More Than Just a Home: How Women Are Buying Financial Freedom & Taking Charge of Real Estate Decisions

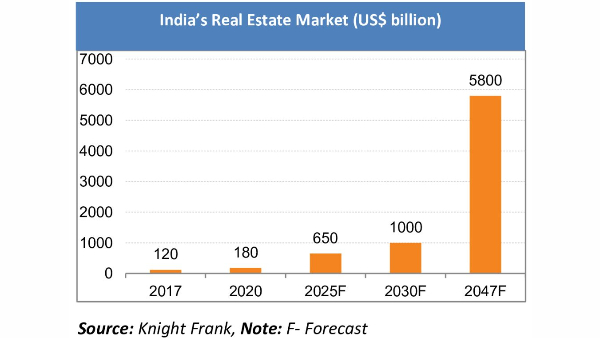

This Independence Day, the idea of freedom isn't just about the nation; it's also about personal independence, and especially for women who have always taken a back seat when it comes to homeownership. But now things are changing. According to industry reports, the percentage of women homebuyers in India has nearly doubled over the past decade as the Indian real estate market is growing exponentially. As per India Brand Equity Foundation, the Indian real estate sector is projected to reach a value of US$ 5 to 7 trillion by 2047, with the potential to surpass US$ 10 trillion.

With that in mind, the contribution of women in this sector cannot be neglected. We see this trend in 2025 that a lot of women in their 20s & 30s are achieving stable incomes & career growth, which says that they now have both the means and the confidence to make large-scale investments like purchasing a home.

Tax Benefits That Put Women Ahead

Supporting this shift in pattern, major policies are encouraging more women to invest in real estate earlier in life.

Kiran Venugopal, Founder & CEO, Bricks & Milestones, explained, "Women homebuyers in India enjoy a great number of financial benefits designed to encourage home ownership. Most state governments provide concessional stamp duty rates, typically 1-2% lower for women than for men. For instance, in Delhi, women are stamped at 4% and men at 6%, meaning there could be significant savings on property purchase. Uttar Pradesh just recently increased its 1% exemption for women to Rs. 1 crore, which can save up to Rs. 1 lakh. But it's worth mentioning that some states, like Karnataka, have the same stamp duty for both men and women."

As per the Income Tax Act, women can claim deductions of up to Rs. 1.5 lakh on principal repayment under Section 80C and up to Rs. 2 lakh on home loan interest for self-occupied properties under Section 24(b).

Smart Financing Moves for Single Women Homebuyers

Single women entering the property market have access to special advantages. Many banks offer slightly lower home loan interest rates for women, about 0.05% to 0.1% lower, and some even increase the Loan-to-Value (LTV) ratio, reducing the upfront down payment.

"Women can save up for the usual 10-20% down payment, and make sure your EMIs constitute less than 30-35% of your monthly income so you don't get cash-strapped. Compare loan offers from three or more lenders to get the best rate and terms. Joint loans with a parent or sibling can also boost qualifying and have both parties claim tax benefits." Kiran further added.

Tier-1 Cities Lead the Surge

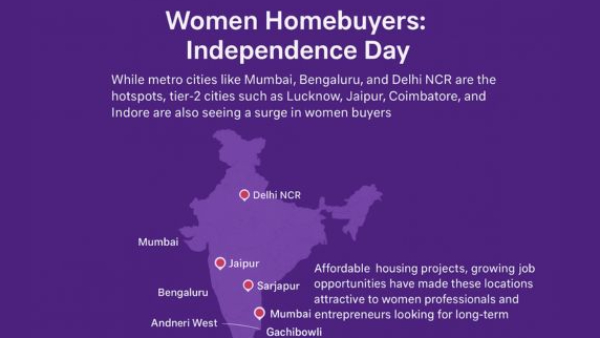

While metro cities like Mumbai, Bengaluru, and Delhi NCR are the hotspots, tier-2 cities such as Lucknow, Jaipur, Coimbatore, and Indore are also seeing a surge in women buyers. Affordable housing projects and growing job opportunities have made these locations attractive to women professionals and entrepreneurs looking for long-term investments.

"Single-women buyers are particularly active in metro and Tier-1 cities like Bengaluru and Pune. In Bengaluru, micro-markets like HSR Layout, Sarjapur, and North Bangalore (near the airport) are popular among women buyers due to good social infrastructure, connectivity, quality schools, and safety. In other states, Pune's Koregaon Park, Mumbai's Andheri West, Chennai's OMR corridor, and Hyderabad's Gachibowli see strong interest from women buyers for similar reasons." Kiran added.

Market Trends

"Ready-to-move-in homes remain the preferred choice for around 71% of women buyers due to lower risk. They gravitate towards ready-to-move-in homes from reputed developers, value community safety, and prefer locations with strong resale and rental demand. We have observed that single women buyers often prioritise proximity to work, safety, and manageable budgets with compact but well-designed units. Married women buyers tend to look for larger homes with family-friendly amenities, good schools nearby, and long-term investment value." He further added.

Biggest Financial Mistakes Women Should Avoid When Buying Property

Women homebuyers today are incredibly savvy; there are some common pitfalls that can be easily avoided.

Focusing only on the property price and forgetting stamp duty, registration fees, GST, and other charges, which can add 15-20% to the total cost.

Not checking the builder's RERA registration, verifying property titles, or getting a professional home inspection.

Sticking to one bank without checking interest rates, EMI options, and terms from multiple lenders.

Choosing a property without considering how easily it can be sold or rented in the future.

Failing to verify all legal approvals and the builder's past track record, which can lead to costly disputes or delays.

Women Are Now Changing Social Narratives

Owning a home has always meant safety and stability, but for women today, it's also a way to show independence and take charge of their future. Gone are the days when women waited until marriage to buy property. Now single women, divorced women, and widows are confidently choosing homes based on what suits their own needs and lifestyle, not just family expectations.In the upcoming years to come, these trends will only grow further, and women's presence in the property market will strengthen the real estate sector and also inspire future generations to dream and achieve without limitations.

Click it and Unblock the Notifications

Click it and Unblock the Notifications