HAL, Cochin, GRSE, Mazagon Dock, BDL Shares: 5 Reasons Why Defence Stocks Are Trending

The majority of defence stocks are rallying on Wednesday, August 20, with the largest defence PSU giant, Hindustan Aeronautics (HAL), leading the bull wagon. A host of factors are driving the defence basket despite market sentiment being volatile.

On August 20, in the early trade, the Nifty India Defence index climbed by 12.70 points or 0.16% to trade at 7,747.95. A lot of stock-specific actions are the main reason for lifting the overall index.

Stocks like Unimech Aerospace, HAL, DCX India, Cochin Shipyard, BEML, Paras Developers, Cyient DLM, Paras Defence, Dynamatic Technologies, IdeaForge Technology, Kaynes Technology, Apollo Micro Systems, MTAR Technologies, and Swan Defence & Heavy Industries gained by 0.5% to 5%.

However, stocks like Bharat Electronics (BEL), Bharat Dynamics (BDL), Bharat Forge, and Mazagon Dock dropped between 1% to 2%, emerging among the top losers.

Here are five reasons why defence stocks are trending:

Hindustan Aeronautics (HAL) Stocks Shine!

The biggest contributor to the upside in defence stocks is the leader of the board, Hindustan Aeronautics (HAL).

HAL's share price is trending after reports stated that the company is likely to bag a huge order. As per a CNBC-TV18 report, government sources said that the Union Cabinet Committee on Security (CCS) has cleared the purchase of 97 Light Combat Aircraft (LCA) Mark 1A fighter jets worth Rs 62,000 crore from HAL.

A strong order book is a key positive.

In the early trade, HAL's share price gained by a whopping 3.34% to hit an intraday high of Rs 4,605 apiece on Wednesday. At the time of writing, HAL traded at Rs 4,537.40 apiece, up by 1.90% with a market cap of Rs 3,03,383.09 crore.

Orderbook Pipeline Restores Faith:

These defence companies are also trending due to their Q1FY26 earnings conference calls, where they highlighted their plans in the coming quarters. Cochin Shipyard and GRSE are the latest to reveal their order book position.

As per the regulatory filing, Cochin's order book position stood at Rs 21,100 crore. While its shipbuilding order pipeline is Rs 2,85,000 crore. Of these, the order pipeline in defence is Rs 2,20,000 crore, and commercial is Rs 65,000 crore.

Additionally, as per an independent broker, LNPR Capital, Garden Reach Shipbuilders & Engineers Ltd (GRSE), operating under the Ministry of Defence, is one of India's leading and oldest shipbuilding companies, primarily catering to the Indian Navy and Indian Coast Guard, while also being the first shipyard in the country to export warships.

Of this orderbook in GRSE, 98% is related to shipbuilding, with a clear defence-heavy mix where 86% comes from defense shipbuilding, 14% from non-defense, 9% from ship repair, and 5% from exports.

Defence Stocks Recover As Russia-Ukraine Tension Persists:

These defence stocks recovered after falling sharply yesterday due to the Washington meeting between US President Donald Trump and Ukraine President Volodymyr Zelenskyy. Trump signalled that he is planning a meeting between Russia and Ukraine leaders, for resolutions to end the ongoing war. On August 19, Nifty India Defence index was down nearly 1%.

"At the conclusion of the meetings, I called President Putin, and began the arrangements for a meeting, at a location to be determined, between President Putin and President Zelenskyy. After that meeting takes place, we will have a Trilat, which would be the two Presidents, plus myself. Again, this was a very good, early step for a War that has been going on for almost four years," Trump said after his meeting with Zelensky and other European leaders.

However, as per the latest report of the BBC, The Kremlin has played down talk of an imminent summit between Russian President Vladimir Putin and Ukraine's Volodymyr Zelensky, as Donald Trump renewed his call for the two leaders to meet to discuss ending the war in Ukraine.

The US president also admitted that the Kremlin and Ukraine war is a tough one to solve and hinted at the possibility of Putin not being interested in ending hostilities. During the Oval meeting in Alaska, Putin dialed down on a ceasefire or peace agreement and instead told Trump he wants a portion of Ukraine.

4. Mission Sudarshan Chakra:

Earlier this week, Prime Minister Narendra Modi announced the launch of the Sudarshan Chakra Mission. This mission, Sudarshan Chakra, a powerful weapon system, will not only neutralize the enemy's attack but will also hit back at the enemy many times more.

5. Defence Sector Outlook:

With the Indian Ministry of Defence setting a target of achieving $26 billion in aerospace and defence manufacturing turnover by 2025, including $5 billion in exports, the outlook for defence stocks is promising, as per the Appreciate Wealth report.

Which Defence Stocks To Buy?

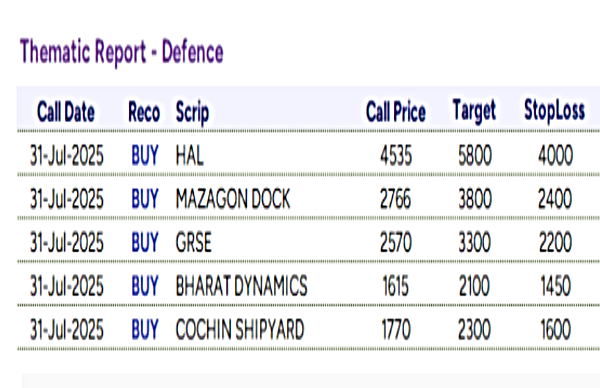

As of August 20, defence giants like HAL, Mazagon Dock, GRSE, Bharat Dynamics and Cochin Shipyard are top picks of PL Capital.

Disclaimer: The recommendations made above are by market analysts and are not advised by either the author, nor Greynium Information Technologies. The author, nor the brokerage firm nor Greynium would be liable for any losses caused as a result of decisions based on this write-up. Goodreturns.in advises users to consult with certified experts before making any investment decision.

Click it and Unblock the Notifications

Click it and Unblock the Notifications