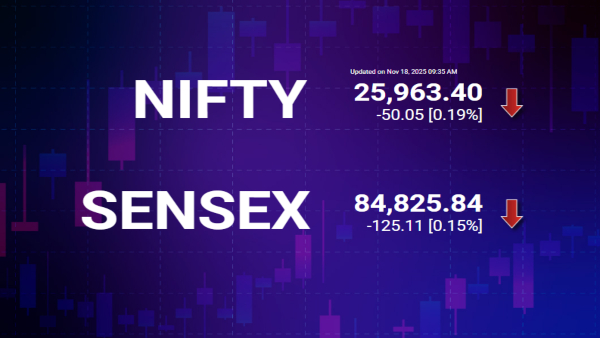

On Tuesday, November 18, the Indian stock market began trading flat, with the Nifty beginning at 26,021.80 and the Sensex rising 91 points to open at 85,042.37.

Due to an untenable lead from Wall Street, the Asian stock markets are usually trading down today, Tuesday, November 18, 2025. Fading hopes for a US rate cut and worries over high valuations of AI-related technology stocks are the main causes of the region's cautious stance. The delayed US jobs and inflation reports, which will provide hints about the state of the US economy and the Fed's policy stance, are what the markets are watching now.

Inox Wind will be the main focus on the domestic front as the company reports a good Q2FY26, although the margin should be higher than the earlier guidance. With Q2 margins now above 20%, management reiterated the 1,200 MW execution guidance and the 18-19% margin projection for FY26. However, given that H2 makes up around 70% of annual volumes, they indicated a good likelihood of completing the year above the recommended margin range.

One of India's largest renewable O&M platforms with a robust annuity-style revenue basis, Inox Green's O&M portfolio is growing quickly to 12.5 GW. Full consolidation is anticipated in FY27, corresponding to a topline of about Rs 1,250 crore at ~50% EBITDA margins.

LIVE Feed

Nov 18, 2025, 3:43 pm IST

Stock Market Live Update: Asian Markets Slip to One-Month Lows Ahead of Key Nvidia Earnings

Asian equities fell to one-month lows on Tuesday, led by sharp declines in Japan and South Korea’s tech-heavy markets. Investor sentiment weakened as markets awaited upcoming earnings from chipmaker Nvidia, seen as a crucial test for valuations across the global semiconductor sector.

Nov 18, 2025, 3:15 pm IST

Stock Market Live Updates: Bharti Airtel Faces Rs 7 Lakh Order from Andhra Pradesh DoT

Andhra Pradesh's Department of Telecommunication (DoT) has reportedly issued an order imposing a penalty of Rs 7 lakh on Bharti Airtel for alleged violations of subscriber verification norms. The company disclosed the development in a filing with the stock exchange.

Nov 18, 2025, 2:59 pm IST

Stock Market Live Updates: Akzo Nobel to Acquire Axalta in Rs 81,000 Crore Cross-Border Deal

In a cross-border share agreement valued at approximately Rs 81,000 crore, Akzo Nobel NV has agreed to acquire smaller competitor paint manufacturer Axalta Coating Systems Ltd.

Nov 18, 2025, 2:32 pm IST

Top Gainer So Far Today

The Nifty 50 saw some heavyweight stocks leading the gains. Bharti Airtel topped the chart with a rise of 1.82%. Other top bull included, Axis Bank, Shriram Finance. Power Grid Corporation, Asian Paints

Nov 18, 2025, 2:17 pm IST

Kings Infra Ventures announced a strategic expansion of its operations

Kings Infra Ventures Ltd. (KIVL), operating in sustainable aquaculture since 1987, has announced a strategic expansion of its operations to North Andhra, focusing on Vizag and Srikakulam. The move aims to establish a 500-acre Integrated Maritech and Aquaculture Cluster, with an initial investment of ₹500 crore, positioning the region as India’s next-generation hub for technology-driven and sustainable seafood production.

Nov 18, 2025, 1:56 pm IST

Most Acrive Stocks Today

On Tuesday, Nov 18, The market saw heavy activity today with several high-volume counters dominating trade. GROWW, PWL, and PAYTM emerged as the most active stocks, recording the highest turnover of the session. Among large-cap names, Bharti Airtel, Axis Bank, HDFC Bank, and Reliance Industries. Mid-cap and sectoral leaders such as Kaynes Technology, BSE, Mphasis, NH, BBTC, and GMR Airports

Nov 18, 2025, 1:10 pm IST

Greaves Cotton Limited and Ligier Group Announce Partnership

Greaves Cotton Limited, a trusted future-ready engineering company with over 165-year legacy of engineering excellence, has partnered with Ligier Group (“Ligier”), one of Europe’s most recognised manufacturers of light & heavy quadricycles. Through this collaboration, Greaves designed 499cc REVO D+ diesel engines that are Euro V+ certified are powering Ligier’s latest models, the Ligier JS50 and Ligier Myli, reinforcing India’s growing role as a trusted global supplier of advanced, regulatorycompliant automotive technologies.

Nov 18, 2025, 12:52 pm IST

Stock Market Live Updates: Trishakti Industries Secures New Work Order from Reliance Industries

Trishakti Industries has secured a significant work order from Reliance Industries. This development marks a notable achievement for Trishakti Industries, as it continues to expand its business partnerships and strengthen its presence in the industry.

Nov 18, 2025, 12:38 pm IST

Stock Market Live Updates: Voltas Gets ‘Hold’ Call from HSBC; Price Target Pegged at ₹1,420

HSBC has maintained its 'hold' rating for Voltas, setting a target price of Rs 1,420. This decision reflects the bank's analysis of the company's current market position and future prospects. Voltas, a key player in the air conditioning and engineering sectors, continues to navigate market challenges while seeking growth opportunities.

Nov 18, 2025, 12:21 pm IST

Stock Market Live Updates: Multiple Stocks Including GMR Airports, Can Fin Homes and Bharti Airtel Touch 52-Week High

Several companies, including GMR Airports, Can Fin Homes, Federal Bank, and Bharti Airtel, have recently reached their highest stock prices in the past year. This development highlights a positive trend in their market performance.

Nov 18, 2025, 12:06 pm IST

Stock Market Live Updates: Nomura Maintains ‘Neutral’ on Exide Industries, Sets Target Price at ₹427

Nomura has maintained its 'neutral' stance on Exide Industries, setting a target price of Rs 427. The financial services group has opted to keep its rating unchanged, reflecting a balanced outlook on the company's performance and market conditions.

Nov 18, 2025, 11:57 am IST

Stock Market Live Updates: Top Gainers, Top Losers

Stock Market Live Updates: Bharti Airtel, Axis Bank, Asian Paints, Shriram Finance, Max Healthcare, Maruti Suzuki, Eicher Motors were among the top gainers on NSE on Tuesday. Whereas, IndiGo, Hindalco, Tech Mahindra, JioFinance,etc were among the top laggards.

Nov 18, 2025, 11:48 am IST

Stock Market Live Updates: Max Healthcare Share Price Target

Stock Market Live Updates: "Max Healthcare Institute (MAXHEALT) reported strong EBITDA growth of 23% YoY to Rs 6.94bn. The company showed phenomenal growth with ~19% EBITDA CAGR over FY22-25. We expect pick-up in the growth momentum given 1) strong expansion plans (+3700 additional beds over FY25-28E), 2) improving payor mix and 3) Bolt on acquisitions like recently added in Lucknow, Nagpur and Noida. Operational efficiency has also been commendable, especially in competitive markets like NCR. Our FY27E/28E EBITDA stands cut marginally by 2-3% and we expect EBITDA/PAT to grow ~2x over FY25-28E. We ascribe 35x EV/EBITDA based on Sept 2027E. Maintain ‘BUY’ rating with TP of Rs. 1,400/share," noted PL Capital in its report.

Nov 18, 2025, 11:34 am IST

Stock Market Live Updates: Eicher Motors Share Price In Green Post Q2 Result; Should You Buy?

Stock Market Live Updates: Eicher Motors share price was trading 0.52% higher at Rs 6,835 per share on BSE at 11:33 am.

"EIM reported its highest-ever quarterly consolidated revenue in Q2FY26 at Rs61.7bn (+44.8% YoY), slightly above street estimates. The management is optimistic about sustained growth in H2 driven by strong demand, new product launches and GST 2.0 reforms. It affirmed its focus on long-term value creation, absolute profitability and maintaining leadership in the mid-size motorcycle segment. We tweak volume, realization and margin estimates translating to revenue/EBITDA/PAT CAGR of 15.4%/15.7%/13.3% over FY25-27E and retain ‘HOLD’ rating with TP of Rs6,840 (previous Rs6,729). We value the core business at 30x P/E Sep’27E and VECV business at 10x EV/EBITDA Sep’27E," noted PL Capital on Tuesday.

Nov 18, 2025, 11:18 am IST

Stock Market Live Updates: Nifty 50 Struggles At 25,900, Sensex Down 200 Pts, Airtel, Axis, Bajaj Top Gainers

Stock Market Live Updates: Nifty 50 Struggles At 25,900, Sensex Down 200 Pts, Airtel, Axis, Bajaj Top Gainers

Nov 18, 2025, 11:00 am IST

FMCG Stocks See Sharp Decline on BSE

Today, several key FMCG stocks on the BSE witnessed significant losses. GM Breweries fell 4.64% to ₹1,100, while CCL Products and Sarveshwar Food dropped 2.88% and 2.66%, respectively. Other major companies like Dabur India, EID Parry, and Gillette India also saw declines of around 2%. This dip gives investors a quick insight into sector volatility and possible market adjustments.

Nov 18, 2025, 10:54 am IST

Corporate Governance: More Crucial Than Ever

India’s market landscape is shifting from a shareholder-only focus to a broader stakeholder approach. Promoter holdings have fallen from 57.6% in 2009 to 50%, FPI ownership is at a 15-year low of 16%, while mutual fund and individual investor participation has surged. With retail investors growing rapidly, strong corporate governance has become more critical than ever to ensure transparency, trust, and informed decision-making.

Nov 18, 2025, 10:37 am IST

NIFTY IT Top Losers Today

The NIFTY IT index saw mild intraday weakness as most key tech stocks traded lower. MphasiS led the decline with a 1.28% drop, followed by Coforge and Tech Mahindra with slight dips. Oracle Financial Services, HCL Tech, Persistent, TCS, Infosys, and LTIMindtree also slipped marginally, reflecting cautious sentiment across the IT sector.

Nov 18, 2025, 10:03 am IST

PhysicsWallah Shares List at Strong Premium as Sensex Trades Firm

PhysicsWallah made an impressive debut on the Indian stock market on Tuesday, delivering a listing premium of over 33% on the NSE compared to its IPO issue price. The IPO, which was open for subscription between November 11 and 13, saw nearly twice the bids received, reflecting strong investor confidence. The stock opened at ₹145 per share on the NSE, significantly higher than the issue price range of ₹103–109. On the BSE, the shares listed at ₹143.10, marking a 31.28% premium. With this robust start, the company’s market capitalization after listing reached ₹40,922.20 crore, signaling healthy demand and positive sentiment among market participants.

Nov 18, 2025, 9:41 am IST

Stock Market Live Updates

Rupees vs Dollar

Nov 18, 2025, 9:41 am IST

Stock Market Live Updates

Sensex and Nifty Live Updates

Nov 18, 2025, 9:33 am IST

BSE Metal Index: Top Intraday Losers Today

The metal sector witnessed mild pressure in intraday trade as several frontline stocks slipped into the red. Hindustan Zinc led the decline with a drop of 1.8%, followed closely by NALCO and Jindal Steel, which also registered notable weakness. Heavyweights like Vedanta, SAIL, NMDC, and Tata Steel posted moderate losses as profit-booking weighed on sentiment. Even large players such as Hindalco and JSW Steel saw slight declines, indicating overall softness across the segment. APL Apollo and Adani Enterprises too ended marginally lower, reflecting a broad but controlled pullback in the metal pack during the session.

Nov 18, 2025, 9:31 am IST

Nifty Prediction Today By Anand James, Chief Market Strategist, Geojit Investments Limited

With both 26130 and 25840 intact, a struggle to gain directional momentum is visible. We will begin the day with a sideways bias, expecting slippages to 25980 or 25900 followed by upswing attempts. Alternatively, a direct rise above 26022 could call for 26130.

Nov 18, 2025, 9:16 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments

There are three favourable factors which can assist the ongoing rally in the market. One, official sources from the White House indicate that ‘ US is close to a trade deal with India.’ Two, the fading AI trade will benefit India. Three, the fundamentals are improving as reflected in resilience in growth and rising earnings. These three factors favour the continuation of the ongoing mild rally in India. FIIs turning buyers also is a positive; but it is too early to say that this a trend. The GST cut- triggered boom in consumption justifies the optimism seen in markets. But if the market rally is to sustain, the boom in consumption also has to sustain. So, watch out for the leading indicators relating to demand and consumption.

Nov 18, 2025, 8:36 am IST

Bank Nifty Prediction By Om Mehra, Technical Research Analyst, SAMCO Securities

Nifty Bank continues to trade comfortably above its short-term moving averages and the Supertrend support.

The RSI has moved up to 71, indicating strengthening momentum, while the MACD remains in positive territory, supporting the ongoing uptrend.

The nearest cushion is placed at 58,500–58,350. As long as the index holds above these zones, the broader tone remains positive. On the upside, sustaining above 59,000 would keep the path open toward the Fibonacci extension targets around 59,450 and potentially higher levels in the coming sessions.

Nov 18, 2025, 8:36 am IST

Nifty Prediction By Om Mehra, Technical Research Analyst, SAMCO Securities

The index continues to hold comfortably above the middle Bollinger Band.

Nifty remains above the 20-EMA around 25,800, which continues to act as a strong support. The broader setup reflects a series of higher highs over the past week, suggesting the market is gradually rebuilding momentum ahead of the next breakout attempt.

The RSI has edged up to 65, indicating improving strength, while the MACD is narrowing its distance from the signal line.

The support is now placed at 25,850–25,780, and holding above this band keeps the bias tilted upward. On the upside, Nifty is hovering just below the 26,050–26,100 resistance zone, which remains the decisive barrier for a fresh move. A sustained close above this zone could pave the way toward the all-time high near 26,277.35.

Nov 18, 2025, 8:36 am IST

Bank Nifty Derivatives Overview By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Derivatives data continues to support the bullish narrative. The 59,000 strike holds the highest Call writers’ open interest, indicating a key resistance zone where supply pressure could emerge. Meanwhile, the 58,500 strike carries the highest Put OI, establishing a strong support base and reflecting confident positioning from bullish participants. This creates a well-defined 58,500–59,000 sentiment range that is expected to guide near-term movement.

Adding further strength to the outlook, the Put–Call Ratio (PCR) has increased to 1.13 from 0.93, highlighting a notable rise in optimism as traders aggressively add put positions and unwind call shorts. The uptick in PCR suggests growing conviction among market participants toward sustained bullishness.

Nov 18, 2025, 8:35 am IST

Bank Nifty Outlook By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Nifty Bank continues to trade comfortably above its short-term moving averages and stays well-supported by the Supertrend, reflecting a robust, trend-favouring structure.

Momentum indicators also align with the bullish sentiment. The RSI has moved up to 71, indicating strengthening momentum and continued buying interest, while the MACD remains in positive territory, supporting the ongoing uptrend. The nearest cushion is placed at 58,500–58,350, and as long as the index sustains above these zones, the broader tone remains firmly positive.

On the upside, sustaining above 59,000 keeps the path open toward the Fibonacci extension targets near 59,450, with potential for the rally to extend further in the coming sessions.

Nov 18, 2025, 8:35 am IST

Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Derivatives positioning continues to support the upward tone, with the 26,000 strike holding the highest Call OI, signalling a near-term supply zone, while the 25,900 strike hosts the highest Put OI, establishing a strong immediate support base. This has created a well-defined 25,900–26,000 sentiment band that is guiding the near-term market tone.

Additionally, the Put–Call Ratio (PCR) has climbed sharply to 1.08 from 0.75, reflecting growing optimism as traders add fresh put positions and reduce bearish exposure. The rising PCR highlights increasing confidence among market participants, reinforcing the broader bullish narrative and strengthening expectations of continued upward momentum.

Nov 18, 2025, 8:35 am IST

Nifty Outlook By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

The index continues to hold comfortably above the middle Bollinger Band, signalling sustained strength in the short- to medium-term trend.

Nifty remains well above the 10-EMA around 25,800, which continues to act as a strong dynamic support. The broader structure reflects a series of higher highs and higher lows over the past week, indicating that the market is gradually rebuilding momentum as it inches toward a fresh breakout attempt. Momentum indicators also align with the bullish bias—RSI has edged higher to 65, indicating improving strength, while the MACD is narrowing its gap with the signal line, hinting at a potential bullish crossover if momentum sustains.

On the downside, immediate support is placed at 25,850–25,780, and holding above this band keeps the overall bias firmly positive. On the upside, Nifty is hovering just below the 26,050–26,100 resistance zone, a critical barrier that needs to be decisively cleared. A sustained close above this zone could open the path toward the all-time high near 26,277.35.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Tuesday, November 18, 2025, 8:31 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications