Jun 27, 2025, 3:21 pm IST

Stock Market Live Updates: Crizac IPO Opens July 2 with Price Band of Rs 233 - Rs 245 Per Share

Crizac Limited will launch its maiden IPO on July 2, 2025, with a price band of Rs 233 to Rs 245 per equity share (face value Rs 2). The offer will close on July 4, 2025. Investors can bid for a minimum of 61 shares, and in multiples of 61 thereafter.

Jun 27, 2025, 2:50 pm IST

Stock Market Live Updates: JSW Paints to Acquire Majority Stake in Akzo Nobel India

JSW Paints is buying a 74.76% stake in Akzo Nobel India for Rs 8,986 crore, which means Akzo Nobel is leaving the Indian market. After this, JSW Paints also launched an open offer worth Rs 3,929 crore to buy another 25% stake from public shareholders.

Jun 27, 2025, 2:04 pm IST

Stock Market Live: Nifty Defence Stocks Continue Their Upward Rally

Stock Market Live: The Nifty Defence stocks will continue to move upwards with their momentum as investors continued to bet on stocks like BDL, HAL, GRSE, Paras, DCX India, etc. Commenting on heightened investors interest towards defence stocks, Siddhartha Khemka, Head - Research, Wealth Management, Motilal Oswal Financial Services Ltd. said, “. Defence- stocks are likely to be in focus, as India’s strengthening manufacturing ties with Europe, backed by NATO’s rising defence spend, present a significant export opportunity. The government has set an ambitious target of ₹50,000 crore in defence exports by 2029. Overall, we expect the market momentum to continue with Nifty likely to move upwards towards its previous life highs driven by healthy domestic macros and supportive global environment. We maintain a positive outlook on domestic-driven sectors such as financials, capital markets, agriculture-linked segments (including agri inputs, tractors, and rural consumption), and defence, which are well-positioned to benefit from ongoing policy support and seasonal tailwinds.”

Jun 27, 2025, 1:57 pm IST

Stock Market Live: India Vix Down 1.13%

Stock Market Live: Indicating stability in the Indian stock market, India’s volatility index (India Vix) was down 1.13% on Friday at 1:50 pm. The Volatility Index measures the market’s anticipation of volatility in the near term. During such moments, the market also moves sharply up or down. India Vix remains negative whenever there has been a decline in the volatility.

Jun 27, 2025, 1:51 pm IST

Stock Market Live: Broadmarket Indices Stay Strong

Stock Market Live: Most of the broad market indices remained strong on Friday. Nifty 100, Nifty 200, Nifty 500, Nifty Midcap 50, Nifty Midcap 50, Nifty Smallcap 100 and other broadmarket indices were trading in green and above 0.5% mark on Friday.

Jun 27, 2025, 1:42 pm IST

Stock Market Live: Who Are The Top Gainers And Losers?

Stock Market Live: IndusInd Bank, Reliance Industries, Asian Paints, Power Grid, ICICI Bank, are among the top gainers on BSE and NSE. Whereas, Bajaj Finance, Wipro, Grasim Industries, JSW Steel are among the top losers on NSE

Jun 27, 2025, 1:32 pm IST

Stock Market Live: Bank Nifty Up 0.25 Points; Union Bank, Maharashtra Bank, PSB Among Top PSU Gainers

Stock Market Live: Bank Nifty is trading higher in the Indian stock market on Friday. Additionally, several, including Union Bank, Maharashtra Bank, PSB, etc were trading higher on June 27.

Jun 27, 2025, 12:45 pm IST

Stock Market Live Updates: Nifty Trades Above 25,600, Sensex Up 250 Pts; PSU Banks, Oil And Gas Lead Rally

Stock Market Live Updates: Nifty 50 is trading at its day's high mark above 25600. Whereas, BSE Sensex is 250 points higher. PSU Banks and OIL and Gas sector stocks are trading higher

Jun 27, 2025, 11:59 am IST

Top Gainers And Losers

Jio Finance, Indusind Bank, Powergrid, Adani Entertainment, Asian Paints and Adani Ports are some of the top Nifty gainers at this hour. While, Dr Reddy, Grasim, Eternal, Bajaj Finance, Bajaj Finserv etc are some of the top losers at nifty falling over 1%.

Jun 27, 2025, 11:53 am IST

SEBI Approves Jio BlackRock as Stock Broker and Clearing Member

SEBI has given Jio BlackRock Broking Private Limited the certificate of registration to operate as a stock broker and clearing member.

Jun 27, 2025, 11:48 am IST

HDB Financial IPO Update: Subscribed 2.16 Times So Far on Day 3

HDB Financial IPO have been subscribed 2.16x. NIIs have subscribed 5.05 times, QIB 1.81 times, while retail subscription is at 94%.

HDB Financial’s Rs 2,500 crore IPO includes a fresh issue of 3.38 crore shares worth Rs 2,500 crore and an offer for sale of 13.51 crore shares worth Rs 10,000 crore.

Jun 27, 2025, 11:40 am IST

Indogulf Cropsciences IPO Sees 63% Subscription by Day 2 so Far; GMP At Rs 9

Indogulf Cropsciences’ IPO was subscribed 63% by the second day, with the retail portion at 1.02 times. NII subscription at 44% while QIB have subscribed just 5%. The grey market premium (GMP) is around Rs 9, suggesting a 8% gain over the issue price.

The IPO is a bookbuilding of Rs 200 crores. The company plans to use the funds for working capital, debt repayment, and setting up a new plant. It has a strong presence in 22 Indian states and exports to 34 countries, with FY24 revenue of Rs 555.8 crore.

Jun 27, 2025, 11:29 am IST

Paisalo Digital Enters Co-Lending Partnership With SBI for SME Loan Products

Paisalo Digital has expanded its co-lending partnership with the State Bank of India to offer loans for SME products. This move aims to support financial inclusion by providing affordable loans to small businesses and other priority sectors.

Jun 27, 2025, 10:23 am IST

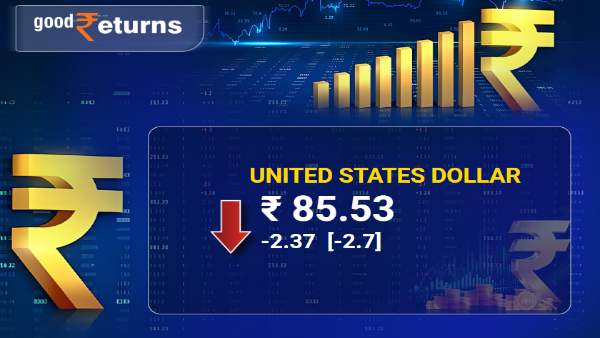

Stock Market Live Updates: Rupee VS Dollar

Indian Rupee opened weaker by 2.7% at 85.53 against the US Dollar

Jun 27, 2025, 9:30 am IST

Company Update: FSN E-commerce Ventures | FY25 Annual Investor Day – A compelling growth story

“Nykaa’s Investor Day showcased the company’s aggressive growth aspirations company across BPC and Fashion segments, with its eB2B business already witnessing strong growth momentum. The company also guided towards FY26 EBITDA breakeven for Fashion, earlier than our FY27 estimate. While management refrained from providing BPC EBITDA margin guidance due to its continued focus on growth, we expect contribution margins to remain stable, with EBITDA margin expansion likely supported by operating leverage. Nykaa’s suggestion of mid-20s GMV growth in BPC and a 3-4x increase in Fashion NSV over the next five years reflect management’s strong confidence in scaling multiple growth levers, reinforcing its distinctive market positioning. Moreover, the company’s ability to deliver robust growth in a tepid demand environment over the last year along with margin enhancement further underlines its differentiated offering. We maintain a ‘BUY’ rating with a Mar’26 TP of INR 250,” said Sachin Dixit of JM Financial Institutional Securities.

Jun 27, 2025, 9:14 am IST

Morning Market Movement Highlights By Akshay Chinchalkar, Head of Research, Axis Securities

The Nifty jumped 1.2% yesterday and closed above the critical 25500 hurdle. Technically speaking, like we had mentioned in yesterday's pre-opening note, the inside day pattern from two days ago was proof that a trending move was coming, and we got one yesterday with more than 5 stocks advancing for every stock that fell in the Nifty. The thrust may have more to go though, with the 25700 - 25800 zone the next immediate upside hurdle, and while tactical support at 25000 is holding, bulls will be optimistic about getting there and beyond sooner than later. Asian cues this morning are supportive, and US stocks are on solid footing as calls for immediate rate cuts from the Fed become louder, helping keep risk-on sentiment elevated.

Jun 27, 2025, 9:13 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

A significant feature of the ongoing bull market which started after the Covid crash ( 7511 Nifty on 23rd March 2020) is its ability to climb all walls of worries. High inflation, aggressive monetary tightening by the central banks, geopolitical events including some wars and conflicts, and unprecedented tariff threats, did pose some threats to the rally, but the bull market climbed all these walls of worries. It appears that the rally is unlikely to be impacted by the approaching July 9th tariff deadline imposed by President Trump. News that the July 9th deadline is likely to be extended is a positive for the market.

A significant development in the currency market is the sustained weakness in the dollar with the dollar index declining to around 97. This explains the big FII investment of Rs 12594 crores yesterday which is a huge buy figure even though it includes some bulk deals. This big FII buying has lifted large caps like HDFC Bank, ICICI Bank, Bharti, RIL and Bajaj Finance, which in turn, has contributed to the sharp spike in the benchmark indices. The market momentum is strong but some profit booking is likely in the near-term.

Jun 27, 2025, 8:22 am IST

Bank Nifty Derivatives Highlights By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

In the F&O segment, sentiment continues to remain upbeat. Put writers have added substantial positions at key levels near the current market price, reflecting their strong intent to defend support zones. On the flip side, call writers have begun shifting to higher strikes, showcasing a cautiously bullish approach. The 58,000 call holds the highest open interest with 5.59 lakh contracts, establishing a near-term ceiling, while on the put side, significant open interest addition of 8.83 lakh contracts at the 57,000 strike reaffirms robust support. The Put-Call Ratio (PCR) has risen from 0.80 to 1.01, signalling strong put writing activity and improving bullish sentiment. Max Pain currently stands at 56,900, acting as a gravitational pull zone as expiry nears.

Jun 27, 2025, 8:22 am IST

Nifty Derivatives Highlights By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From the F&O standpoint, the broader sentiment continues to lean bullish. Put writers are aggressively adding positions near prevailing levels, suggesting their confidence in holding key support zones. Meanwhile, call writers have tactically shifted to higher strikes, showcasing cautious optimism for continued gains. The 26,000 strike carries the highest open interest on the call side with 50.64 lakh contracts, establishing it as a formidable resistance level. At the same time, the 25,500 put has recorded significant open interest buildup of 52.77 lakh contracts, affirming strong support at current levels. The Put-Call Ratio (PCR) has improved to 1.20 from 1.05 in the previous session, reflecting enhanced put writing and highlighting a distinctly bullish undertone. The Max Pain level now sits at 25,400, hinting at a gravitational pull toward this level as we approach the weekly expiry.

Jun 27, 2025, 8:19 am IST

Bank Nifty Outlook Today By Om Mehra, Technical Research Analyst, SAMCO Securities

The index continues to trade comfortably above all key moving averages, including 50-day SMAs. On the Fibonacci extension, Nifty Bank has decisively crossed the 100% projection at 57,049, with the next potential targets now placed at 57,566 (1.272 level) and 58,223 (1.618 extension). These extensions are based on the recent rally leg from 55,149 to 57,049. The daily RSI stands at 65, approaching the upper band but still not overbought, while the MACD shows a bullish crossover, with a rising histogram, strengthening underlying momentum. On the intraday scale, Nifty Bank is finding steady support near VWAP, and dips are being bought into. The previous resistance zone between 56,300 and 56,700 now turns into a reliable support zone. Unless the index breaks below this, the short-term outlook remains decisively positive.

Jun 27, 2025, 8:19 am IST

Nifty Outlook Today By Om Mehra, Technical Research Analyst, SAMCO Securities

On a broader time frame, the Nifty maintains its higher-high formation and is now comfortably sustaining above the 78.6% Fibonacci retracement drawn from the 52-week high and low, underlining the dominance of the bulls. The daily RSI is placed above the 65 level, with a positive crossover in MACD, indicating strong internal strength. With a short-term rally of over 1,000 points (approx. 4.40%) in the last 10 sessions, the support base has now shifted higher to 25,300, which aligns with the trendline zone. The immediate resistance is seen at 25,700, followed by 25,850. On the hourly chart, the VWAP offers steady intraday support, highlighting sustained accumulation during dips.

Click it and Unblock the Notifications

Click it and Unblock the Notifications