ICL Fincorp's New NCD Issue Opens Nov 17: Earn Up to 12.62% Returns with Gold-Backed NCD; All Details Inside

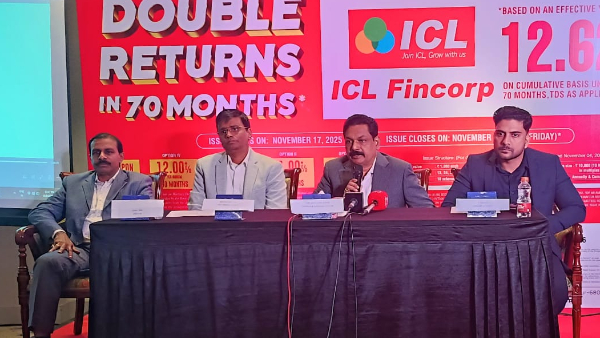

Thrissur-based ICL Fincorp has announced the rollout of its 7th series of the public issue of Secured Redeemable Non-Convertible Debentures (NCDs), which will open on November 17. The issue was formally launched at a press conference in Bengaluru in the presence of Adv. K.G. Anil Kumar, Chairman & Managing Director; Venkit Ram, Director; Madhavankutty T, Chief Financial Officer; and T.V. Vishak, Company Secretary.

All About the NCD Issue

The NCD issue that is opening on November 17 will remain open for subscription until November 28, providing investors an effective yield of up to 12.62%. The minimum investment amount is Rs. 10,000, and the total issue size stands at Rs. 100 crore.

Each NCD carries a face value of Rs. 1,000, and the company has introduced 10 investment options with tenures ranging from 13, 24, 36, 60, and 70 months. Investors can choose between monthly, annual, and cumulative interest payout options, with interest rates in the range of 10.50% to 12.62%.

According to ICL Fincorp, the interest rates for the schemes are as follows:

Monthly interest schemes:

- 13 months: 10.5%

- 24 monhs: 11%

- 36 months: 11.5%

- 60 months: 12%

Cumulative schemes:

- 13 months: 11%

- 24 months: 11.5%

- 36 months: 12%

Annual interest options:

- 24 months: 11.25%

- 36 months: 11.75%

Doubling scheme:

This scheme is for 70 months with an effective yield of 12.62%, where an investment of Rs. 1 lakh returns Rs. 2 lakh at maturity. The NCDs carry a CRISIL BBB-/Stable rating.

Risk Factors: What Retail Investors Should Know

Speaking to GoodReturns, Madhavankutty T, CFO of ICL Fincorp, talked about the security of the issue. "Our loan book is 98-99% gold loans, making these NCDs highly secure as they are backed by physical gold. Historically, gold as an asset class has delivered more than 10% annual returns over the last 15 years. I mean, gold is an asset class. So, there's hardly been any instance, except for once or twice the rate got corrected. So, other than that, there is not much risk. And also, there are enough regulations to cover."

"For instance, RBI permits LTV of only 75% and 85%. So, 85% for less than 2 lakhs of loan, and 70% loan to value in case it is more than 2 lakhs. So, which means you have got enough buffer to take care of your loan." He further added

Use of Proceeds

The capital raised from this issue will be strategically used to support ICL Fincorp's growth initiatives and further enhance the quality of services offered to our customers and stakeholders across India.

"We will be utilising the money to raise the loan requirements and demands that are there in each of the branches. And these funds will be going for the purpose of the business and expansion of the company also," said T.V. Vishak, Company Secretary.

About ICL Fincorp

ICL Fincorp Limited is an Indian non-banking financial company (NBFC) headquartered in Irinjalakuda, Thrissur, Kerala. Established in 1991 as Jawahar Finance Limited and later renamed, the company adopted its current identity in 2016. Today, it operates over 300 branches across 10 states, including Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Karnataka, Maharashtra, Odisha, Gujarat, West Bengal, and Goa.

Click it and Unblock the Notifications

Click it and Unblock the Notifications