Jun 25, 2025, 3:28 pm IST

Stock Market Live Updates: HDB Financial Services IPO Opens; Rs 12,500 Crore Issue at Rs 700–Rs 740 Price Band

The highly anticipated Rs 12,500 crore initial public offering (IPO) of HDFC Bank's subsidiary, HDB Financial Services, is now open for public subscription. The price band has been set between ₹700 and ₹740 per share. Based on the upper end of this price range, the company's valuation stands at Rs 61,400 crore.

Jun 25, 2025, 2:38 pm IST

Stock Market Live Updates: Tarun Kumar Khulbe Appointed as CFO of Jindal Stainless Ltd

Jindal Stainless Ltd has notified the stock exchange that Tarun Kumar Khulbe, who currently serves as the CEO and Whole-time Director, has also been appointed as the Chief Financial Officer (CFO) of the company, effective June 25, 2025.

Jun 25, 2025, 2:11 pm IST

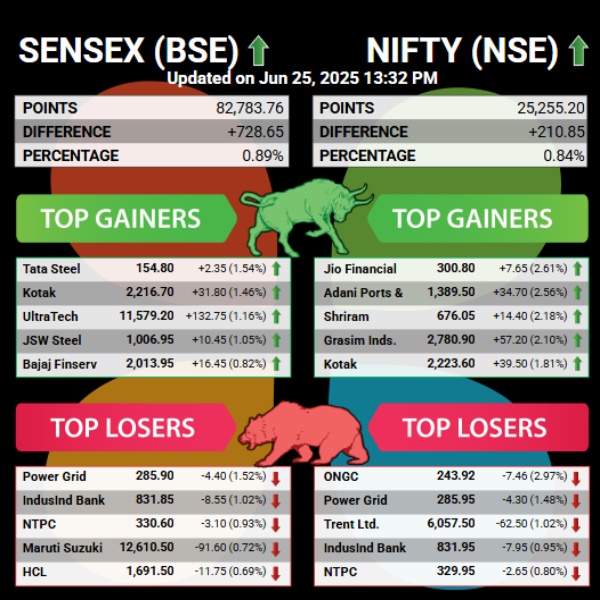

Stock Market Live: Which Stocks Are Top Losers and Gainers on BSE, NSE?

Stock Market Live: Tata Steel, Jio Financial, and JSW Steel are top gainers on NSE and BSE. Meanwhile, ONGC, Power Grid, NTPC are among top laggards

Jun 25, 2025, 2:08 pm IST

Stock Market Live: Grasim Starts Commercial Production of Resin Manufacturing Block in Maharashtra; Stock in Green

Stock Market Live: Grasim Industries on Wednesday notified the commencement of commercial production of Resin manufacturing block at Maharashtra. The commercial production at Company's Birla Opus Paints plant has started after the company has installed a Resin manufacturing block with an installed capacity of 22 million litres per annum.

"We wish to further inform that the commercial production of Resin manufacturing block with an

installed capacity of 22 million litres per annum has now started with effect from 24th June 2025

at Mahad Plant which shall help to meet Resin requirement for manufacturing of paints in-house," said the company in its press release. Grasim Industries shares were trading 0.89% higher at Rs 2805.05 per share at 2 pm on Wednesday.

Jun 25, 2025, 12:57 pm IST

Stock Market Live: Top Gainers, Top Losers on NSE

Stock Market Live: Titan Tata Consumer, Tech Mahindra, Nestle India, Infosys, were among the top gainers on Nifty 50. Whereas, BEL, Kotak Bank, Eicher Motor, Axis Bank, etc were among the top NSE laggards.

Jun 25, 2025, 12:45 pm IST

Stock Market Live: Lupin Receives US FDA Approval For New Medicines

Stock Market Live: Lupin Limited received approval for its US FDA for the company's drug Prucalopride Tablets. The stock is trading marginally lower at Rs 1930.45 per share on BSE. The company "received approval from the U.S. FDA for the Company’s Abbreviated New Drug Application for Prucalopride Tablets, 1 mg, and 2 mg. Prucalopride Tablets which are bioequivalent to Motegrity® Tablets, 1 mg and 2 mg, of Takeda Pharmaceuticals U.S.A. Inc."

Jun 25, 2025, 12:23 pm IST

Stock Market Live: RITES Shares Surge 1.3% After Order Win

Stock Market Live: RITES shares were trading 1.3% higher, a day after the railway PSU announced that it has bagged order win in Gujarat. The Gujarat Urban Development Company Limited (GUDC) has signed a deal with RITES and has “appointed it as TPI agency for WSS/UGD/STP projects under Amrut 2.0/SJMMSVY under GUDC for ULBs of Gujarat,” according to the BSE filing released by RITES on Tuesday.

Jun 25, 2025, 9:59 am IST

Nifty Prediction Today By Anand James, Chief Market Strategist, Geojit Investments Limited

Though Nifty pulled back shortly after breaching our first objective of 25200, the successful close above our key intraday pivot of 24940, encourages us to continue nurturing upside hopes. That said, momentum is lacking, and an outright push to 25460 may not be seen. Expect a consolidation or dips, if unable to push beyond 25170.

Jun 25, 2025, 9:45 am IST

Nifty Fails to Hold Gains; Bulls Eye 25317, Bears Guard 25000 Mark

“The nifty ended higher yesterday but not before selling off hard at the close. Technically speaking, the initial thrust broke above the sideways range in place since mid-May and took out the critical 25222 level in the process, but the close was anything but inspiring for bulls. Therefore, who gets the upper hand in the near-term will depend on whether yesterday's high or low gets taken out first, ideally on a closing basis. So 25000 and 25317 are the levels to watch out for. Beyond 25317, 25500 is next resistance. Under 25000, 24800 is the next support level. Global cues remain good with the Nasdaq 100 jumping to a fresh record high,” said Akshay Chinchalkar, Head of Research, Axis Securities.

Jun 25, 2025, 9:15 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

A significant feature of the recent market trend has been its resilience despite major challenges like the West Asian crisis. Even during the short India-Pak conflict the market has been resilient. A significant contributor to this resilience has been FII buying during the crisis. Interestingly FIIs have been selling, like yesterday, after the crisis blows over. On the other hand DIIs have been sustained buyers in the market, thanks to the continuing inflows into mutual funds. This will impart resilience to the market even when FIIs sell on valuation concerns.

The latest commentary from the Fed chief Jerome Powell indicates that there are risks to inflation from the uncertainty over tariffs and, therefore, rate cuts are likely only towards the end of the year.

The main challenge for investors now is to find stocks with the right growth-value mix since growth stocks are highly valued. For long-term investors stocks in segments like the capital market, domestic consumption like aviation, telecom and premium consumption like hotels, automobiles and jewellery hold promise.

Jun 25, 2025, 8:50 am IST

Bank Nifty Prediction Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From a technical standpoint, the index remains well-supported by the short-term moving averages—specifically the 10-day and 20-day exponential moving averages—providing further affirmation of the prevailing bullish bias. While the index struggles to hold on to higher-level gains, a sustained breakout above the all-time high remains key to establishing directional clarity. A Doji candlestick pattern appeared on the daily chart near resistance, signifying indecision and supply pressure at elevated levels. Nonetheless, the index’s ability to maintain its footing above the 56,000–55,500 support zone reflects steady accumulation at lower levels. A firm and convincing close above the 57,000 mark could reignite bullish sentiment and potentially propel the index toward the 57,500–57,700 zone. Until the 55,500 level is decisively breached, any declines are likely to present fresh buying opportunities.

Jun 25, 2025, 8:22 am IST

Nifty Prediction Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From a technical standpoint, the index remains well-supported by its short-term moving averages—the 10-day and 20-day exponential moving averages (DEMA)—lending further credence to the ongoing constructive setup. Although the index remains confined in a consolidation phase, a breakout beyond this range is essential to establish a clear directional bias. On the daily chart, a bearish candlestick with a prominent upper shadow has emerged, highlighting sustained selling pressure at higher levels. Nevertheless, the ability of the index to hold above the 24,750–24,700 mark underscores persistent buying interest at lower zones. A strong close above the 25,250 level would likely rekindle bullish sentiment and pave the way for a rally toward the 25,500 zone. Conversely, meaningful downside risks would emerge only if the index breaches the critical 24,700 support—until then, pullbacks are likely to be met with buying interest.

Jun 25, 2025, 8:09 am IST

Bank Nifty Derivatives Highlights By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

In the derivatives segment, market sentiment leans toward cautious optimism. Put writers have built significant positions around the current spot price, showcasing strong intent to defend key support levels. Simultaneously, call writers are actively adding exposure at higher strikes, suggesting limited near-term upside with a neutral to mildly positive bias. The 57,000 strike holds the highest open interest on the call side, with 15.16 lakh contracts, reinforcing it as a crucial resistance area. On the other hand, the 56,000 put strike has attracted heavy writing—totaling 19.03 lakh contracts—underscoring robust support around that zone. The Put-Call Ratio (PCR) has remained steady at 0.85, reflecting a balanced positioning with a tilt toward consolidation. Meanwhile, Max Pain stands at 56,000, implying a possible magnetic pull toward this level as expiry draws closer.

Jun 25, 2025, 8:09 am IST

Nifty Derivatives Highlights By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From the derivatives front, market sentiment appears cautiously optimistic. Put writers have shown notable confidence by adding aggressive positions near the current spot levels, signifying strong intent to defend support zones. At the same time, call writers have been actively building positions at nearby strikes, reflecting a capped upside view in the near term. The 25,200 strike continues to command the highest open interest on the call side with 1.13 crore contracts, thereby acting as a major resistance. On the flip side, the 25,000 put strike has seen substantial writing—1.05 crore contracts—indicating a solid base around that level. The Put-Call Ratio (PCR) has dipped to 0.80 from the previous 1.01, suggesting a tilt toward call writing and a mildly bearish undertone. Meanwhile, the Max Pain point is positioned at 24,800, implying a potential magnetic pull toward this level as expiry approaches.

Jun 25, 2025, 8:08 am IST

Bank Nifty Outlook Today By Om Mehra, Technical Research Analyst, SAMCO Securities

The 20-day median, currently around 56,000, continues to act as a pivot, around which the index has been coiling. The RSI has ticked up to 59 but remains lodged below the decisive 65 mark, where momentum typically gains strength. On the hourly chart, the structure reflects a higher-high formation. Until a clean breakout occurs above 56,850, the trend may remain choppy and sideways. The support is placed near 55,700.

Jun 25, 2025, 8:08 am IST

Nifty Outlook Today By Om Mehra, Technical Research Analyst, SAMCO Securities

Nifty floats above the 9-day and 20-day moving averages, which may act as a cushion during minor dips. The RSI has moved back above the 55 mark, after some exhaustion. However, it is yet to break above 60 for a clearer directional confirmation. The MACD histogram remains flat, but is slowly flattening, indicating a potential shift in tone. The upper Bollinger band near 25,300 continues to pose strong resistance, and a close above this level would likely open the door for a fresh directional leg. Until then, Nifty may remain range-bound with support around 24,800.

Click it and Unblock the Notifications

Click it and Unblock the Notifications