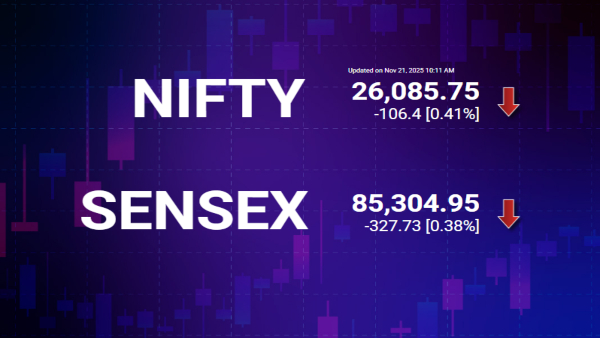

The Indian stock market opened on a dull note today amid poor global cues as Nifty dropped 82.60 points to open at 26,109.55 market whereas Sensex opened 285.28 points lower from the previous close to open at 85,347.40 level. M&M was the top gainer in the Nifty index during the opening session, while Hindalco shares were down around 3%.

As of Friday morning, November 21, 2025 (IST), the Asian stock market is typically trading down due to Wall Street's overnight losses.

Many of the key indices, like Japan's Nikkei 225, South Korea's KOSPI and China's SSE Composite are showing declines, with several opening to a negative sentiment. The cautious sentiment across Asian markets is largely a reaction to a sharp reversal and drop in the US stock market yesterday, particularly in the tech sector, which faded gains that followed a positive earnings report from Nvidia.

Reliance Group will be the focus of attention on the domestic market after it was made clear that the assets that the ED recently attached belong to Reliance Communications, which has not been a part of the group since 2019 and is currently going through independent insolvency proceedings overseen by the NCLT and its lenders.

Reliance Power and Reliance Infrastructure are both bank debt-free and continue to operate regularly with strong shareholder support, according to the firm, and the ruling has no effect on their operations or future outlooks.

LIVE Feed

Nov 21, 2025, 3:44 pm IST

Stock Market Live Updates: Indian Rupee Hits Record Low Amid Delays in US Trade Deal

The Indian rupee weakened significantly, reaching a record low against the US dollar, following news of delays in the US trade deal. Market analysts attributed the slide to heightened uncertainty in global trade relations, which has put pressure on emerging market currencies, including the rupee as per Bloomberg report.

Nov 21, 2025, 3:32 pm IST

Stock Market Live Updates: Indian Equity Indices Close in Red

Indian equity markets ended the day on a negative note, with the Nifty index settling at 26,100 on November 21. The BSE Midcap and Smallcap indices both declined by 1.3 percent. All sectoral indices closed in the red, with capital goods, realty, PSU bank, and metal sectors each falling around 1 percent.

Nov 21, 2025, 3:15 pm IST

Stock Market Live Update: Shanghai Composite Index Suffers Steepest Weekly Loss Since Last December

The Shanghai Composite Index closed down by 2.5%, marking its sharpest single-day decline since April 7. This significant drop pushed the week’s cumulative loss to 3.9%, representing the most substantial weekly decline since December 30, 2024.

Nov 21, 2025, 2:41 pm IST

Stock Market Live Updates: Nifty Bank Index Falls with Major Banks Among Top Losers

The Nifty Bank index declined by 0.5% in intra-day trading, with several leading banks registering losses. ICICI Bank, Canara Bank, and HDFC Bank were among the top losers on the day. State Bank of India (SBI) and Bank of Baroda also experienced a downward trend

Nov 21, 2025, 12:58 pm IST

Stock Market Live: Kotak Mahindra Bank to Decide on Stock Split: Board Meeting Scheduled Today

The board of Kotak Mahindra Bank is scheduled to meet today to deliberate on a potential stock split. This move could make the bank's shares more accessible to a broader range of investors by reducing the price per share.

Stock splits are often pursued by companies to enhance liquidity and attract more investors. By lowering the price of individual shares, they become more affordable, potentially increasing trading activity and broadening the shareholder base.

Nov 21, 2025, 12:43 pm IST

Stock Market Live: Citi Maintains Bullish View on M&M, Sets Target Price at ₹4,230

Citi has maintained its 'buy' recommendation for Mahindra & Mahindra (M&M), setting a target price of Rs 4,230. This decision reflects the company's strong market position and growth potential in the automotive sector.

Nov 21, 2025, 12:31 pm IST

Stock Market Live: Hindalco Industries Falls 2.5% After Fire Reported at Novelis’ Oswego Plant

Hindalco Industries' stock experienced a 2.5% decline following reports of a fire at the Novelis plant located in Oswego, New York. This incident has raised concerns among investors, impacting the company's market performance. The fire at the Oswego facility has drawn significant attention due to its potential implications on production and supply chains. The is an essential part of Hindalco's operations, and any disruption could have far-reaching effects.

Nov 21, 2025, 12:05 pm IST

Stock Market Live: Capillary Technologies Stock Jumps 13% After Weak Debut on BSE

Capillary Technologies experienced a notable 13% increase in their share value following their debut on the Bombay Stock Exchange (BSE). Initially, the shares were listed at a 3% discount compared to the Initial Public Offering (IPO) price. This surge highlights investor confidence despite the initial lower listing.

Nov 21, 2025, 12:01 pm IST

Stock Market Live: Mahindra Mahindra Shares Up 1.19% Higher On BSE; Should You Buy?

Stock Market Live: Mahindra & Mahindra shares were trading 1.19% higher on BSE at Rs 3760.4 per share at 11:59 am. The strong momentum in the auto stock has come after several brokerage firm revised their targets on the stock after its meeting on Thursday. Motilal Oswal has maintained a "BUY rating with a TP of INR4,275 (valued at Sep'27E SoTP)."

Nov 21, 2025, 11:58 am IST

Stock Market Live: Groww Share Price Up 5% Post Q2 Result

Stock Market Live: Groww share price was trading higher on Friday. The company scrip was trading 5.35% higher at Rs 165 per share on BSE with a market capitalisation of Rs 1,01,765.57 crore. Billionbrains Garage Ventures, the parent company of online stockbroking major Groww, has reported a consolidated net profit of Rs 471.4 crore for the second quarter of the financial year 2026. This represents a 12 percent year-on-year increase compared to the net profit of Rs 420.16 crore recorded in the same quarter of FY25.

Nov 21, 2025, 11:51 am IST

Stock Market Live: Tech Mahindra Share Price Trading Higher, Should You Buy?

Stock Market Live: Tech Mahindra shares were trading 0.19% higher at Rs 1,459 per share on BSE with a market capitalisation 1,42,981.47 crore at 11:50 am. "The company is on track to execute its 3-year roadmap and expects turnaround to be completed by FY27. It focuses on scaling up its high-growth service lines (Engineering, Cloud, Data and AI, and Consulting), deepening client relationships for expanding wallet share, investing in consulting and GenAI, and accelerating automation-led delivery for margin expansion. The management aspires to deliver profitable and sustainable growth, higher than the peer average. It expects revenue to grow ~1.3x over FY20-27 which implies ~3.7% CAGR over FY25-27, and is broadly in line with our expectations. We retain REDUCE on TechM and our TP of Rs1,450, at 18x Sep-27E EPS," noted Emkay Research.

Nov 21, 2025, 11:48 am IST

Stock Market Live: AWL Agri Business share price in red post Adani Block Deal

Stock Market Live: AWL Agri Business shares were trading in red on Friday after Adani Block Deal. Adani Commodities LLP, a subsidiary of Adani Enterprises Limited (AEL), has reportedly offloaded its remaining 7% stake in AWL Agri Business Limited in a block deal. Adani Enterprises block deal attracted strong participation from institutional investors and mutual fund houses, reported CNBC TV 18 citing sources.

Nov 21, 2025, 11:22 am IST

Stock Market Live Updates: Sensex Down 283 Pts, Nifty At 26,000; Hindalco, JSW, Tata Steel Top Losers

Stock Market Live Updates: Sensex Down 283 Pts, Nifty At 26,000; Hindalco, JSW, Tata Steel Top Losers

Nov 21, 2025, 10:46 am IST

Astec Life Shares Jump 6% on Market Rally

Trading volumes on Thursday were the highest since February 2010, reflecting strong market activity.

Wednesday’s turnover stood at ₹581 crore, surpassing the company’s free-float market capitalization of ₹451 crore.

A total of 81 lakh shares changed hands on Thursday, compared to the 20-day average of 40,000 shares.

5.1 lakh shares were marked for delivery, significantly higher than the 20-day average of 18,000 shares.

The stock has delivered a 26% year-to-date return (RD) but has posted negative returns for three consecutive years.

Nov 21, 2025, 10:32 am IST

India VIX Jumps Over 13% as Market Volatility Spikes

The India Volatility Index (VIX) surged by more than 13%, signaling heightened market uncertainty. The spike reflects rising nervousness among investors amid recent market movements. Analysts say such sharp increases in VIX often indicate short-term volatility ahead.

Nov 21, 2025, 10:15 am IST

Alembic Pharma Shares Surge, Their Biggest Climb in 18 Weeks

Alembic Pharmaceuticals was trading at Rs 953.45, up Rs 54.70 (6.09%), after hitting an intraday range of Rs 958.50–901.30. Trading activity spiked sharply, with volumes surging to 57,746 shares, nearly 914% higher than the five-day average. This rebound follows a 0.83% decline in the previous session, where the stock closed at Rs 898.75. Alembic Pharma remains 15.05% below its 52-week high of Rs 1,122.40, yet 31.4% above its 52-week low of Rs 725.60. The company’s market capitalisation currently stands at Rs 18,741.31 crore.

Nov 21, 2025, 10:14 am IST

Nifty-Sensex

.

Nov 21, 2025, 10:02 am IST

Zaggle Prepaid Signs 3-Year Technology Partnership With BIBA Fashion

Zaggle has entered into an agreement with BIBA Fashion to provide its Zaggle Zoyer platform to the company. The partnership will enable BIBA Fashion to use Zaggle’s technology for streamlined expense management and improved operational efficiency.

Nov 21, 2025, 9:50 am IST

Adani Block Deal: Institutional Investors Snap Up 7% of AWL Agri

Adani Group said that its 7% block deal in AWL Agri witnessed strong institutional demand, underscoring robust investor appetite for the company’s equity.

According to the group, leading global and domestic institutions participated in the transaction. Vanguard, Charles Schwab, ICICI Prudential Mutual Fund, and SBI Mutual Fund were among the key buyers in the block deal. Additionally, Tata Mutual Fund, Quant Mutual Fund, and Bandhan Mutual Fund also took part, further highlighting broad-based institutional interest in AWL Agri.

Nov 21, 2025, 9:37 am IST

Billionbrains (Groww) Shares Soar as Market Braces for Earnings

Billionbrains Garage Ventures was trading at Rs 164.64, up Rs 8.02 or 5.12 percent, showing a strong rebound in today’s session. The stock moved between an intraday high of Rs 165.79 and a low of Rs 156.14, reflecting a steady recovery after recent volatility.

In the previous trading session, the share had closed sharply lower at Rs 156.62, a decline of 7.84 percent or Rs 13.32, making today’s upward movement particularly notable.

Nov 21, 2025, 9:24 am IST

Nifty Prediction Today By Anand James, Chief Market Strategist, Geojit Investments

The strong push above the month-long trading range adds more confidence towards achieving 26550 or more in the near term. Meanwhile, the brief push yesterday above the upper bollinger and the close back below thereafter, suggests that upswings may be limited today as well. Inability to float above 26237 or a direct fall below 26160 could see bear bias dominating, with expectations of 26028-25984.

Nov 21, 2025, 8:53 am IST

Market Outlook Today By Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments Limited

Market volatility has spiked up. Nasdaq, the barometer of the AI trade, closed down 2.15% yesterday crashing 4.4% from the intraday peak. This kind of market movement is a signal of more volatility in store. While there are valuation concerns in AI stocks with many experts warning of a bubble burst, the Nvidia CEO disagreed with this cautionary warning with the statement “we see a different picture characterised by sustainable rise of advanced AI systems.” At lower valuations, fresh buying may again emerge in AI stocks. We will have to wait and see how this volatile phase unfolds.

There is excessive speculative trading in many stocks in India, particularly in some newly listed stocks. Retail investors better avoid such speculative trades which usually end in tears for the vast majority. The ideal investment strategy now would be to buy fairly-valued high quality stocks on declines and wait patiently. Since India has been an under-performer in this year’s AI trade, India will benefit if the AI trade fades and money starts flowing into non-AI stocks in counties like India. But a big crash would impact all markets. So wait and watch how things unfold.

Nov 21, 2025, 8:25 am IST

Nifty Bank Derivatives Overview By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

The derivatives setup continues to reflect strong optimism and a constructive undertone. Call writers are steadily shifting to higher strike prices, while Put writers are building substantial positions at near-the-money levels—indicating confidence in sustained upside traction. A notable open interest accumulation of nearly 11.96 lakh contracts at the 60,000 call strike highlights its relevance as a major resistance ceiling. Simultaneously, significantly higher put OI of about 14.70 lakh contracts at the 59,000 strike reaffirms strong support at lower levels.

Aggressive put writing coupled with call unwinding and upward rollovers reflects strong bullish positioning. The Put-Call Ratio (PCR) remains steady at 1.20, pointing to optimistic sentiment as participants continue to maintain long-biased positions, suggesting that dips may be met with firm buying interest.

Nov 21, 2025, 8:25 am IST

Bank Nifty Outlook Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

Technically, Nifty Bank continues to print new all-time highs, and even minor intraday declines are being absorbed swiftly by aggressive buying—signalling a healthy and constructive broader setup. The index is comfortably trading above its 10-day and 20-day exponential moving averages, which continue to act as dynamic support zones. The conversion of prior resistance levels into strong support reinforces the long-term positive bias and maintains alignment with the ongoing uptrend. As long as the index sustains above the 59,000–58,850 support band, traders are likely to adhere to a “buy-on-dips” strategy.

On the upside, immediate resistance is placed around the 59,500 mark, where significant call-writer activity has emerged. A decisive close above this level could open the gates for renewed momentum-driven buying, potentially pushing the index further toward higher uncharted levels. On the downside, any dip below 58,850 is expected to draw renewed accumulation as long as structural supports remain intact.

Momentum indicators also validate the bullish outlook—the 14-Day RSI holding above 70 highlights strong short-term momentum, though slightly overstretched conditions suggest the possibility of brief pauses or consolidation phases. Looking ahead, 59,500 remains the key near-term resistance, while the 58,950–59,000 zone is likely to act as a crucial pivot area.

Nov 21, 2025, 8:24 am IST

Nifty Derivatives Snapshot By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

The derivatives landscape continues to reflect a constructive undertone and strong optimism. Call writers have been persistently shifting their positions to higher strike prices, while put writers are accumulating substantial open interest at nearby strikes—indicating a firmly bullish phase. A significant open interest build-up of nearly 1.17 crore contracts at the 26,500 call strike highlights its importance as a major resistance ceiling. Meanwhile, heavily put OI—approximately 1.54 crore contracts—at the 26,000 strike reaffirms strong support at lower levels.

Simultaneous aggressive additions in put writing, along with unwinding and upward rollovers by call writers, underline firm bullish positioning and a sustained positive bias. The Put-Call Ratio (PCR) has risen sharply to 1.50 from 1.33, mirroring heightened optimism, though it also suggests mildly overheated sentiment where minor profit-taking cannot be ruled out.

Nov 21, 2025, 8:24 am IST

Nifty Outlook Today By Dhupesh Dhameja, Derivatives Research Analyst, SAMCO Securities

From a technical standpoint, Nifty has convincingly pierced key resistance levels and is steadily inching towards record highs. The broader setup stays constructive as the index continues to hold above its 10-day and 20-day exponential moving averages—zones that have consistently acted as dynamic support. Additionally, previous resistance levels have now turned into reliable support, reinforcing the long-term bullish bias and keeping the ongoing uptrend firmly intact. As long as the index sustains above the 25,900–25,850 support corridor, traders are likely to maintain a “buy-on-dips” approach.

On the upside, immediate resistance is placed near the 26,270 zone—its previous all-time high. A stable close above this threshold may unlock fresh momentum-led buying, potentially propelling the index into new territory. Conversely, any dip below 25,850 is likely to draw renewed buying interest as long as structural supports remain intact.

Momentum indicators also support the bullish narrative—the 14-Day RSI hovering above 65 reflects solid short-term strength and confirms active positive momentum. Going ahead, 26,270 will remain the crucial near-term resistance, while the 25,950–26,000 band is expected to act as a strong pivot zone.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Friday, November 21, 2025, 8:20 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications