IRFC, BEML, RVNL, IRCON Shares Crashed: Why Railway Stocks Dropped Despite Large Order Books Trajectory?

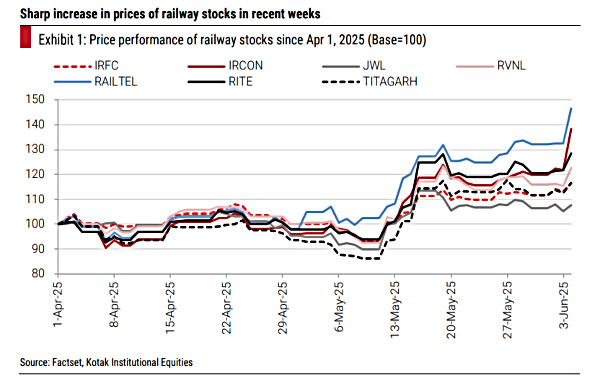

Indian railway stocks crashed on Thursday, June 19 with BEML, IRFC, RITES, and IRCON dragging the broader sector. The sharp selling in railway stocks emerged despite the outlook for large order books and optimism in the sector. The latest correction is on expected lines, as railway stocks rallied strongly in the first five months of 2025.

Railway Stocks:

After market hours of June 19, IRFC stock dropped by 3%, while BEML and IRCON International plunged by 4% and 3.50% respectively. IRCTC and Container Corporation dipped by 1.7% and 2.4% as well.

Meanwhile, RVNL was down by 4.11%, RailTel Corp slipped 4.5%, and RITES shares tumbled 3.6%. Other railway stocks like Texmaco Rail and Titagarh Rail Systems also plummeted by 3.9% and 3.6% respectively.

Are Railway Stocks Overvalued?

One of the key reasons for profit booking could be attributed to the overvaluation of railway stocks. This year, the trend in railway stocks has been fuelled by order books, Operation Sindoor and capex-push.

From May to June 3, the market capitalization of 7 railway stocks increased by 20% or Rs 610 billion. Also, the market capitalization of 7 railway stocks stood at Rs 3.6 trillion, versus a book value of Rs 784 billion and net profits of Rs99 billion (FY2025 basis). Additionally, cash and investments accounted for 25% of the book value at end-FY2025 and other income accounted for 12% of the pre-tax profits of the railway stocks in FY2025, as per Kotak Institutional Equities data.

Analysts predicted the latest correction.

Kotak's analysts had said, "We do not see scope for a meaningful pickup in railway capex in the medium term for a few reasons: (1) Indian Railways may have largely maximized the capacity of its extant railway network with large investments in rolling stock and track over the past 10 years and (2) low visibility on new projects such as a high-speed railway network on the lines of dedicated freight corridors or the upcoming Ahmedabad-Mumbai high-speed line."

Eventually, analysts highlighted that there was a disconnect between the fundamentals and valuations of the railway companies.

"The valuations are very hard to reconcile with the financials and growth prospects of the companies. Also, we would note that (1) cash and investments account for a large portion of the book value and (2) other income (on cash and investments) is a significant portion of the pre-tax profits of the companies," Kotak's note had explained.

During the Budget 2025, the central government announced a total capital expenditure of Rs 2,65,200 crore for railways for FY26. Notably, in both 2024-25 and 2025-26, the budgetary support was Rs 2,52,200 crore, financing 95% of the capital expenditure in these years.

Among the key initiatives announced in the Budget for driving railway sectors are --- the construction of new railway lines will proceed at an accelerated pace, with a budget of Rs 32,235.24 crore in FY 2025-26. Additionally, Rs 4,550 crore has been allocated for gauge conversion in FY 2025-26, and Rolling stock has been capped at Rs 57,693 crore for FY 2025-26. A major push is also being made for the doubling of tracks, with a marked budget of Rs 32,000 crore in FY 2025-26.

Railway Companies Outlook Positive:

"Government capex has been front-loaded in FY26, with combined central and state spending in March-April rising 68% YoY. This is positive for railway, defence, and capital goods players," Siddhartha Khemka, Head of research, Wealth Management, Motilal Oswal Financial Services said.

Also, Kinjal Shah, Senior Vice President & Co-Group Head - Corporate Ratings, ICRA Limited said, "Given the uncertain global environment, ICRA expects the private capital expenditure (capex) cycle to remain measured. However, certain sunrise sectors such as electronics, semiconductors and niche segments within the automotive space like electric vehicles will continue to see a scale-up in investments, in line with the various production-linked incentives programmes announced by the Government of India (GoI). Further, entities linked with the Indian Railways and Defence sectors would also see their large order books translating into revenues and earnings."

Data from JM Financial showed that the railway sector's order awards and tenders stood at Rs 418 billion in May 2025, sharply up from Rs 345 billion in April 2025.

Which Railway Stocks To BUY?

According to Prabhudas Lilladher, the following are the top picks in the railway basket:

1. IRFC: BUY For Target Price Rs 165

2. Jupiter Wagons: BUY For Target Price Rs 500

3. RVNL: BUY For Target Price Rs 450

4. Texmaco Rail: BUY For Target Price Rs 200

5. Titagarh Rail: BUY For Target Price Rs 1,000

Disclaimer: The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications