Indian Stock Market Resilient In Big Geopolitical Crisis: When Will Sensex Hit 1.5 Lakh & Nifty 50,000?

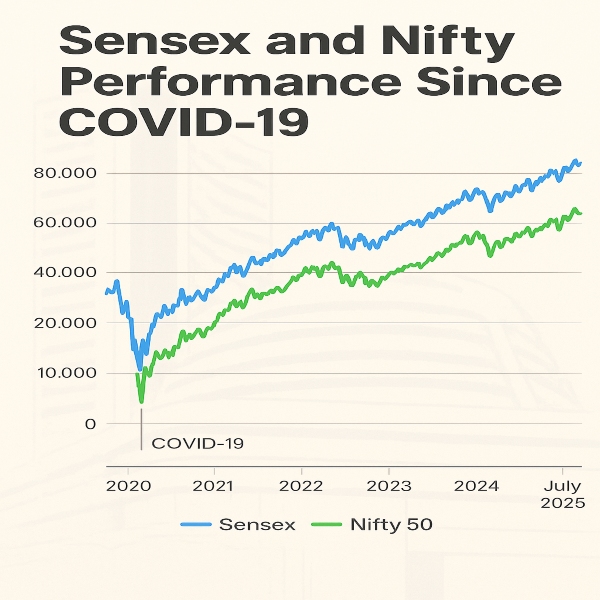

The Indian stock market continues to be a pillar of resilience in times of global uncertainties, trade wars, and geopolitical crises since Covid-19. From 2020 to date, Sensex and Nifty have skyrocketed by over 200%, outshining the global crash, recession fears, multi-decadal high inflation, and sharp spike in rates, owing to a strong increase in domestic retail investor buying.

YTD, Sensex and Nifty have gained by 6-7% and are trading above pivotal levels of 83,400 and 25,460. The outlook for 2025 and in the longer run on Sensex and Nifty is bullish. That does make us wonder, when will Sensex and Nifty hit the 1.5 lakh and 50,000 marks?

Sensex and Nifty During Big Geopolitical Tensions:

"In a world of economic upheaval and geopolitical tension, India's equity markets have emerged as a pillar of resilience. Despite foreign institutional investors (FIIs) pulling out during volatile periods-including sharp drawdowns in 2022 and early 2023-the markets have remained strong. Even the Q1 2025 correction, though steep, was limited to an 18% drop from all-time highs, narrowly avoiding bear market territory," said Vineet Agrawal, Cofounder, Jiraaf (Bond Investment Platform).

"Indian equity markets have shown remarkable resilience in the face of major geopolitical shocks since the onset of the COVID-19 pandemic. Despite periodic global disruptions, domestic indices such as the Sensex and Nifty have not only recovered quickly but also achieved record highs, highlighting the strength of India's macroeconomic fundamentals and investor confidence," said Gaurav Garg, Lemonn Markets Desk.

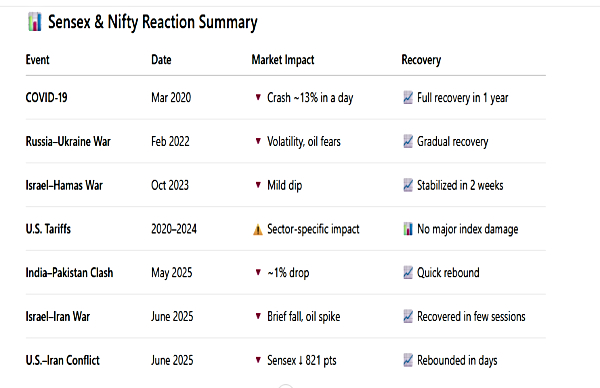

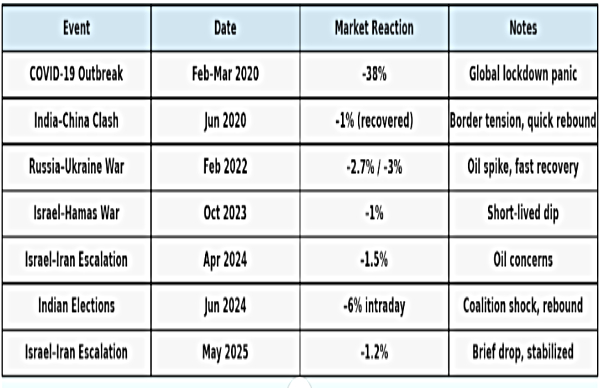

In the past five years, the COVID-19 pandemic emerged to be the most damaging event for the stock market, with the Sensex and Nifty crashing by 13% in March 2020 alone. While war crises in the Middle East and Russia-Ukraine caused short-term volatility and bearish momentum.

Also, the impact of the India and Pakistan geopolitical crisis was also limited. And although US tariffs impacted specific Indian stocks like IT, pharma and metals, overall the market remained resilient.

Here's how major geopolitical tensions impacted Sensex and Nifty since Covid, as per Garg:

The Russia-Ukraine conflict, which erupted in early 2022, triggered immediate volatility in global equity markets, including India. Concerns over energy security, inflation, and supply chain disruptions led to sharp corrections in Indian indices. However, the markets rebounded relatively swiftly, driven by strong domestic consumption, policy stability, and robust corporate earnings.

Tensions between the United States and China over trade and technology have remained a recurring source of global uncertainty. While these developments have led to intermittent volatility, Indian equities have benefited from a global supply chain realignment, with India emerging as a preferred alternative manufacturing and sourcing destination.

More recently, the Middle East has witnessed escalations that raised concerns about crude oil supply, particularly through the Strait of Hormuz. This has had a temporary impact on investor sentiment, especially in energy-sensitive sectors. Despite these shocks, Indian markets have displayed a consistent ability to absorb risk and recover on the strength of domestic factors.

The U.S. Federal Reserve's monetary policy decisions have also significantly influenced foreign institutional investor (FII) flows. Periods of aggressive rate hikes resulted in risk-off sentiment globally, prompting capital outflows from emerging markets, including India.

What Led Sensex and Nifty To Become Pillar Of Resilience?

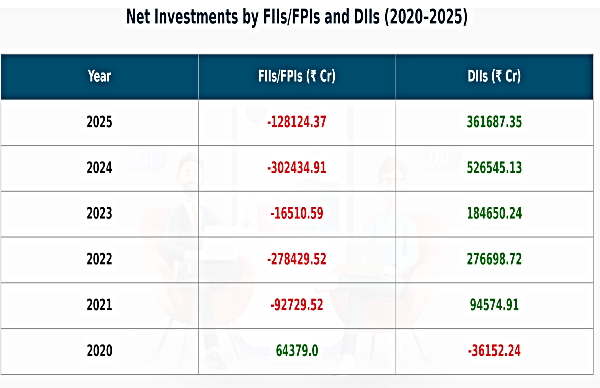

"The backbone of this stability are the domestic institutional investors (DIIs) and retail investors. Between 2020 and 2024, they injected over Rs 2.75 lakh crore into Indian equities, keeping the market buoyant. Their conviction has propelled the Sensex close to 80,000 and the Nifty above 24,000 by mid-2025," said Agrawal.

From 2020 to July 2025, the only time DIIs were net sellers was in 2020 with an outflow of Rs 36,152.24 crore. From 2021 to date, DIIs have only been buyers, with their all-time high inflow in the Indian stock market seen in 2024 at Rs 5,26,545.13 crore. FIIs record selling was seen in 2024 at Rs 3,02,434.91 crore. Data shows that DII's strong buying has curbed the relentless and frenzied sell-offs by FIIs since 2021.

"Domestic institutional investors have played a pivotal role in stabilizing markets during global sell-offs. With a strong focus on long-term value creation and domestic growth themes, DIIs have consistently stepped in during market corrections, cushioning the impact of foreign selling," Garg said.

In contrast, he added, "foreign institutional investors remain highly sensitive to global macro developments, particularly U.S. interest rates, geopolitical risks, and dollar liquidity. While FIIs have pulled out during high-volatility periods, they have returned to Indian equities whenever global conditions stabilized and India's growth outlook appeared favorable."

"As of end-2024, FIIs held a 17.23% market share, closely followed by DIIs at 16.90%," said Dr. Ratish Gupta, Director of Wealth Wisdom India.

When Will Sensex And Nifty Hit the 1.5 Lakh and 50,000 Mark?

Here's what these experts told GoodReturns:

With India's macroeconomic fundamentals, favorable demographics, and growing retail participation intact, the long-term outlook remains optimistic. Assuming 12-14% CAGR and stable geopolitics, analysts see the Sensex reaching 1.5 lakh and the Nifty 50 reaching 50,000 by 2030. All-time highs may well be within reach by September, said Jiraaf''s co-founder.

Consistent buying support from FIIs and DIIs, underpinned by India's strong macroeconomic fundamentals, has kept the long-term uptrend intact. Gupta added, "If this trajectory sustains, analysts believe the Sensex could scale the 1.5 lakh mark, and the Nifty may reach 50,000 over the next five to ten years."

Along similar lines, Garg said, with the Indian economy projected to grow at an average rate of 7-8% annually, market experts believe that the Sensex could reach 1.5 lakh and the Nifty 50,000 over the next 5-7 years. He highlighted:

- Sensex 150,000 Target: At a compounded annual growth rate (CAGR) of 10-12%, the Sensex could realistically touch 150,000 by 2029-2030.

- Nifty 50,000 Target: From current levels of approximately 25,000, the Nifty may double by 2031-2032, assuming stable macroeconomic conditions.

In his concluding remarks, Garg said, "Despite turbulent global events, the Indian equity market's structural strength, supported by domestic investors and policy stability, has made it a standout performer among emerging markets. As long as India continues on its current economic path, long-term market milestones such as Sensex 1.5 lakh and Nifty 50,000 remain within reach."

Disclaimer: The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications