GST Council Meeting: 0%, 5%, 12%, 18%, & 28% GST Rate Items List; Should FM Sitharaman Reduce GST Slabs?

All eyes have shifted to Finance Minister Nirmala Sitharaman, who is going to chair the 56th council meeting on September 3rd and 4th. Major reforms in GST rates are expected, which are likely to bring huge relief to both businesses and the common man. While the majority of experts are predicting a reduction in GST slabs, can the government afford to do so since GST collections have been squeezed since April 2025?

"What is going to be the major sigh of relief for the consumers is migrating from the current four-tier structure towards a two-tier one," said Dipanwita Mazumdar, Economist, Bank of Baroda, to GoodReturns.

"The shift to a two slab GST is more than rate rationalisation, it's a structural reset aimed at reducing classification disputes, correcting inverted duty structures, and giving industry the long-term certainty it has been seeking," added Kulraj Ashpnani, Partner, Dhruva Advisors LLP.

Before understanding the benefits of just 2 GST slabs, let us first get into the details of the current GST slabs.

What are the GST Rates?

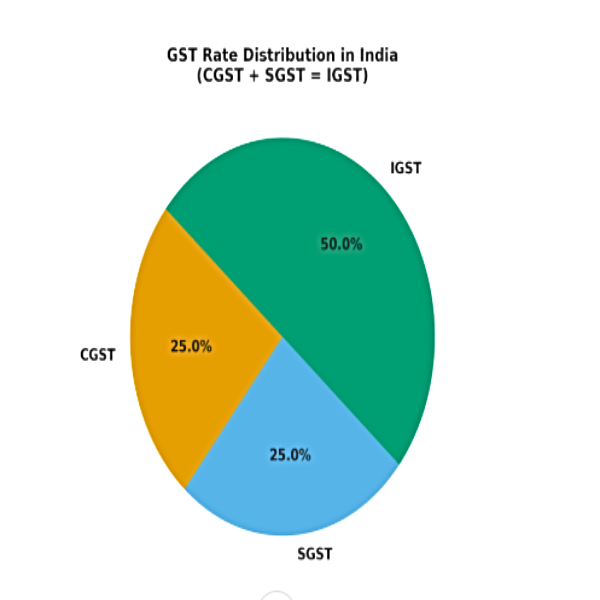

Goods and services tax (GST), since July 2017, has replaced the old indirect tax rates in India; however, not all items have been added under GST, such as oil and gas petroleum products. GST is a tax rate that is applied to goods or services and is prevalent under the CGST, SGST and IGST Acts.

Notably, there are central and state GST rates, popularly known as CGST and SGST, which are both half of the Integrated Goods and Services Tax (IGST).

Latest GST Rates Structure In India:

At present, there are five primary GST rates, namely 0%, 5%, 12%, 18% and 28%. There are also lesser GST rates like 3% and 0.25%.

0% GST Rate Items

| Products | GST Rate |

|---|---|

| Milk | 0% |

| Kajal | 0% |

| Eggs | 0% |

| Educational Services | 0% |

| Curd | 0% |

| Lassi | 0% |

| Health Services | 0% |

| Children's Drawing & Colouring Books | 0% |

| Unpacked Foodgrains | 0% |

| Unbranded Atta/Maida | 0% |

| Unpacked Paneer | 0% |

| Gur | 0% |

| Besan | 0% |

| Unbranded Natural Honey | 0% |

| Fresh Vegetables | 0% |

| Salt | 0% |

| Prasad | 0% |

| Palmyra Jaggery | 0% |

| Phool Bhari Jhadoo | 0% |

5% GST Rate Items

| Products | GST Rate |

|---|---|

| Sugar | 5% |

| Packed Paneer | 5% |

| Tea | 5% |

| Coal | 5% |

| Edible Oils | 5% |

| Raisin | 5% |

| Domestic LPG | 5% |

| Roasted Coffee Beans | 5% |

| PDS Kerosene | 5% |

| Skimmed Milk Powder | 5% |

| Cashew Nuts | 5% |

| Footwear ( | 5% |

| Milk Food for Babies | 5% |

| Apparels ( | 5% |

| Fabric | 5% |

| Coir Mats | 5% |

| Matting & Floor Covering Spices | 5% |

| Agarbatti | 5% |

| Mishti/Mithai (Indian Sweets) | 5% |

| Life-saving drugs | 5% |

| Coffee (except instant) | 5% |

12% GST Rate Items

| Products | GST Rate |

|---|---|

| Butter | 12% |

| Ghee | 12% |

| Processed food | 12% |

| Almonds | 12% |

| Mobiles | 12% |

| Fruit Juice | 12% |

| Preparations of Vegetables | 12% |

| Fruits | 12% |

| Nuts or other parts of Plants, including Pickle Murabba | 12% |

| Chutney | 12% |

| Jam | 12% |

| Jelly | 12% |

| Packed Coconut Water | 12% |

| Umbrella | 12% |

18% GST Rate Items

| Products | GST Rate |

|---|---|

| Hair Oil | 18% |

| Capital Goods | 18% |

| Toothpaste | 18% |

| Industrial Intermediaries | 18% |

| Soap | 18% |

| Ice-cream | 18% |

| Pasta | 18% |

| Toiletries | 18% |

| Corn | 18% |

| Flakes | 18% |

| Soups | 18% |

| Printers | 18% |

| Computers | 18% |

28% GST Rate Items

28%

| Products | GST Rate |

|---|---|

| Small cars (+1% or 3% cess) | 28% |

| High-end motorcycles (+15% cess) | 28% |

| Consumer durables such as AC and fridge | 28% |

| Luxury & sin items like BMWs | 28% |

| Cigarettes and aerated drinks (+15% cess) | 28% |

How Lowering GST Slabs Could Be Beneficial?

The Bank of Baroda economist explained most importantly, the higher slab of 12% rate is pushed towards the lower rate of 5% and the 28% rate to the 18% rate. Thus, the majority of consumer goods which lie within this bracket, especially FMCG and durable goods, are likely to benefit under the baseline scenario. We estimate that 11.4% of % composition of PFCE (private final consumption expenditure) will receive a direct advantage. The second-round impact through further reduction in intermediate input cost will be higher.

According to Ashpnani, by lowering taxes on essential and aspirational goods, the proposed GST revamp puts money back into the pockets of the common man, boosts consumption, and makes growth more inclusive.

"This proposal is not just about tax rates; it's about evolving GST into a simple, stable, and transparent system that supports inclusive growth and strengthens India's journey towards Atmanirbhar Bharat," he said.

Furthermore, Kumar Rajagopalan, CEO, Retailers Association of India (RAI), told GoodReturns, reducing GST on everyday essentials and aspirational goods will make products more affordable, drive higher consumption, and support overall economic growth. We recommend that the tax rate on a single product be standardised at one GST rate across all price points, regardless of the value per piece.

"Simplifying the tax system into two main slabs will reduce complexity, improve compliance, and enhance ease of doing business," adding Rajagopalan," Special rates for sin goods ensure that the reform balances affordability with revenue considerations."

Can the Government Afford To Cut GST Slabs?

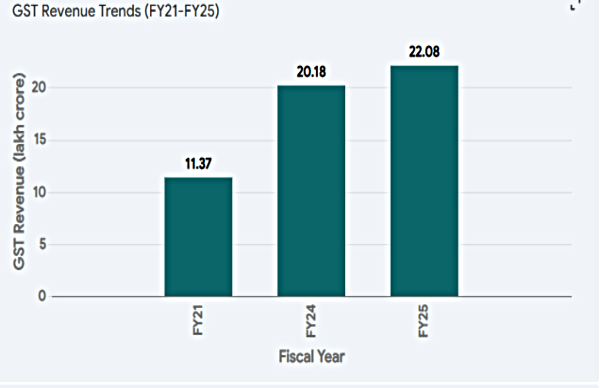

In August 2025, GST collection stood at Rs 1.86 lakh crore, registering a growth of 6.5% on year-on-year basis. However, the latest GST collection was lower compared to July 2025 print of Rs 1.96 lakh crore. GST Collections touched an all-time high of Rs 2.37 lakh crore in April 2025. Despite the latest crunch, over 5 years time frame, GST collections have seen remarkable surge. However, experts believe that proposed changes in GST slab rates could impact state GST collections.

ICRA's report said, actual SGST collections in FY2026 will be impacted by proposed changes in GST slab rates. If consumers defer discretionary purchases to avail expected lower tax rates after rationalisation, near-term consumption may get compressed. The timing of such changes, the extent of alteration in consumer behaviour, and the final rate structure will determine the potential revenue loss, if any, for states in FY2026 and beyond.

Click it and Unblock the Notifications

Click it and Unblock the Notifications