Jul 03, 2025, 3:29 pm IST

Stock Market Live Updates: NIFTY 50 Trades Lower at 25,394.95; Streaming Indicates Slightly Higher Close

As of 3rd July 2025, at 3:22 PM, the NSE NIFTY 50 index stood at 25,394.95, which is down by 58.45 points or 0.23%. The streaming value at the same time was slightly higher at 25,407.75, showing a decline of 45.64 points or 0.18%.

Jul 03, 2025, 2:40 pm IST

Stock Market Live Updates: DCM Shriram Shares Surge Nearly 12%

As of 2:37 PM on July 3, shares of DCM Shriram Ltd were trading at Rs 1,382.00, reflecting a sharp gain of Rs 144.10 or 11.64% for the day.

Jul 03, 2025, 1:51 pm IST

Tata Power Renewable Commissions Record 752 MW of Solar Projects In Q1 FY26

Tata Power Renewable Energy Limited, one of India’s largest renewable energy Company and a subsidiary of The Tata Power Company Limited (Tata Power), has commissioned 752 MW of renewable Solar projects in Q1 FY26, a record quarterly addition, up 112% from 354 MW in Q1 FY25. TPREL’s EPC project installations are a testament to seamless execution, disciplined project management, and a strong commitment to quality and safety.

Jul 03, 2025, 1:47 pm IST

European Commission Approves Biocon Biologics’ Denosumab Biosimilars

Biocon Biologics Ltd (BBL), a fully integrated global biosimilars company and subsidiary of Biocon Ltd., today announced that the European Commission (EC) has granted marketing authorisation in the European Union (EU) for Vevzuo and Evfraxy biosimilars of Denosumab

Jul 03, 2025, 1:46 pm IST

Quess Corp Joins the ONDC Network to Offer 2Million Jobs

Quess Corp, a staffing and workforce solutions provider, through its platform led business offering - Hamara Jobs (blue and grey collar jobs), becomes the first company to join the Open Network for Digital Commerce (ONDC) as an Anchor Network Participant in the Work Opportunities domain. As part of this role, Quess will contribute to strengthening India’s digital employment ecosystem by helping onboard other participants and shaping a collaborative, communitydriven approach to protocol evolution. Through its integration, Hamara Jobs will add over 5 lakh verified job listings annually to the ONDC network, significantly enhancing job availability and expanding access to trusted employment opportunities for job seekers across India.

Jul 03, 2025, 12:59 pm IST

MOIL Registers Record Quarterly Production Since Inception

During April-June, 2025 period also, MOIL has registered Best ever quarterly production of 5.02 lakh tonnes, higher by 6.8% over CPLY. Also best ever Q1 exploratory core drilling of 34,900 meters, which is higher by 16.2% over CPLY.

Jul 03, 2025, 12:59 pm IST

FAST India Collaborates with Indegene

The Foundation for Advancing Science and Technology (FAST) India today announced a strategic, long-term partnership with Indegene to scale up India’s biotech ecosystem. The partnership will focus on expanding research and collaboration between academia and the industry, helping accelerate innovation from the ground up. FAST India, a non-profit organization (NPO), is committed to positioning India among the world’s top three science and technology nations within the next decade. The NPO’s key initiatives include the flagship India Science Festival, national science competitions, platforms to showcase R&D from India and abroad, and research that promotes translational science and effective industry-academia collaboration.

Jul 03, 2025, 12:31 pm IST

Godrej Industries’ Chemicals Business to Invest over INR 750 CR for Capacity Expansion

Godrej Industries Limited’s Chemical Business today announced significant capacity expansions in sync with the company’s growth plan to become a USD 1 Billion global business before 2030. With a total capital outlay for expansions to exceed INR 750 Crore over the next few years, the company has already kicked off several projects. The company announced doubling of its Fatty Alcohol and Euric Acid capacities with an addition of 35,000 tons per annum and 20,000 tons per annum respectively. It has tripled its specialities capacity with an addition of 21,000 tons per annum while the glycerine capacity will be doubled with an addition of 24,000 tons per annum.

Jul 03, 2025, 12:31 pm IST

Blue Cloud Softech Solutions launches BluHealth Platform, an AI-Powered Healthcare Platform

Blue Cloud Softech Solutions Limited (BCSSL), a global leader in Cybersecurity and technology solutions, has launched its BluHealth Platform v2.0 healthcare platform, transforming from a proof-of-concept to an AI-integrated, enterprisegrade solution for large-scale healthcare delivery. The BluHealth Platform features AI-powered clinical decision support, instant medical interpretations, and intelligent care routing, along with non-invasive HbA1c testing, 60- second facial scan screenings powered by the BluHealth Scanner, and rugged, field-ready hardware enabled by the BluHealth Screener. Fully interoperable, HIPAA/GDPR compliant, and ready for universal health coverage initiatives, the BluHealth Platform is redefining digital health for underserved communities worldwide.

Jul 03, 2025, 10:42 am IST

Market Live Update: HSBC India June services PMI Data OUT

The HSBC June Services PMI of India rose to 60.4 in June compared to 58.8 in May. Meanwhile, the composite PMI data for June was broadly flat to 61 as against 59.3 in May 2025.

Jul 03, 2025, 10:08 am IST

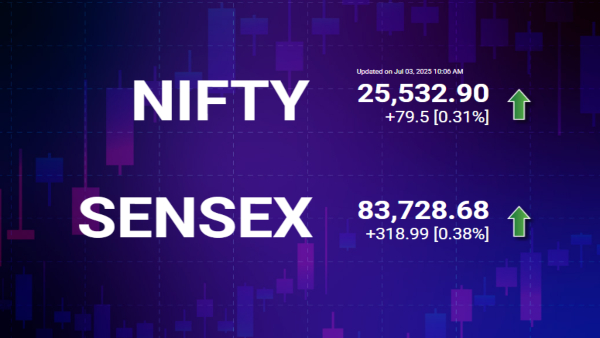

Stock Market Live Updates

The Indian stock market was trading in the green as of the most recent update, which was made at 9:57 AM on July 3, 2025, indicating a successful start to the day. At 25,534.25, the Nifty 50 index climbed 80.85 points, or 0.32%. In the same way, the Sensex rose 259.31 points, or 0.31%, to 83,669. The rising pattern suggests that market sentiment is still positive, perhaps bolstered by robust global cues.

Jul 03, 2025, 9:54 am IST

Daily market movement of Crypto by CoinDCX research team

After multiple attempts, the Bitcoin price launched a massive upswing and surged beyond the pivotal resistance. The crypto markets have become somewhat bullish, with the top altcoins attracting significant gains. Cardano triggered a massive run with over 7% gains, while Dogecoin & Ethereum surged over 5%. Besides, the top gainers include Bonk with over a 21% rise, followed by Celestia & dogwifhat with over 17% each. Meanwhile, Four drops over 3%, followed by Bitcoin Cash with a mere 0.12%, which could be flipped soon.

In an interesting development, the SEC paused the conversion of Grayscale’s Digital Large Cap Fund into an ETF covering BTC, ETH, XRP, SOL & ADA, placing it under further review. Besides, BlackRock’s Bitcoin ETF has now generated more revenue than its S&P 500 ETF. On the other hand, OpenAI ends speculation and clarifies ‘Open AI tokens’ are not legitimate equity and states that they are not involved in the creation of tokens or partnered with Robinhood. Besides, the US federal housing regulator calls on Congress to investigate Fed Chair Jerome Powell and fears a termination.

Jul 03, 2025, 9:40 am IST

Rupee vs Dollar

Compared to its previous closing of 85.71, the Indian rupee began Thursday slightly higher at 85.66 to the dollar.

Jul 03, 2025, 9:38 am IST

Nykaa In Focus

On July 2, the initial investors of Nykaa, particularly Harindarpal Singh Banga and Indra Banga, sparked new interest in the stock as they moved to sell off a significant amount of their stake in FSN E-Commerce Ventures, Nykaa's parent company, in a block deal worth about Rs 1,200 crore (0 million). The sale will begin at a floor price of Rs 200 per share and is set to sell up to 60 million shares, or around 2.1–2.5% of the firm.

Jul 03, 2025, 9:19 am IST

Nifty Prediction Today By Anand James, Chief Market Strategist, Geojit Investments Limited

Having reached the 25440 objective that we had set out at the start of the week, the trend looks better poised to support upswing attempts, should bulls regroup. Upsides may require a burst above 25588 to bring 26200-500 trajectory back into play. Downside marker will remain at 25300.

Jul 03, 2025, 9:17 am IST

Flash Update: Avenue Supermarts | Pressure on revenue growth sustains

“Q1FY26 revenue up ~16% YoY to ~INR 159 bn (1% lower vs. initial estimate): Q1FY26 revenue growth grew 16% YoY (vs 17/18% YoY growth in Q4/Q3FY25) to INR 159 bn. We note revenue growth was 1% below our initial estimate and 2% below consensus estimates,” said Gaurav Jogani of JM Financial Institutional Securities Limited.

Jul 03, 2025, 9:16 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

Nifty is likely to trade in the 25200-25800 range for some more time till a trigger breaks the range. A positive trigger can come from a possible India-US trade deal to be announced in a few days. The US-Vietnam trade deal indicates the eagerness of the US administration to strike as many trade deals as possible since deals with EU and Japan appear unlikely soon.

Some recent data from the US indicate negative news on the jobs front. This can trigger more capital outflows from the US and further weakening of the dollar, which has already depreciated by more than 10% this year. This is good news for EMs like India. But the challenge is the tepid earnings growth in India and indications of only modest earnings growth in FY26. Given the weak micros and high valuations, the market will face hurdles in its attempt to break out above the upper end of the range.

Jul 03, 2025, 9:15 am IST

Morning Market Movement Highlights By Akshay Chinchalkar, Head of Research, Axis Securities

The nifty fell yesterday in what is now a three-day retreat. Technically speaking, we are only consolidating the bullish rectangle breakout and as long as the 25200-25270 area is protected, bulls are merely taking a breather. Under 25200, we risk 25000. On the upside, the recent swing high at 25670 is where the bullish trigger lies. With the deadline for the tariff pause expiring next week, it will be interesting to see if the current optimism globally holds up. Today is weekly derivatives expiry, so higher than usual volatility may be seen.

Jul 03, 2025, 8:54 am IST

Bank Nifty Outlook Today By Dhupesh Dhameja, Derivatives Analyst, SAMCO Securities

Despite Nifty Bank hitting record levels, the lack of aggressive volume expansion or momentum suggests a mature rally rather than an exhaustion. As the index nears its 10-day EMA, it is expected to find support and maintain the broader upward trajectory.

Immediate resistance lies in the 57,500–57,600 zone, where supply has capped recent advances. However, the ongoing retracement appears orderly and is likely to be an opportunity for accumulation rather than a cause for concern. The index continues to hold above the psychologically significant 57,000 mark and the critical support of 56,800, which also coincides with the recent breakout zone—signalling the prevailing bullish sentiment remains intact.

As long as Nifty Bank sustains above the 56,800 support, the trend remains constructive. Any pullback toward this region may provide favorable entry points for fresh long positions. From a technical standpoint, the index trades firmly above its key short-term moving averages, while the Relative Strength Index (RSI) remains steady above the 60 level—supporting the case for continued bullish momentum. In a trending market, such consolidations typically precede another leg higher.

Overall, the broader structure stays supportive of the bulls, and the current range bound move could be a brief pause before the next breakout.

Jul 03, 2025, 8:41 am IST

Nifty Outlook Today By Dhupesh Dhameja, Derivatives Analyst, SAMCO Securities

As the index approaches its 10-day EMA, which has historically served as a reliable support, this phase of time-wise correction appears more of a healthy breather than a bearish reversal.

With Nifty hovering close to the key resistance band of 25,640–25,740, any interim dip is likely to remain orderly and could provide a solid platform for accumulation.

The index’s ability to convert former resistance levels into new supports—especially above the psychologically important 25,000 mark—continues to reinforce the broader bullish sentiment. As long as the index maintains above the 25,300 threshold, a “buy-on-dips” approach remains constructive.

The technical structure remains intact, with the index well-supported by short-term moving averages and the RSI holding comfortably above 60, indicating sustained positive momentum. Additionally, the falling India VIX adds to the bullish backdrop. A breakout above 25,750 could trigger the next leg of the rally toward the 26,000 milestone.

Click it and Unblock the Notifications

Click it and Unblock the Notifications