Nvidia Becomes First To Hit $4 Trillion; One AI Company Is Bigger Than GDP Of UK, France, Canada, More

AI behemoth Nvidia has become the first company to touch a $4 trillion market cap, reclaiming the world's largest company title as well. Overnight, the chipmaker touched a new record high of $164.42 and gained a market valuation of over $100 billion, which was enough to push Nvidia to crack a new milestone. Now, sitting above a $3.9 trillion m-cap, Nvidia has become bigger than the GDPs of major economies like the UK, France, Italy and Canada.

Why Did Nvidia Stock Touch a $4 Trillion M-Cap?

On July 9, Nvidia hit the threshold of a $4 trillion market cap after its share price rallied by at least 2.76% to hit a new all-time high of $164.42. After the closing bell, Nvidia stock ended at $162.88 apiece, up by 1.80%. Still, Nvidia made the most money on July 9th, with the market cap gaining by $70.23 billion to $3.972 trillion.

In the pre-market of July 10th, Nvidia is already up by nearly 1% and above the $163 mark.

What is eye-catching is that Nvidia stock soared to new heights despite the global market being jittery due to US President Donald Trump's tariff saga, which is expected to create trade uncertainties globally. The latest strong bull run in Nvidia is an example of rising investor appetite for AI companies due to optimism on artificial intelligence being the new future.

"The move up on Nvidia is a great example of how sentiment can lead price over fundamentals," Ross Maxwell, global strategy lead at VT Markets told GoodReturns.In. He added, "Whilst this will obviously grab the headlines, as traders, we need to be aware of what this means and what can come next."

Nvidia's Journey To $4 Trillion:

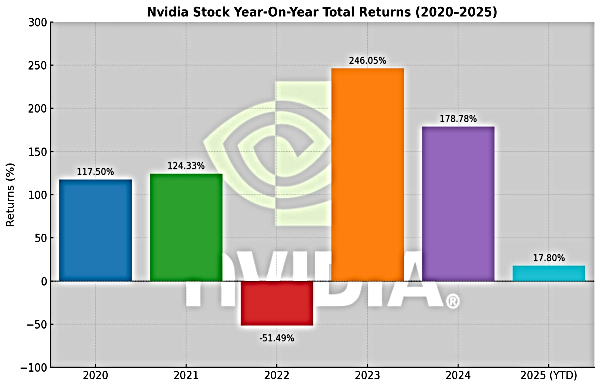

Since COVID-19, Nvidia stock has seen tremendous growth. With the exception of 2022, Nvidia has continued to give triple-digit returns, hitting new highs and rising at a mind-boggling pace.

For instance, in 2020 alone, despite the COVID-19 pandemic bringing the entire world to a standstill, Nvidia rose by 117.5% in that respective year alone. This only led to 124.33% gains in 2021. However, Nvidia faced a sharp setback in 2022, with overall year-to-year returns negative by 51.5%. But 2023 was the year of new historic movements for Nvidia stock.

In 2023 and 2024, Nvidia stock has skyrocketed by a whopping 246% and 179%, respectively. In 2025, so far, Nvidia has recorded nearly 18% gains.

The first time Nvidia touched the $1 trillion mark was in June 2023. In a span of one year, the mega stock tripled to hit the $3 trillion mark—faster than tech giants like Apple and Microsoft.

Nvidia Is Bigger Than Major Economies:

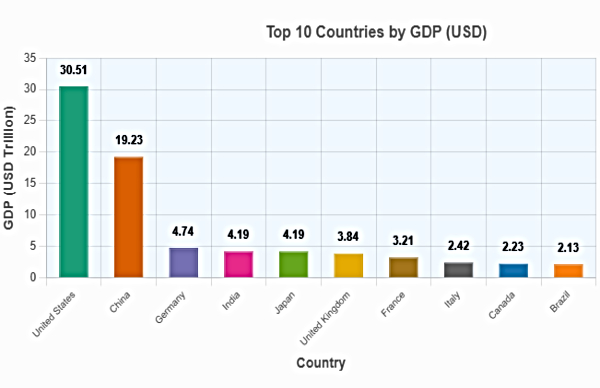

At a $3.9 trillion market cap, Nvidia is bigger than the $3.84 trillion GDP of the United Kingdom, followed by France, which has a GDP of $3.21 trillion.

Nvidia is higher by $1.48 trillion to $1.77 trillion than countries like Italy, Canada and Brazil, whose GDPs are $2.42 trillion, $2.23 trillion, and $2.13 trillion.

In the top 10 rankings, the UK is the sixth largest economy, followed by France at seventh, Italy at eighth, Canada at ninth, and Brazil at tenth.

Since Nvidia has given a sneak peek of its potential for hitting $4 trillion and beyond, Nvidia is currently racing to reach the GDPs of fourth and fifth largest economies like India and Japan.

Short-Term Selling Ahead?

Maxwell said, "Traders who believed Nvidia to be overvalued and were waiting for the 'fair value' have probably missed the move. Whilst those trading momentum and structure have benefited. When we hit big milestones, we can often see profit taking coming in, which means we can expect some short-term volatility across the tech sector, especially as we are in earnings season as well."

"The sentiment caused by the milestone may also lead to sector rotation into AI leaders benefiting indices like the Tech heavy Nasdaq. As always, as a trader, it is important to watch how the market reacts rather than the headline itself," he added.

Will Nvidia Continue the Bull Run?

The Jensen Huang-backed AI is ruling the world of AI, and the future outlook is only brighter and greater.

Just this week, Citi's stock analyst Atif Malik raised his target on Nvidia to $190, as he believes the world's total addressable market for data-center AI chips could reach $563 billion by 2028, which is higher than his earlier prediction of $500 billion. He also believes Nvidia to shrug off US President Trump's potential new rules and restrictions on shipments of some AI chips to Southeast Asia.

Further, the analyst expects Nvidia's adjusted gross margins to reach in the mid-70s range by the end of the current fiscal year, as Nvidia and Blackwell's deal moves ahead.

Meanwhile, analysts at BofA have maintained a BUY rating on Nvidia with $180 target, owing to Nvidia's 80% dominance in the fastest-growing AI market, which is expected to be enough to drive the share price higher.

Based on 40 Wall Street analysts offering 12 month price targets for Nvidia in the last 3 months. The average price target is $175.97 with a high forecast of $250.00 and a low forecast of $100.00, as per TipRanks.

Disclaimer: The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications