribed, with retail investors bidding for 7% and non-institutional investors just 2%, according to NSE data.

Sep 22, 2025, 11:27 am IST

Stock Market Live Updates: Adani Green Jumps 4% as Power Stocks Shine

Adani Green Energy shares surged 4% on September 22, currently trading at Rs 1,077. The overall power sector is also showing strength, with the BSE Power index up 1.8% at 6,992. Among the top performers in the index are Adani Energy Solutions, rising 2.2% and Torrent Power, which gained 1.3%.

Sep 22, 2025, 10:53 am IST

Stock Market Live Updates: Adani Power Shares Surge 20% on Stock Split Ex-Date

Adani Power shares jumped nearly 20% on the ex-date of its stock split. The stock price rose by Rs 28.35, reaching Rs 170.25 as of 10:50 AM on September 22.

Sep 22, 2025, 10:29 am IST

Stock Market Live Updates: IT Stocks Crash Amid H-1B Visa Fee Shock

Tech stocks nosedived on Monday, led by Tech Mahindra (-6%), Mphasis (-5.5%), Persistent (-5.3%), and LTI (-5%). Other major losers included Coforge (-4.1%), Infosys (-3.5%), Wipro (-3.3%), TCS (-3.3%) and HCLTech (-3%), as investors reacted sharply to the steep hike in U.S. H-1B visa fees.

Sep 22, 2025, 9:43 am IST

Currency Update

On September 22, 2025, the Indian Rupee began the day higher against the US dollar, rising 22 paise to trade at ₹88.17 per dollar, or a gain of 0.25%.

Sep 22, 2025, 9:37 am IST

Opening Bell

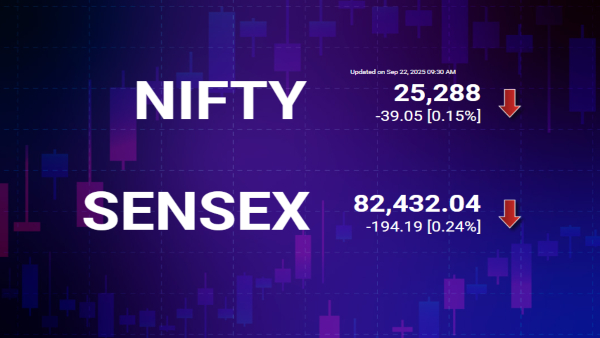

Today, September 22, 2025, saw a dismal start to the Indian stock market, with both benchmark indexes trading down. The Sensex down 194.19 points, or 0.24%, to 82,432.04, while the Nifty fell 39.05 points, or 0.15%, to 25,288.

Sep 22, 2025, 9:32 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

The market is likely to witness a dualistic behaviour today with the IT sector getting impacted by the H1B visa issue and and the domestic consumption themes responding to the potential big boost to consumption coming from the lower GST rates kicking-in from today. This festival season is likely to witness one of the best consumption booms in recent times.

Indian stock market’s huge underperformance during the last one-year compared to most markets of the world, is likely to end soon. But a runaway rally is unlikely since high valuations continue to be a concern.

The present low interest rate regime will aid the consumption boost and will also facilitate increase in credit demand. This has the potential to boost the profitability of financials. Banking stocks which have been under pressure from NIM compression fears are fairly valued and have the potential to deliver decent returns.

Sep 22, 2025, 8:38 am IST

Bank Nifty Outlook Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

On Friday, the index largely remained under bearish pressure, though intermittent support was visible through the day. Importantly, it has been respecting its steep ascending trendline, which has consistently triggered reversals over the past three weeks. Adding to the positivity, a Bullish Harami candlestick conformation on the weekly chart further validates the uptrend, while the index ended the week above the psychological 55,000 mark. On the daily chart, Nifty Bank closed slightly lower than the prior session, indicating continued profit-booking and potential sideways movement in the near term. Nonetheless, corrective dips are likely to attract buying interest. Momentum indicators also remain constructive, with RSI holding near the 60 zone, confirming the positive undertone.

With resistance-turned-support dynamics in play, the 55,100–55,200 band has now emerged as a strong demand zone. On the higher side, 55,800–56,000 remains the immediate obstacle. As long as the base holds firm, a buy-on-dips strategy continues to favour the bulls.

Sep 22, 2025, 8:38 am IST

Nifty Outlook Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

During Friday’s session, bears had the upper hand, though intermittent support was visible throughout the day. The index has been closely following its steep ascending trendline, which has consistently acted as a strong reversal zone over the past three weeks. Additionally, it remains comfortably above its breakout level, which now serves as a decisive support. On the daily chart, Nifty closed slightly lower than the previous day’s low, hinting at ongoing profit-booking and possible sideways consolidation ahead of the weekly expiry on Tuesday. Still, corrective dips are expected to attract accumulation. Momentum indicators remain supportive, with RSI sustaining above 60, signalling continued strength.

The 25,200–25,250 band has now emerged as a solid demand zone, while resistance is seen at 25,500. As long as this base remains intact, a buy-on-dips strategy continues to be favoured.

Sep 22, 2025, 8:37 am IST

Bank Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

The derivatives setup continues to show resilience, with put writers holding a distinct edge over call writers. At the 56,000 strike, significant open interest accumulation of 14.88 lakh contracts has cemented this level as a strong resistance zone. On the flip side, the 55,000 strike carried the highest put OI of 14.55 lakh contracts, making it a reliable support level.

Sustained put writing at lower strikes signals limited conviction for deeper declines, while parallel additions on call positions highlight expectations of a range-bound move in the immediate term. The Put-Call Ratio (PCR) eased marginally to 1.02 from 1.10 but still reflects a bullish undertone, leaving room for sustained momentum once resistance is cleared.

Sep 22, 2025, 8:37 am IST

Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Derivatives data points to some caution as call writers aggressively added positions, gaining an upper hand over put writers. Fresh open interest of 1.69 crore contracts at the 25,400 strike reinforced this level as a key resistance ceiling, while significant put OI of 1.40 crore contracts at 25,300 reaffirmed it as immediate support. The addition of both call and put positions near at-the-money strikes indicates a lack of strong directional bias, suggesting a range-bound move in the near term. The Put-Call Ratio (PCR) cooled sharply to 0.82 from 1.09, reflecting a mildly negative sentiment. Nonetheless, shallow corrections may still provide buying opportunities.

Sep 22, 2025, 8:35 am IST

Markets to Face Elevated Volatility Amid Global Policy Developments and Trade Negotiations - Mr. Devarsh Vakil, Head of Prime Research, HDFC Securities

The Trump administration has introduced significant changes to the H-1B visa program. A new executive order imposes a 0,000 application fee for each new H-1B visa. The fee is applicable only for new applicants and will not affect renewals or current H-1B holders.

This sudden fee hike has sparked confusion and panic among tech companies and international workers, particularly those from India, which accounts for over 70% of H-1B beneficiaries. Costs of deploying Indian professionals to US client sites for new projects will surge, making on-site assignments less financially viable for many companies.

The Indian festival season begins today, marked by the auspicious start of Navratri.

PM Modi highlighted in an address to the nation yesterday that next-generation GST reforms will come into effect from today, bringing benefits to all citizens in the festive season. The new GST structure aims to increase savings, making everyday items more affordable.

Commerce and Industry Minister Piyush Goyal is scheduled to visit the United States today to accelerate talks on a bilateral trade agreement.

Markets will closely watch signals on a bilateral trade agreement and any prospects of tariff rollbacks. Constructive commentary could aid sentiment for exporters and IT companies, though the new H-1B visa fee dampens the sentiment for onsite-heavy IT firms.

Our markets are poised to open subdued, and market volatility will remain elevated due to changes in the H1B policy.

Derivatives positioning, domestic reforms, H1B Visa fee changes and trade negotiations will be the key drivers this week.

Click it and Unblock the Notifications

Click it and Unblock the Notifications