Benchmark indices were trading slightly in the red on Thursday afternoon amid mixed global cues and profit booking in select heavyweights. As of 2:30 PM, the Sensex slipped 59.95 points or 0.07% to 83,399.20, while the Nifty 50 declined 52.60 points or 0.21% to 25,545.05.

The Indian stock market opened on a mixed note as Nifty started the session lower today at 25,593.35 below the 25,600 mark, whereas Sensex gained around 58 pts to open at 83,516.69. During the opening session, the top 5 gainers on the Nifty index were Asian Paints, Indigo, M&M, Axis Bank, L&T and Sun Pharma, whereas the top 5 losers were Hindalco, Grasim Ind, Power Grid, Eternal and Adani Enterprises.

In terms of the global market, Asian stock markets are typically trading higher today, tracking gains on Wall Street overnight.

This upward trend comes after a period of fall caused by investor worries about the valuation of technology stocks, especially those related to artificial intelligence (AI), and cautionary remarks from US Federal Reserve officials. Investors will be concentrating on the Q2 earnings season in the domestic market.

Today's major results include those from LIC, Cholamandalam Investment and Finance Company, Cummins India, Apollo Hospitals Enterprises, ABB India, Mankind Pharma, Zydus Lifesciences, Bajaj Housing Finance, Lupin, NHPC, Godrej Properties, Abbott India, UPL, Procter and Gamble Hygiene and Health Care, and MCX.

LIVE Feed

Nov 06, 2025, 3:33 pm IST

Closing Bell: Nifty Ends At 25,500; Sensex Falls 148 Pts At 83,311; Grasim, Hindalco, Adani ENT Top Casualties

Closing Bell: Nifty Ends At 25,500; Sensex Falls 148 Pts At 83,311; Grasim, Hindalco, Adani ENT Top Casualties

Nov 06, 2025, 2:54 pm IST

Stock Market Live: Sun Pharma Repotrs 2.6% Surge in Net Profit; Should You Buy?

Stock Market Live: Sun Pharma reported nearly 2.6% surge in net profit to Rs 3,188 crore in the September quarter of financial ear 2025-26. The stock was trading 0.06% higher at Rs 1693.7 crore on BSE at 2:53 pm. InCred Equities has given an 'Add' rating to the stock with a target price of Rs 2,000 per share.

"We upgrade Sun Pharma’s rating to ADD (from HOLD), reflecting the sustained momentum across key markets and a strong launch pipeline in the innovative medicines franchise. While near-term margins may remain range-bound due to elevated S&D expenses, we expect margin expansion to resume from FY27F as high-margin innovative products scale up. Downside risk: Slowdown in the specialty portfolio."

Nov 06, 2025, 2:46 pm IST

Stock Market Live Updates: Sensex Below 83,400, Nifty Down 50 Pts; Asian Paints, Reliance, IndiGo, Top Gainers

Stock Market Live Updates: Sensex Below 83,400, Nifty Down 50 Pts; Asian Paints, Reliance, IndiGo, Top Gainers

Nov 06, 2025, 2:27 pm IST

KPI Green Energy Limited Signs Power Purchase Agreement with GUVNL

KPI Green Energy Limited announced the execution of a Power Purchase Agreement (PPA) with Gujarat Urja Vikas Nigam Limited (GUVNL) for a 150 MW grid-connected wind power project in Gujarat. This follows the Letter of Intent (LoI) issued on July 14, 2025, under GUVNL’s competitive bidding process and subsequent approval from the Gujarat Electricity Regulatory Commission (GERC) for the tariff and PPA. The project, scheduled to commence power supply on November 3, 2027, will operate under a long-term PPA with a fixed tariff of ₹3.64 per unit for 25 years.

Nov 06, 2025, 2:11 pm IST

Symphony Ltd Q2 FY26 Results

Symphony Limited, the air-cooling solutions major, reported a significant year-on-year decline in its financial performance for the September quarter (Q2 FY26). On a standalone basis, the company’s revenue from operations fell 40% YoY to Rs 155 crore from Rs 259 crore in the same quarter last year. EBITDA dropped 63% YoY to Rs 27 crore, with margins contracting sharply by 10.5 percentage points to 17.3%, compared to 27.8% in Q2 FY25. Consequently, profit after tax (PAT) declined 58% year-on-year to Rs 28 crore, down from Rs 67 crore in the corresponding period last year.On a consolidated basis, the results mirrored the same trend, with revenue declining 44% YoY to Rs 163 crore and EBITDA plunging 68% YoY to Rs 25 crore. Consolidated EBITDA margins stood at 15.1%, down from 26.4% a year ago, while PAT slipped 66% to Rs 19 crore.

Nov 06, 2025, 2:09 pm IST

SBI approves divestment of 3,20,60,000 equity shares

State Bank of India (SBI), the country’s largest lender, today, announced its decision to divest 3,20,60,000 equity shares, being equivalent to 6.3007% of total equity capital of SBI Funds Management Limited (SBIFML) through Initial Public Offering (IPO), subject to regulatory approvals. Amundi India Holding, the other promoter of SBIFML will divest 1,88,30,000 equity shares, being equivalent to 3.7006% of total equity capital of SBIFML, with a total of 10.0013% stake comprising of 5,08,90,000 shares to be listed. Both the promoters of SBIFML have jointly initiated the IPO, which will likely be completed in 2026

Nov 06, 2025, 1:48 pm IST

Zydus Lifesciences Financial Performance for Q2 & H1 FY26

Zydus Lifesciences Ltd. announced its unaudited consolidated financial results for the quarter and half year ended September 30th, 2025. Revenue from operations at Rs. 61,232 mn, up 17% over last year. • Research & Development (R&D) investments for the quarter stood at Rs. 4,820 mn (7.9% of revenues). EBITDA for the quarter was Rs. 20,158 mn, up 38% YoY. EBITDA margin for the quarter stood at 32.9%, which is an improvementof 500 bps on a YoY basis. Net Profit for the quarter was Rs. 12,586 mn, up 38% YoY.

Nov 06, 2025, 1:19 pm IST

Sundaram Clayton Reports Q2 FY 2025-26

Sundaram Clayton Limited (SCL) reports its EBITDA at Rs. 79.1 Cr for Q2 FY 2025-26 as against Rs. 72.5 Cr in Q2 2024-25. The standalone revenue is at Rs. 462.9 Cr for Q2 2025-26 as against Rs. 542.1 Cr for Q2 2024-25 (includes revenue from the 2W casting business, Hosur sold in Q4 FY2024-25). Despite the lower revenue, SCL reports a strong EBITDA improvement of 9 % in Q2 FY 2025-26.

Nov 06, 2025, 12:57 pm IST

Stock Market Live Updates: Devyani International Reports ₹21.8 Crore Net Loss vs ₹0.02 Crore Profit YoY

Devyani International reported a net loss of Rs 21.8 crore for the second quarter, contrasting with a profit of Rs 0.02 crore in the same period last year. The company's shares were trading at Rs 156.00, reflecting a decline of Rs 3.70 or 2.32 percent.

Nov 06, 2025, 12:45 pm IST

Stock Market Live Updates: Garden Reach Shipbuilders Reports 57% Rise in Q2 Profit

Garden Reach Shipbuilders has reported a significant increase in its financial performance for the second quarter. The company's consolidated profit has risen by 57.3 percent, reaching Rs 153.8 crore compared to Rs 97.8 crore in the same period last year.

The shipbuilding company also experienced a substantial boost in revenue. It recorded a 45.5 percent increase, with earnings climbing to Rs 1,677.4 crore from Rs 1,152.9 crore year-on-year.

Nov 06, 2025, 12:28 pm IST

Stock Market Live Updates: Jefferies Keeps ‘Buy’ Recommendation for Paytm Shares

Jefferies has maintained its 'buy' rating for Paytm, increasing the target price to Rs 1,600. The decision follows Paytm's reported 24 percent year-on-year revenue growth and an adjusted EBITDA of Rs 180 crore, which slightly exceeded expectations. This financial performance highlights the company's robust core business and potential for future growth.

Nov 06, 2025, 12:09 pm IST

Stock Market Live Updates: Deepak Fertilisers Q2 consolidated profit

Deepak Fertilisers And Petrochemicals Corporation reported a 1.5% increase in consolidated profit for the second quarter, reaching Rs 213.2 crore compared to Rs 210.1 crore in the same period last year. Revenue also saw a significant rise of 9.4%, climbing to Rs 3,005.8 crore from Rs 2,746.7 crore year-on-year.

Nov 06, 2025, 11:47 am IST

Sensex Update: Tata Elxsi's Groundbreaking MoU with GSMA Reshapes Market Outlook

Tata Elxsi has partnered with GSMA by signing a Memorandum of Understanding (MoU) as part of the GSMA Fusion initiative. This collaboration is designed to speed up the adoption of enterprise APIs.

Nov 06, 2025, 11:28 am IST

Stock Market Live Updates: Hindalco Faces 7% Stock Plunge Following 0-Million Novelis Plant Fire Impact

Hindalco Industries experienced a significant decline in its stock value, falling over 7 percent during the morning session on November 6. This drop followed the announcement of second-quarter results by its subsidiary, Novelis, for the financial year 2026.

Nov 06, 2025, 11:13 am IST

Stock Market Live Update: Asian Paints Rises 5.5% Amid CEO Resignation at Birla Opus!

Asian Paints Ltd, the leading paint manufacturer in the country, saw its shares increase by 5.5% on November 6. This surge positioned it as the top gainer on the Nifty index.

Nov 06, 2025, 10:57 am IST

Sensex Movers: HSBC Retains SBI ‘Buy’ Rating, Target Set at ₹1,100

Healthy loan growth and rising revenue are major positives.

Asset quality remains stable, and earnings per share (EPS) are expected to grow 6–9% from FY26 to FY28.

Strong growth in core pre-provision operating profit (PPoP) supports higher valuation multiples

Nov 06, 2025, 10:50 am IST

IGI India Reports Strong Q2: Profit Jump of 63% on Revenue Growth

International Gemmological Institute (IGI) India’s Q2 profit rose 18.4% to ₹129.8 crore from ₹109.6 crore last year.

Revenue increased 21.4% to ₹303.7 crore compared to ₹250.1 crore a year ago.

The stock is currently trading at ₹359.50, up 7.27% intraday, after a previous close of ₹335.15.

It has a 52-week high of ₹642.30 and a 52-week low of ₹282, currently 44% below the high and 27% above the low.

Market capitalisation of IGI India stands at ₹15,536.14 crore.

Nov 06, 2025, 10:31 am IST

Ola Electric Q2 Results: EV Maker Posts Strong Revenue Growth, Narrows Losses

Ola Electric reported a net loss of ₹418 crore for Q2, narrowing from ₹495 crore in the same quarter last year. Revenue declined 43% year-on-year to ₹690 crore, compared with ₹1,214 crore in the year-ago period. The company’s EBITDA loss improved to ₹203 crore from ₹379 crore YoY, reflecting better operational efficiency.

Nov 06, 2025, 10:12 am IST

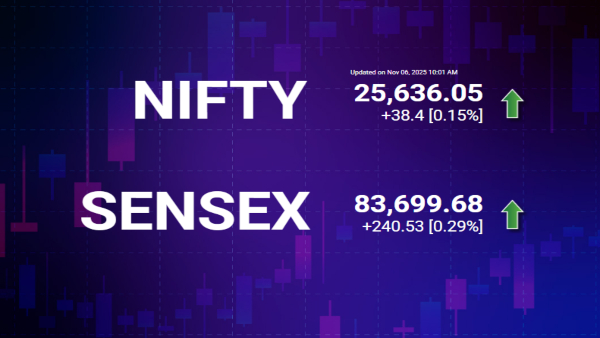

Markets@10 | Sensex Gains 240 Points, Nifty Holds Above 25,600

The Sensex rose 239.69 points (0.29%) to 83,698.84, while the Nifty gained 31.65 points (0.12%) to 25,629.30. Market breadth was negative, with 1,237 stocks advancing, 2,101 declining, and 165 remaining unchanged.

Nov 06, 2025, 10:11 am IST

Rupee vs Dollar

.

Nov 06, 2025, 9:57 am IST

Marksans Pharma Secures UK MHRA Marketing Authorization for New Product

Marksans Pharma was trading at Rs 187.95, up 0.64 percent, after receiving marketing authorization from the UK MHRA. The stock touched an intraday high of Rs 193.30 and a low of Rs 186.85. Trading volume stood at 59,211 shares, 41.36 percent lower than its five-day average of 100,977 shares. In the previous session, the stock had closed 1.94 percent lower at Rs 186.75. The scrip is currently 47.57 percent below its 52-week high of Rs 358.50 and 15.98 percent above its 52-week low of Rs 162.05, with a market capitalisation of Rs 8,517.21 crore.

Nov 06, 2025, 9:39 am IST

Indian Hotels Q2 Profit Falls 48% Despite 11% Revenue Growth

Indian Hotels Company Ltd (IHCL) reported a 48.6 percent drop in consolidated net profit to Rs 284.9 crore for the quarter ended September 2025, compared with Rs 554.6 crore in the same period last year.

Revenue, however, rose 11.8 percent year-on-year to Rs 2,040.9 crore from Rs 1,826.1 crore, reflecting continued strength in business performance.

On the BSE, the stock was quoting at Rs 720.95, down Rs 22.50 or 3.03 percent. During the session, it touched an intraday high of Rs 736.30 and a low of Rs 711.20.

Trading volume stood at 82,108 shares, higher than both its five-day average (63,627 shares) and 30-day average (64,658 shares) — an increase of 29.05 percent and 26.99 percent, respectively.

In the previous session, the stock had closed 0.48 percent lower at Rs 743.45.

The scrip has touched a 52-week high of Rs 894.15 (on December 30, 2024) and a 52-week low of Rs 678.90 (on November 7, 2024). It is currently trading about 19.4 percent below its 52-week high.

Nov 06, 2025, 9:25 am IST

Nifty Outlook By Anand James, Chief Market Strategist, Geojit Investments

With the 20 day SMA stepping in on Tuesday, preventing collapse right away to 25400 pencilled in earlier, a pull back is in store. Such an upmove however may not gain momentum if unable to result inconsistent trades above 25630/50. Favoured view expects a push above the same though, aiming 25770, or 26035 in an optimistic scenario.

Nov 06, 2025, 8:45 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments

Yesterday’s holiday saved the Indian market getting impacted by the mild turbulence in global markets. Today the scenario is different with stability returning to markets. In the coming days the focus of the market will be the developments in the US Supreme Court which is hearing the petition against Trump tariffs. Observations by some judges that ‘President Trump had overstepped his authority’ is a significant development. If the final judgement goes in line with these observations, there will be major volatility in markets, with emerging markets, particularly India which has been targeted for steep 50 percent tariff, rallying smartly.

For the near-term, however, the resumption of sustained selling by FIIs ( Rs 15336 crores in the last five days) and increasing FII short positions will weigh on markets.

Nov 06, 2025, 8:22 am IST

Bank Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Derivatives data paints a subdued and cautious picture, as call writers continue to build substantial positions at higher levels, asserting control in the derivatives segment. Meanwhile, put writers have reduced their exposure at earlier strikes and repositioned at lower levels, reflecting a defensive tone among traders. A significant open interest (OI) buildup of 9.82 lakh contracts at the 58,500 call strike indicates a strong resistance cap, whereas a notable put OI of 17.41 lakh contracts at the 58,000 strike provides limited support.

The surge in call writing activity highlights growing hesitancy among market participants. Simultaneously, the Put-Call Ratio (PCR) slipped marginally to 0.83 from 0.85, underscoring a neutral-to-cautious sentiment, with sellers maintaining dominance at higher zones.

Nov 06, 2025, 8:21 am IST

Bank Nifty Outlook By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From a technical standpoint, the index continues to oscillate within a sideways consolidation phase, awaiting a trigger for directional clarity. Currently hovering near its 10-day exponential moving average (10-DEMA), the index signals a wait-and-watch setup. Unless it decisively clears the 58,200–58,300 zone, sellers are expected to retain an upper hand, using minor rebounds to reinitiate short positions.

On the downside, immediate support is placed at 57,500–57,600, a crucial base for the index. A breakdown below this range could invite renewed selling pressure, accelerating the downside move. Conversely, a sustained move above 58,300 would be required to restore confidence and revive short-term bullish momentum. Momentum indicators further reflect fatigue, with the RSI (14) easing toward 60 and forming a lower-high pattern, signalling waning strength and a potential pause in upward traction. Hence, 57,500 remains the key level to watch for support, while 58,200–58,300 stands as a significant resistance zone in the near term.

Nov 06, 2025, 8:21 am IST

Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Derivatives data reflects a defensive tone, with call writers actively adding positions at higher levels, while major put writers have shifted to lower strikes, signalling risk aversion. A significant open interest (OI) buildup of 77.61 lakh contracts at the 26,000 call strike suggests firm resistance, while notable put OI of 51.90 lakh contracts at the 25,200 strike provides limited support.

The sharp rise in call writing underscores growing scepticism among traders. Meanwhile, the Put-Call Ratio (PCR) has inched up to 0.73 from 0.63, indicating a cautious sentiment, with sellers maintaining control near resistance zones.

Nov 06, 2025, 8:21 am IST

Nifty Outlook By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From a technical standpoint, the index appears to be in a bearish-to-range-bound setup as long as it fails to sustain above the swing high of 26,100. The close below the 20-day exponential moving average (20-DEMA) indicates a temporary halt in bullish momentum. Unless the index decisively reclaims the 25,800–25,900 zone, short sellers are likely to dominate, using any rebound to initiate fresh positions.

On the downside, immediate support is placed at 25,520, coinciding with the 0.382 Fibonacci retracement level. A sustained move below this threshold could accelerate the decline and reinforce the ongoing weakness. Conversely, a move above 25,800 would be required to negate the bearish bias and restore short-term optimism. Momentum indicators are also echoing caution — the RSI (14) has slipped to around 52, suggesting fading bullish strength and limited upside potential. Hence, 25,520 remains the key level to watch for support, while resistance is capped at 25,750–25,800.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Thursday, November 6, 2025, 8:18 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications