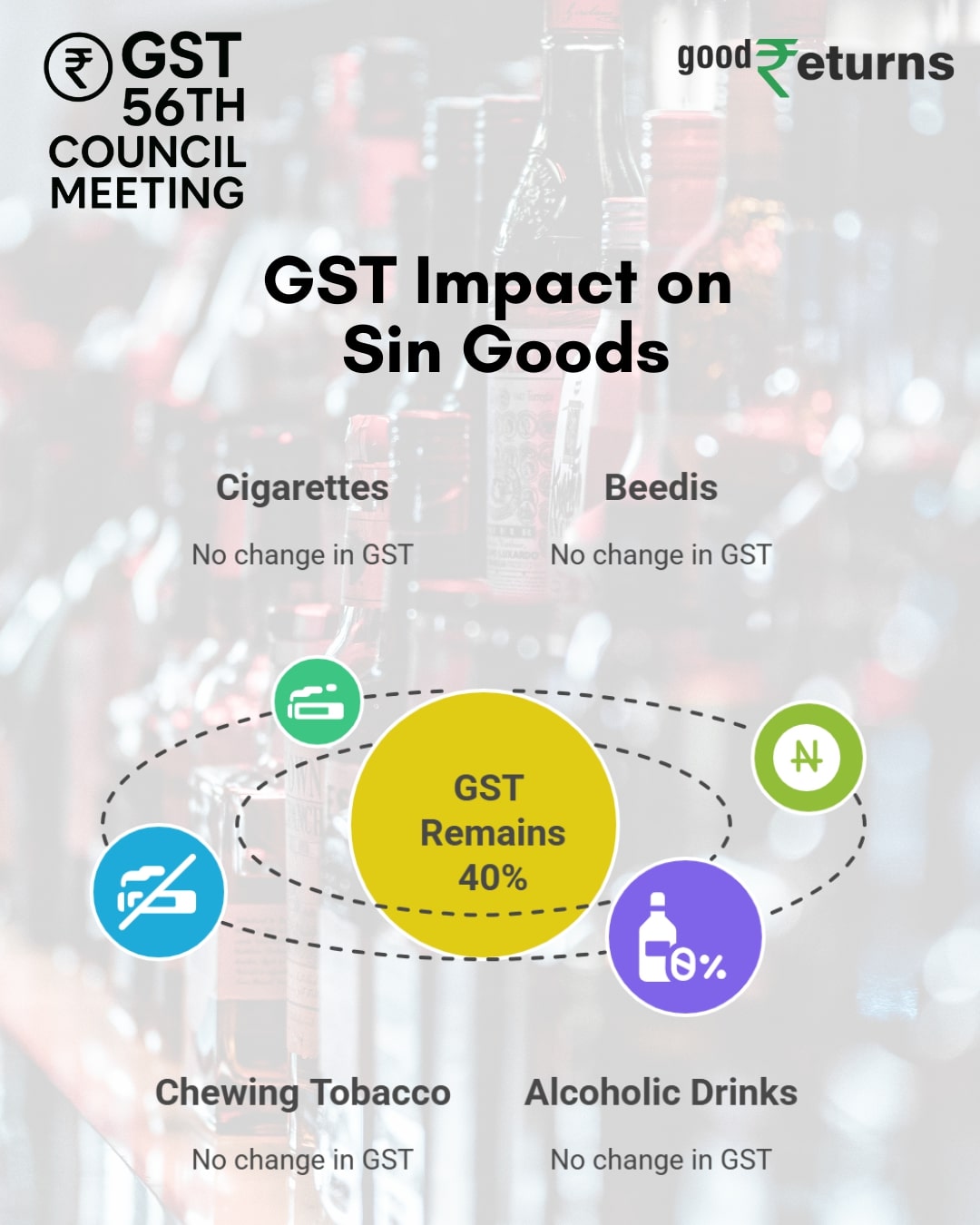

The 56th GST council meeting concluded with major reforms in the Tax structures. Finance Minister Nirmala Sitharaman-chaired panel scrapped the GST rates of 12% and 28%, while approving just two slabs, 5% and 18% while introducing a new 40% slab for luxury and sin goods such as pan masala, gutkha, cigarettes, high-end vehicles, and sugary drinks. The new GST rationalisation will come into effect from September 22.

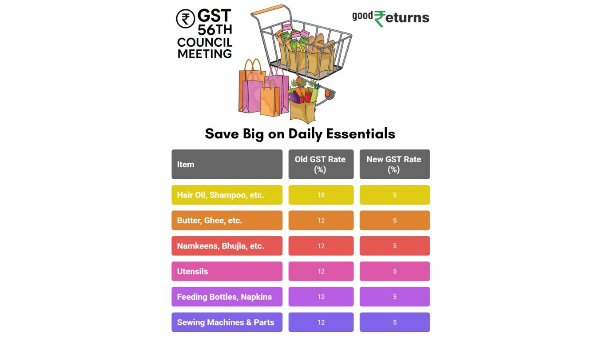

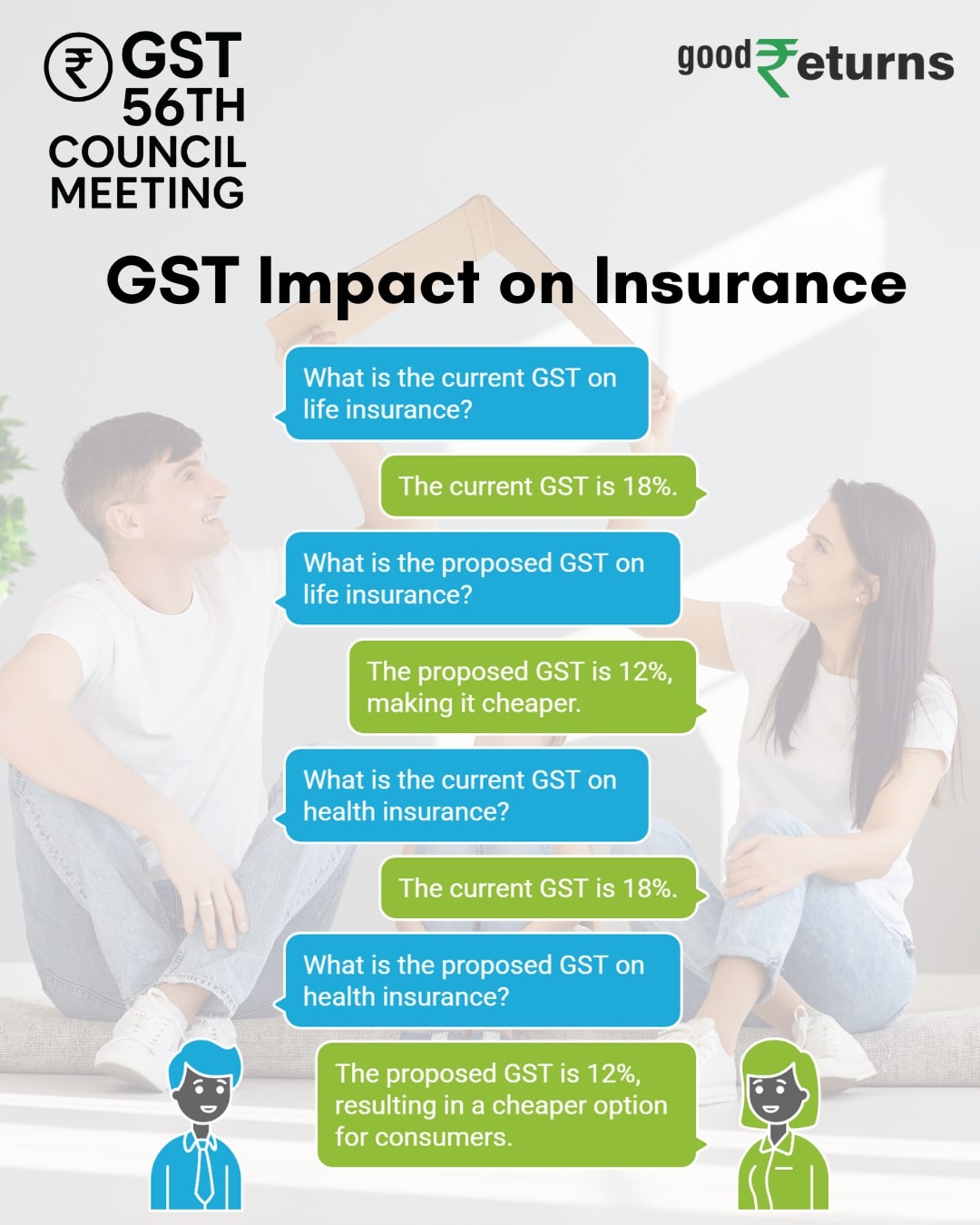

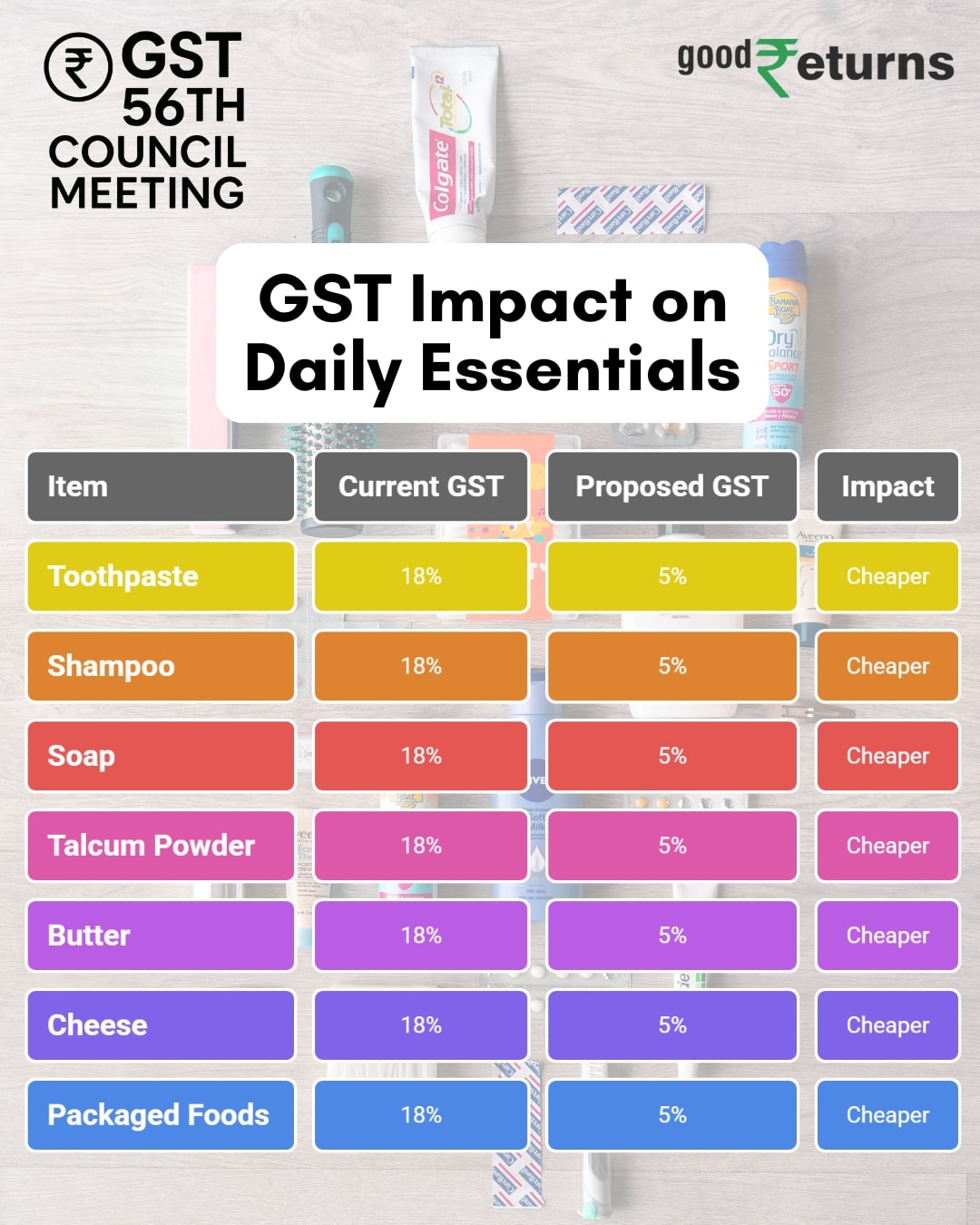

Essentials like dairy, paneer, vegetables, dry fruits, and life-saving drugs will now attract lower or zero GST, while health and life insurance premiums have been made tax-free. The FMCG, agriculture, hospitality, renewable energy, and wellness sectors stand to benefit from reduced GST rates, while motorcycles up to 350cc

During the press conference, FM said, "The Prime Minister set the tone for the next generation reforms on 15th August when he spoke from the Red Fort. He decided to give the benefit at the earliest, by Diwali."

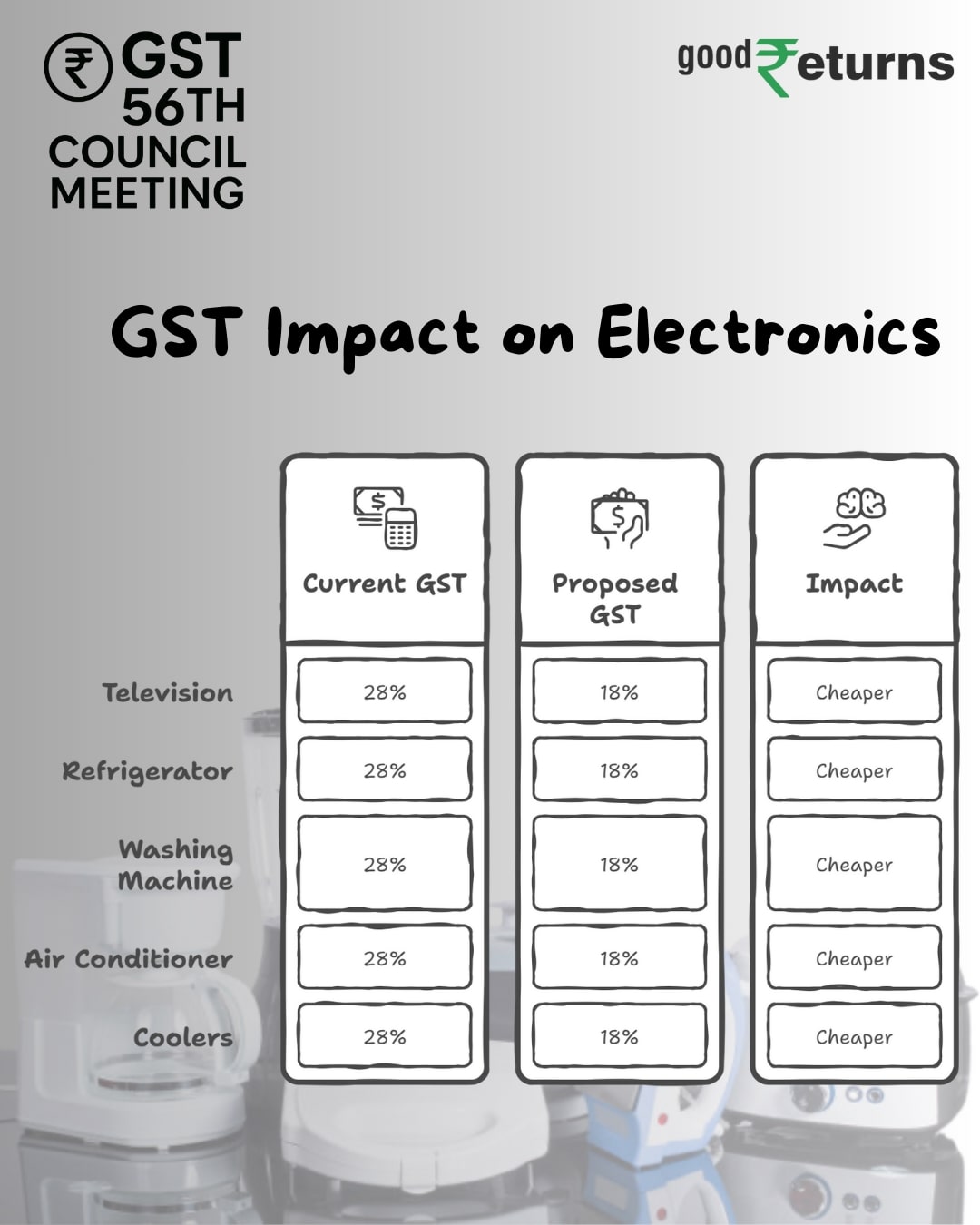

Items that have seen big GST rate cuts are electronic appliances like ACs, small cars, essentials, and much more. Health and life insurance are exempt from GST. Overall, the GST rate outcomes are in line with expectations.

Also, Prime Minister Narendra Modi said, "The next generation of GST reforms is a gift for every Indian this Diwali. Taxes for the general public will be reduced substantially. Our MSMEs and small entrepreneurs will get huge benefits."

LIVE Feed

Sep 04, 2025, 4:48 pm IST

Thank You, Readers!

With this, we wrap up our live coverage of GST updates. Thank you for staying with us. For the latest news and in-depth updates, keep reading Goodreturns.

Sep 04, 2025, 4:47 pm IST

GST Reforms to Lower Cement, Steel, Paint Costs

"The rationalisation of GST under the proposed reforms marks a landmark moment for the real estate and construction industry. Simplifying tax slabs on key inputs like cement, steel, and paints will reduce pricing inefficiencies, improve procurement processes, and ease cash flow challenges all of which are crucial for sustainable project execution. Even a modest reduction in input costs can significantly enhance project viability and timelines, particularly in affordable and mid-income housing where pricing sensitivity is high." Aniruddha Mehta, Chairman & Managing Director, Umiya Buildcon Ltd

Sep 04, 2025, 4:20 pm IST

GST Reform Impact On Real Estate Sector

"GST 2.0 is not just an incremental reform but a structural reset for Indian real estate. The shift to a broad two-slab structure of 5% and 18%, along with a 40% demerit rate, signals the government’s intent to simplify and strengthen an eight-year-old tax regime. For the real estate sector, the rationalisation of rates on key construction materials like cement and steel from 28% to 18%, and granite blocks and sand-lime bricks from 12% to 5%, directly translates into lower project costs and more affordable homes.” Ashish Kukreja, CEO and Founder of Homesfy.in and mymagnet.io

Sep 04, 2025, 4:20 pm IST

Positive Market Sentiment After GST Reforms

Positive this will play out, though a small concern remains wherein recent measures like the rate cuts + budgetary measures taken on reduced taxes have not created necessary consumption boosters. We will have to wait and see if this welcome third step reverses the consumption trend or if there is a deeper problem around availability of money with consumers. For now, the market sentiments will be positive.”

Sep 04, 2025, 4:19 pm IST

GST Rate Reductions to Aid Tariff-Hit Industries

“The GST cuts are here and have been announced quickly/ efficiently with an element of urgency, to boost demand before the festive season. Focus has been to give support to tariff impacted labour intensive industries , to make goods cheaper and will improve sentiments post the tariff issues / general slowdown. History has showed that such measures add significantly to GDP growth and a repeat is expected.” Said Nitin Rao, CEO, InCred Wealth

Sep 04, 2025, 3:48 pm IST

GST Rationalisation a Big Push for Growth

“The GST rate rationalisation, following the income tax cuts and lower interest rates, is a serious effort to boost consumption and hence the overall economic growth outlook. A wide range of products and some services will now be at lower rates which is a positive surprise. While the direct beneficiaries include consumer, autos, cement, healthcare and insurance sectors, the second order beneficiaries in terms of growth will be retail banks & NBFCs.” Rahul Singh, CIO-Equities, Tata Asset Management

Sep 04, 2025, 3:48 pm IST

GST Reforms Well-Timed, May Spur Capex & Consumption

"The GST rationalisation is a welcome and well-timed move and its positive implications for consumer demand and producer sentiment will help to offset a portion of the negative impact of the evolving US tariffs and penalties on Indian GDP growth. Any revenue foregone by the Centre and the states would effectively have to be made up through other revenue streams or expenditure rationalisation. Private sector capex decisions may get a boost for domestic consumption oriented sectors. As of now, the RBI may choose to retain its growth forecast for India's FY2026 GDP at 6.5%, unless there is a thawing in the tariff/penalty situation later this month." Said Aditi Nayar, Chief Economist, ICRA Ltd

Sep 04, 2025, 3:27 pm IST

GST on Gold, Silver Unchanged at 3%, Jewellery at 5%

The GST Council's announcement on maintaining 3 percent GST on gold and silver and 5 percent on jewellery-making charges has brought stability but comes with mixed results. For jewellers, it doesn't change how they do business as there is no relief on margins, despite their hopes of getting a rate cut, in order to stimulate demand, to the end-consumer. Higher costs may still have a detrimental impact on affordability, particularly during the festive season. For investors, unchanged GST provides clarity to the buyer, and also does not create havoc in the market, however, entry costs remain slightly high compared to global benchmarks.” Said Prithviraj Kothari, Managing Director of RiddiSiddhi Bullions Ltd. (RSBL)

Sep 04, 2025, 3:22 pm IST

Insurance Sector Cheers GST Reforms

"We sincerely thank the government for this monumental decision to remove GST from life and health insurance. It sends across a clear message that health and life insurance are critical products for the economy and hence, they are now GST exempt. Term insurance is a highly crucial product and this move will positively impact the whole category in an unprecedented way,” said Sarbvir Singh, Joint Group CEO, PB Fintech.

Sep 04, 2025, 3:22 pm IST

GST Reforms Impact On Gems & Jewellery Sector

“With the rollout of next-gen GST reforms, we believe consumers will experience a tangible increase in disposable income thanks to the combined effect of income tax relief and reduced GST rates. For the gem and jewellery sector, this presents a significant opportunity, as more consumers are now empowered to invest in jewellery not just as adornment, but as a symbol of prosperity and financial security.” said Avinash Gupta, Vice Chairman, All India Gem and Jewellery Domestic Council

Sep 04, 2025, 2:55 pm IST

GST Exemption on Life & Health Insurance Premiums:What It Means for Policyholders

“GST council has officially exempted individual life and health insurance premiums from the 18% GST bracket from 22nd September. This includes term insurance, ULIPs and health policies. For term insurance, GST exemption could result in notable cost reduction making them more affordable. On the other hand insurers may lose eligibility for input tax credits.” said Vaqarjaved Khan, CFA, Sr. Fundamental Analyst, Angel One Ltd

Sep 04, 2025, 2:23 pm IST

GST Reduction On Coffee

.

Sep 04, 2025, 2:21 pm IST

GST Comparison

Pre GST Vs Next Gen GST

Sep 04, 2025, 1:48 pm IST

GST Cut in B2B Textile and Ethnicwear Sector to Drive Volumes and Margins

Vishal Pacheriwal, Managing Director of Parnika India said, "In the B2B bulk textile & ethnicwear space, most of the GST cut benefit will likely be shared with resellersto encourage higher order volumes. However, companies like Parnika could also retain a small margin gain (2–3%), especially on premium categories, to strengthen profitability."

Sep 04, 2025, 1:31 pm IST

Two-Tier GST Structure to Enhance Tax Efficiency and Investor Confidence

View from Ross Maxwell, Global Strategy Lead at VT Markets, "The GST Council’s approval of a two-tier rate structure of 5% and 18% is aimed at improving India’s indirect tax system. The move aims to lower compliance costs, reduce disputes, and help businesses by making it more predictable. This will in turn, help boost investor confidence, as it signals policy stability and a stronger commitment to reforms."

Sep 04, 2025, 1:03 pm IST

GST Restructuring Set to Boost Real Estate Affordability and Demand

Mr Piyush Bothra, Co-Founder and CFO, Square Yards, "The latest GST restructuring comes as a major boost for the real estate sector. With the reduction in costs of key construction materials such as cement and steel, input expenses for developers are expected to ease, making projects more viable. The move towards a simplified two-slab structure will also streamline compliance, making processes smoother and faster. For the residential segment, this is likely to translate into tangible benefits for homebuyers as developers pass on the savings over the coming months. While the impact may take some time to reflect, it could provide much-needed relief in the backdrop of rising property prices and add to overall affordability. Coupled with the optimism of the upcoming festive season, these reforms are well placed to drive stronger demand in the property market."

Sep 04, 2025, 12:35 pm IST

Lower Tax Burden to Spur Investment and Reflect Fiscal Confidence

"Shri Ashishkumar Chauhan, MD & CEO, NSE, said "Reduce the overall tax burden on citizens and businesses, thereby boosting profitability, productivity, and investments that drive India’s economic growth.

Reflect the strong confidence in India’s fiscal stability and long-term growth trajectory."

Sep 04, 2025, 12:13 pm IST

GST Simplification to Revive Consumption and Broaden Economic Impact

Pranav Haridasan, MD and CEO, Axis Securities said, "The government’s move to simplify GST by reducing slabs from four to three is a smart step. Essential and aspirational goods now largely fall under the 5% and 18% brackets, which makes the system simpler and fairer. Unlike income tax cuts that benefit specific sections, GST rationalisation reaches everyone — especially rural households and the middle class."

Sep 04, 2025, 11:51 am IST

Coordinated Policy Measures Set to Accelerate Economic Growth

Sadaf Sayeed, CEO of Muthoot Microfin, highlighted the positive impact of coordinated fiscal and monetary measures on India's economy. "With fiscal and monetary policies moving in tandem, the recent 50 bps rate cut by the RBI coupled with GST rationalisation by the government is set to provide a strong boost to India’s economic growth. As rate transmission takes effect, we can expect consumption to rise naturally, further supporting growth momentum."

Sep 04, 2025, 11:38 am IST

GST Rate Reduction to Ease Inflation and Public Burden

Ravi Patodia, Member of the Bhadohi Carpet Export Promotion Council (CEPC), welcomed the government's decision to reduce GST rates on commonly used items from 12% and 18% to 5%. Speaking to ANI, he stated that this move will provide significant relief to the general public by lowering the overall tax burden and helping to control inflation. Patodia emphasized that the decision is timely and beneficial, especially in light of the current tariff crisis, and praised it as a positive step towards easing economic pressure on consumers.

Sep 04, 2025, 10:44 am IST

GST 2.0 Reform: Lower Taxes on Essentials, 40% GST for Luxury and Sin Goods from September 22

The GST Council, led by Finance Minister Nirmala Sitharaman, has rolled out significant reforms under GST 2.0, effective from September 22. The revamped structure reduces the GST slabs to two primary rates—5% and 18%—with a new 40% rate for luxury and sin goods. Essential items like UHT milk, baby products, groceries, personal care goods, footwear, and textiles now fall under the lower 5% bracket, easing the financial burden on middle-class households. Meanwhile, taxes on luxury vehicles, tobacco, pan masala, and aerated drinks have increased to 40% to discourage non-essential consumption. These reforms aim to balance affordability with fiscal discipline while boosting compliance and festive demand.

Sep 04, 2025, 10:35 am IST

Call to Remove GST on Insurance to Boost Affordability and Coverage

Akash Parwal, CEO of Square Insurance, said, “Removing GST from health and life insurance would directly reduce the cost of premiums, making insurance products more affordable and accessible. At present, the 18% GST increases the cost of a ₹25,000 health policy by approximately ₹4,500, which can discourage middle-class households and younger buyers from purchasing coverage. Eliminating this tax could support the objective of increasing insurance penetration in India, where less than 5% of the population has life cover and under 1% has health insurance.

Sep 04, 2025, 10:15 am IST

India's Economy Gets a Boost with Simplified GST

“The GST Council’s move to rationalise tax slabs is a clear signal of India’s shift towards simplicity, transparency, predictability, ease of doing business and thus strengthening the foundation for a long-term structural growth. For affluent households, the higher levy on luxury categories will modestly increase lifestyle costs, but the broader economy stands to benefit from lower taxation on everyday goods. The balance between boosting demand and aligning luxury & sin consumption with higher tax incidence is measured, with a likely net revenue impact of Rs.48,000 crs. This fiscal impact should be manageable from the likely boost in demand and other avenues. This should also create fresh opportunities across multiple sectors eg. FMCG, healthcare, housing. Overall, this change should help drive growth in domestic consumption,” said Naval Kagalwala, COO and Product Head, Shriram Wealth Ltd.

Sep 04, 2025, 9:23 am IST

GST Council Meeting | Clear shift towards supporting consumption says Hitesh Suvarna of JM Financial Institutional Securities

The GST council decided to move to a two rate structure – 5% and 18% with a special maximum rate of 40% with effect from 22nd September. Tax rates have been slashed across categories, with maximum benefit to FMCG, fertilizers, agricultural and medical equipments followed by cement, auto and durables. Health and life insurance will be exempt from GST. Tobacco products, luxury items will be charged at the highest rate of 40%. Although the GST council indicated that the fiscal impact of the rate rationalisation would be to the tune of INR 480 Bn (0.15% of GDP), they expect it to be offset by the buoyancy in tax collections. With this move we see a clear intent of the government in supporting domestic consumption, to cushion the economy from the external pressures. The stretch on the fiscal deficit target for FY26 may be absorbed though lower capex intensity.

Sep 04, 2025, 9:18 am IST

GST overhaul cuts rates on essentials, eases burden for households and businesses

“The GST reforms represent a paradigm shift toward economic rationality, with rate reductions on essentials like dairy, medicines, and food directly benefiting consumers due to their inelastic nature. This streamlined two-slab structure prioritises fundamental economic drivers while significantly reducing compliance burdens for businesses. Combined with RBI rate cuts, FY26 income tax rebates, and moderating inflation, these reforms create multiple stimuli for consumption and economic growth. The policy demonstrates a transformative commitment to inclusive taxation, moving beyond revenue generation to enhance ease of living and doing business across all citizen segments,” said Mr. Devarsh Vakil, Head of Prime Research at HDFC Securities.

Sep 04, 2025, 8:59 am IST

Lower GST Rates Set to Accelerate Consumption-Led Growth

“The GST reforms are both bold and transformative, exceeding expectations in their scale and impact. By cutting rates across a wide spectrum—from everyday essentials and insurance products to big-ticket purchases like automobiles and home appliances—the reforms touch virtually every corner of household consumption. This move not only leaves more disposable income in the hands of consumers but also sets the stage for a broad-based boost to demand. Importantly, because indirect taxes are inherently regressive—taking a larger share of income from the poor and middle class—these reductions deliver disproportionate benefits to these segments, enhancing affordability and strengthening consumption-led growth. The expected consumption uplift can create a multiplier effect on overall economic growth,” said Mr. Pranab Uniyal, Head - HDFC Tru (Investment Advisory) of HDFC Securities.

Sep 04, 2025, 8:54 am IST

GST Reforms Bring Efficiency and Liquidity, Lifting Investor Confidence

Recent GST changes are driving the stock market as they boost sentiment and compliance. The low cost of tax burdens on crucial sectors such as Consumption, FMCG, auto and retail also accelerates demand, while filing simplification also ensures hassle free operations. Investors are interpreting this as a sign of stronger earnings growth to come. The reform adds liquidity, increases efficiency, and improves investor confidence and has a positive effect on the stock market across multiple sectors as per Kirang Gandhi, Pune based Financial mentor.

Sep 04, 2025, 8:47 am IST

Healthcare Gets Cheaper as Council Slashes Taxes on Medicines, Devices & Insurance

GST Council under the new Next-Generation GST (GST 2.0) framework has announced sweeping tax cuts in the healthcare segment. The GST rate on drugs, medicines, medical devices, and spectacles has been slashed from 12% to 5%, while individual life and health insurance premiums will now attract zero GST, down from 18%.

Sep 04, 2025, 6:16 am IST

GST Council Live Updates: Special Rate 40% Introduced

A special tax rate of 40% has been introduced, while most goods remain in the 5% to 18% range. This higher rate will apply to sin and super-luxury goods such as paan masala, cigarettes, gutka, chewing tobacco, zarda, unmanufactured tobacco, and bidis

Sep 04, 2025, 5:53 am IST

GST Council Meeting Live Updates: Who Benefits From GST Rates Cut?

According to the council, the latest GST rates rationalization will improve the lives of all citizens and ensuring ease of doing business for all, including small traders and businessmen. Also, it focuses on focus on Common-man, Labour-intensive Industries, Farmers and Agriculture, Health, Key Drivers of the economy.

Sep 04, 2025, 5:52 am IST

GST Council Meeting Live Updates: GST Rates Rationalisation

The council rationalised the current 4-tiered tax rate structure into a citizen-friendly ‘Simple Tax’ - a 2 rate structure with a Standard Rate of 18% and a Merit Rate of 5%; a special de-merit rate of 40% for a select few goods and services.

Sep 03, 2025, 11:33 pm IST

GST Council Meeting Live Updates: New GST Revamp To Allow Businesses At Great Ease

This reform is not just on rationalising rates, it's also on structural reforms, ease of living, so that businesses can work together with great ease. We have corrected inverted duty structure problems, we have resolved classification related issues, and we have ensured there will be stability and predictability about the GST Reforms: FM

Sep 03, 2025, 11:32 pm IST

GST Council Meeting Live Updates: PM Modi Sets Tone For Next-Gen GST Reforms

FM Nirmala Sitharaman said, the Prime Minister set the tone for the next generation reforms on 15th August when he spoke from the Red Fort. He decided to give the benefit at the earliest, by Diwali.

Sep 03, 2025, 5:21 pm IST

GST Council Meeting Live Updates: Big Decision OnSeptember 4th

The GST Council meeting today focused on key proposals. The final decisions are expected tomorrow, and we’ll be back with fresh updates as and when they come. Stay tuned for more live coverage.

Sep 03, 2025, 5:05 pm IST

GST Council Meeting Live Updates: Council Moves to Ease Compliance Burden

According to an ET Now report, the GST Council has introduced measures to reducing the compliance burden for MSMEs, startups, and businesses, making tax processes simpler and faster.

Sep 03, 2025, 4:45 pm IST

GST Council Meeting Live Updates: Council May Cut Registration Timeline to 3 Days, Export Refunds in 7 Days

The GST Council is likely to approve a major relief for businesses by cutting the GST registration timeline to just 3 days for non-risky applicants, ensuring faster onboarding. Registrations would be issued within three working days from the date of application filing. Additionally, the Council has reportedly cleared a proposal to process GST refunds for exports within 7 days, a move aimed at boosting liquidity for exporters, according to CNBC-TV18.

Sep 03, 2025, 4:24 pm IST

GST Council Meeting Live Updates: Sin Goods To get Costlier

Sin goods may face a higher tax of 40%.

Sep 03, 2025, 3:58 pm IST

GST Council Meeting Live: Luxury and Sin Goods In higher taxation Radar

“The 56th GST Council meeting is widely seen as a stepping stone towards GST 2.0, with rate rationalisation and slab consolidation at the core of discussions. The possible phasing out of the 12% and 28% brackets could simplify compliance and reduce disputes, while rate cuts on mass-consumption items are aimed at bolstering domestic demand. At the same time, policymakers must balance revenue concerns, which likely means luxury and sin goods will remain under higher taxation. Overall, today’s deliberations signal a shift towards a cleaner and more growth-supportive indirect tax framework at a time when exporters are facing external headwinds” said Gaurav Garg, Lemonn Markets Desk.

Sep 03, 2025, 3:46 pm IST

GST Impact On Insurance

What's Expected

Sep 03, 2025, 3:15 pm IST

GST Council Meeting Live: Council Begins Key Rate Rationalisation Talks

According to CNBC TV 18, The Council has started deliberations on the highly anticipated rate rationalisation report, which includes proposals to reduce GST rates on life and health insurance premiums.

Sep 03, 2025, 2:57 pm IST

EAM Engages in Strategic Dialogue with German FM Johann Wadephul on Strengthening India-Germany Relations

External Affairs Minister S. Jaishankar engaged in a press interaction with German Foreign Minister Johann Wadephul. The meeting focused on enhancing bilateral ties and expanding strategic cooperation between India and Germany. They also addressed global challenges like trade, security, and climate change.

The discussions underscored the mutual commitment of both nations to multilateralism. This shared dedication aims to foster peace and prosperity within an evolving global landscape. Both leaders emphasised the importance of working together to tackle pressing international issues.

Sep 03, 2025, 2:19 pm IST

GST Council Meeting Live: FM Chairs Meeting

GST Council Meeting Live: Union Minister for Finance and Corporate Affairs Nirmala Sitharaman chairs the 56th meeting of the GST Council, in New Delhi, today.

Sep 03, 2025, 2:15 pm IST

GST Council Meeting Live: Likely Impact On Electronics Goods

GST Council Meeting Live: Television, Fridge, and washing machine to get cheaper?

Sep 03, 2025, 2:01 pm IST

GST Council Meeting Live: A GST Rate Cut Could Save Rs 17,400 On A 500 sq ft Home

GST Council Meeting Live: A potential GST rate cut could save a whopping Rs 17,400 on a 500 square feet home, with the reduction of cost on cement, paint, and sanitary fittings, according to experts.

"Cement pricing, a key top-line driver, may see gradual hikes, but sharp post-GST increases are unlikely. Input costs remain largely unaffected, while government subsidies and incentives (~Rs162bn accrued) continue to boost EBITDA, though GST cuts could slightly impact profitability and greenfield/brownfield expansion plans," noted Yes Securities.

Sep 03, 2025, 1:57 pm IST

GST Council Meeting Live: Important For Centre TO Assess Revenue Loss Due To GST Rate Rationalisation

GST Council Meeting Live: The gross GST collections have shown a sharp surge on a year-on-year basis. GST rate rationalisation can have a significant impact othe revenue loss and the government must assess the situation before making any announcement, noted Karthik Manim Partner-Indirect Tax at BDO India.

"The gross GST Collections have shown a growth of 6.5% on a year-on-year basis, with a growth of 9.6% in domestic GST collections offset by a degrowth of 1.2% in GST collections on imports. The growth in domestic GST collections is due to a growth in collections in almost all major States like Maharashtra, Karnataka, Haryana etc., with all these States cloaking ~10% growth in revenue collections. However, on a month on month basis, the gross GST collections have shown a decline of ~4.8% and it would be an important input for the GST Council for assessing revenue loss as it considers the GST rate rationalization proposals later this week," stated Mani.

Sep 03, 2025, 1:51 pm IST

GST Council Meeting Live: Proposed GST rate Cut Could Accelerate Demand, Boost Consumption, Says Expert

GST Council Meeting Live: The proposed GST rate cut could significantly boost consumption and accelerate demand. A rejig of daily use items to lower GST slab rates would give a major impetus to every day demand for rural customers. “GST 2.0 represents one of the most pro-consumption policy moves in recent years. By reducing prices in everyday categories and big-ticket durables alike, the reform could accelerate demand just as rural incomes and inflation trends are turning favourable,” said Sonam Srivastava, Investment Manager on smallcase and Founder at Wright Research.

Sep 03, 2025, 1:29 pm IST

GST Council Meeting Live: What Is Bothering Textile Industry Players About GST Rate Cut Proposals?

GST Council Meeting Live: Several textile industry players have expressed concern about a potential 18% taxation on garments above Rs 2,500. If the GST Council does in fact keep Rs.2,500 as the cut-off level for the 5% slab, and

charge all products above this level at 18%, it will mean a cruel blow to the ASPIRING MIDDLE-CLASS and the Organized Sector of Garment Manufacturers – who are the worst affected by the Tariff Wars, according to textile industry players.

Sep 03, 2025, 1:15 pm IST

GST Council Meeting Live: The Proposed GST Slab Simplification Would Be A Game-Changer

GST Council Meeting Live: The implementation of proposed GST slab simplification would be a gamechanger for the economy and small scale businesses, according to an expert.

“The Centre is pushing for a simplified structure with two slabs—5% and 18% alongside a 40% rate for sin and demerit goods. If implemented, this could be a game-changer for consumption-led sectors. FMCG names have already rallied for three straight sessions on expectations of lower tax burdens and improved pricing power,” said Hariprasad K, SEBI - registered Research Analyst and Founder - Livelong Wealth.

Sep 03, 2025, 1:05 pm IST

GST Council Meeting Live: Govt Plans To Reduce Compliance Burden, Make It Easy For Small Businesses To Thrive, Says Fin Min Sitharaman

GST Council Meeting Live: A day before the GST Council Meeting, Finance Minister Nirmala Sitharaman said that the government is planning to further reduce the compliance burden, making it easier for small businesses to thrive. " Hon’ble Prime Minister Shri @narendramodi has also recently announced the creation of a ‘Task Force for Next-Generation Reforms’, with a clear mandate to simplify regulations, lower compliance costs, and build a more enabling ecosystem for start-ups, MSMEs and entrepreneurs," said Sitharaman.

Sep 03, 2025, 1:01 pm IST

GST Council Meeting Live: How It Will Impact A Common Man's Life?

GST Council Meeting Live: The proposed GST rate cut, if implemented will lead to a massive reshuffling and rejig in the GST slabs structure and positioning of daily use items.

Sep 03, 2025, 12:50 pm IST

GST Council Meeting Live: Discussion Underway To Bring Automatic Return Filing

GST Council Meeting Live: GST Council meeting members are currently discussing GST compliance and also the proposal to bring in automatic return filing. The members are also considering proposal to reduce compliance issues under discussion, reported CNBC TV 18 citing sources.

Sep 03, 2025, 12:42 pm IST

GST Council Live Updates: What To Expect For the FMCG Sector?

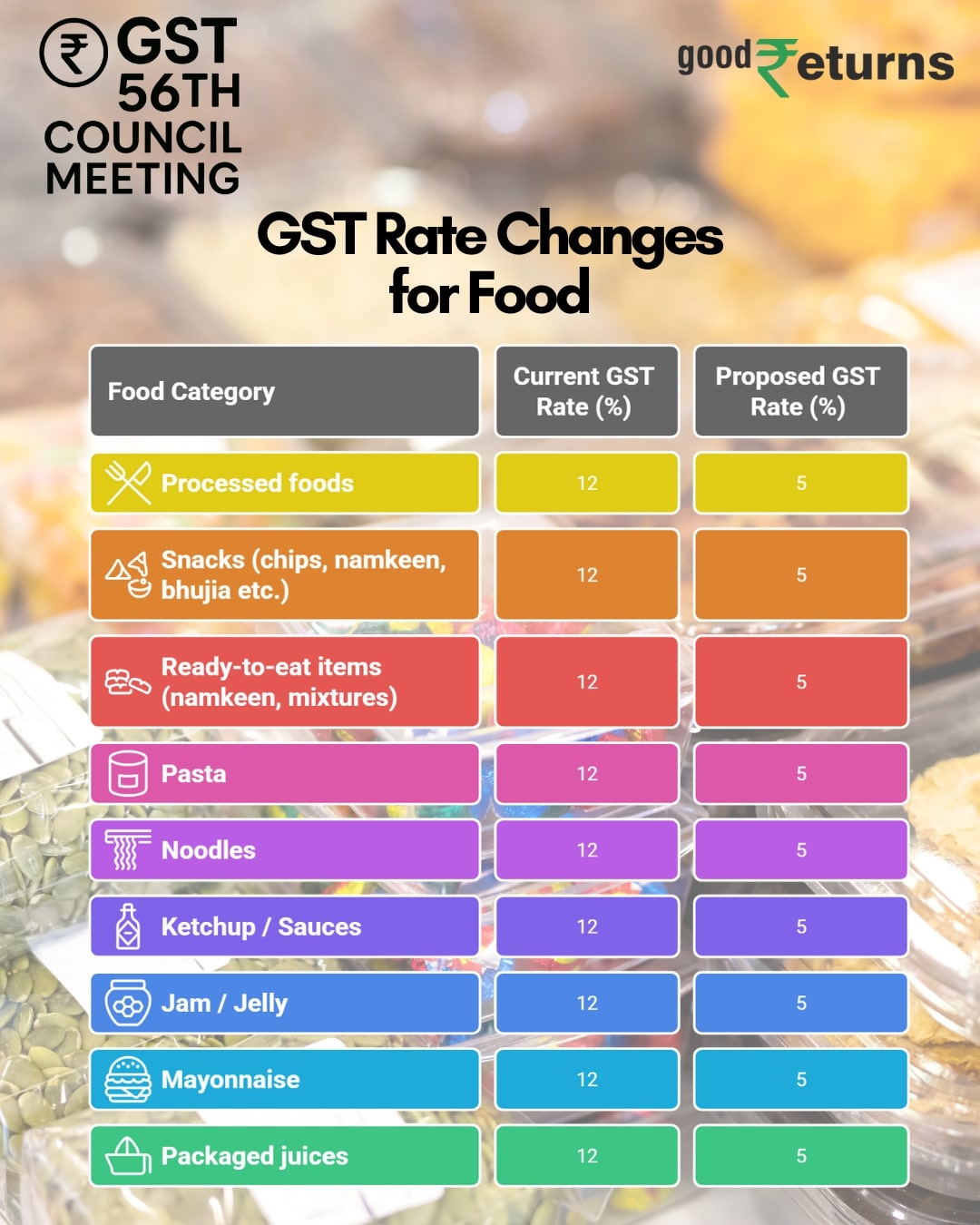

GST Council: Experts hint that the proposed GST reforms may lead to a decline in the prices of shampoos, toothpaste and talcum powder as such daily use items will be shifted to the 5% slab from 18% slab. Whereas, items like milk powder, cooking oils, noodles, chocolates, and sugar will also be shifted to the 5% bracket.

Sep 03, 2025, 12:25 pm IST

GST Council Meet 2025 Live: States Seek Revenue Protection

GST Council Meet 2025 Live: As the GST Council meeting is underway, six opposition party-led states have urged the Centre to provide revenue protection.

Sep 03, 2025, 12:01 pm IST

GST Council Meeting Live Updates: Simpler GST Structure May Drive Demand & Economic Growth

“GST rationalisation is a welcome step that can help achieve a balance between revenue and economic growth. For textiles and agriculture, reducing rates would benefit producers as well as consumers directly through cost savings and competitiveness. Cement, an important input for housing and infrastructure, can witness increased demand if lowered from the highest slab. Consumer durables, also, can see increased sales traction with lower pricing. Rationalisation, overall, is not just a function of rate cuts; it's about framing a more equitable, simpler tax system that spurs consumption, brings about compliance, and benefits India's broader growth ambitions.” said Aman Gupta, Director, RPS Group

Sep 03, 2025, 11:52 am IST

GST Council Meeting Live Updates: Food Items Likely to Get Tax Relief

Expected Estimates

Sep 03, 2025, 11:38 am IST

GST Council Meeting Live Updates: FM Nirmala Sitharam Begins the Meeting

GST Council Meeting Begins in Delhi

Sep 03, 2025, 11:20 am IST

8 Opposition-ruled States Press For Revenue Protection

8 opposition-ruled states press for revenue protection, while Andhra Chief Minister backs the proposal.

Sep 03, 2025, 11:16 am IST

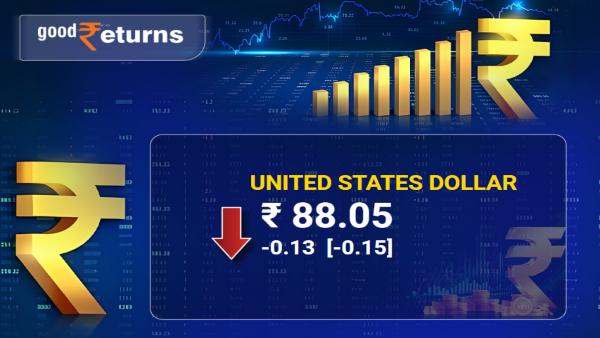

Rupee vs Dollar

The rupee has recovered by around 15 paise from its all-time low level to 88 against the US dollar in early trade on Wednesday. The recovery came as persistent foreign fund outflows and dollar strength weighed on investor sentiments.

Sep 03, 2025, 11:04 am IST

Andhra Finance Minister On GST Changes

Andhra Chief Minister has accepted the changes in the proposed GST Slabs

Sep 03, 2025, 10:58 am IST

GST Reforms To Address Current Tax Structure

The GST reforms are expected to address the current structure of the tax system. By examining existing frameworks, authorities hope to identify areas that require simplification. This could lead to a more efficient tax collection process, benefiting both businesses and consumers across the country.

Sep 03, 2025, 10:54 am IST

Jharkhand Finance Minister On Proposed GST

"We'll approve the proposal of Centre only if they give assurance of compensation, don’t think voting will be needed to approve GST proposals."

Sep 03, 2025, 10:49 am IST

GoM Clears Proposal To Change GST Slabs

Government will likely scrap 12% & 28% GST Slabs

Sep 03, 2025, 10:24 am IST

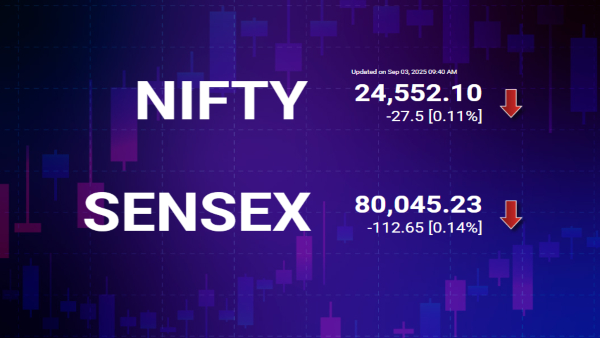

GST Council Meeting Live Updates: Market Opens in Red

The stock market opened on the lower side thor morning ahead of the GST Council meeting. The Sensex started the day at 80,120.79, down 37.09 points (0.046%), while the Nifty 50 edged slightly higher at 24,591.15, up 11.55 points (0.047%).

Sep 03, 2025, 10:11 am IST

GST Council Meeting Live Updates: Tax Relief on Agriculture, Cement, and Textiles in Spotlight

“Off-mid GST Council meeting is being watched with interest, with rationalization likely to have far-reaching implications on industry and consumers. GST cut in agriculture inputs would lower cultivation costs, boosting rural income and consumption. Lower rate textiles would encourage indigenous production and employment. GST cut in cement from 28% to 18% would lower construction costs, benefiting infrastructure and realty. Similarly, consumer durable slashes may revive consumption levels in cities. If implemented well, GST rationalization is capable of triggering growth across all sectors while giving a cleaner and improved-simplified tax system.” said Siddharth Maurya, Founder & Managing Director, Vibhavangal Anukulakara Pvt. Ltd

Sep 03, 2025, 8:55 am IST

GST Council Meeting Live Updates: Expectations High on GST Rationalization for Insurance Sector

“The proposed GST rationalization on insurance should be viewed as one of the most pivotal

policy considerations on the table today. It isn't merely a fiscal adjustment but also a strategic

enabler for India's social and economic ambitions. From a macroeconomic perspective, this

move is in direct alignment with IRDAI's vision of 'Insurance for All by 2047' and the broader

goal of a financially secure 'Viksit Bharat'.” said Vishal Gupta, CEO, PhonePe Insurance

Sep 03, 2025, 8:34 am IST

GST Council Meeting Live Updates: Will Your Next Two-Wheeler Become Cheaper After Proposed GST Rate Cut?

GST Council Meeting Live Updates: The proposed GST rate cut could significantly impact the prices of two-wheelers, but bikes with high CC engines may attract higher tax rate, according to experts. Industry experts believe that if the 28% slab is merged into the 18% category, this could lead to a 10% reduction in prices, making two-wheelers and small cars significantly more affordable for the average Indian buyer.

Sep 03, 2025, 7:45 am IST

Sectors To Benefit From GST Restructuring

The sectors expected to benefit most from the current GST Council meeting and proposed rate rationalization include FMCG, automobiles, consumer durables, banking/NBFCs, cement, insurance, textiles, healthcare, and footwear.

Sep 03, 2025, 7:41 am IST

Recap of the 55th GST Council Meeting

The 55th GST Council met on December 21, 2024, in Jaisalmer and approved major rate and exemption changes. FRK rate was cut to 5%, gene therapy was exempted, and Compensation Cess for merchant exporters was set at 0.1%. ACC blocks with over 50% fly ash were taxed at 12%, and margin-based 18% GST was applied to old/used vehicle sales, including EVs (except individual-to-individual EV sales). Clarifications were also made for agricultural products like pepper and raisins, and popcorn classification to avoid disputes.

On compliance and law, the Council approved a track-and-trace system for goods prone to evasion, clarified GST on vouchers, and planned the rollout of an Invoice Management System with CGST updates.

Sep 03, 2025, 7:25 am IST

Welcome To Our live Coverage of the 56th GST Council Meeting

Stay tuned for decisions for Live updates from today’s GST Council Meeting and big decisions on GST rates, tax reforms, exemptions & announcements impacting businesses and consumers.

For investment related articles, business news and mutual fund advise

Allow Notifications

You have already subscribed

Share This Article

Story first published: Wednesday, September 3, 2025, 7:22 [IST]

Click it and Unblock the Notifications

Click it and Unblock the Notifications