GST 2.0: SBI Says, Rationalisation Of GST Rates To Result In Stronger Revenue Collections

GST reforms during the 56th council meeting could result in stronger revenue collections for states, as per economists at the State Bank of India (SBI). Finance Minister Nirmala Sitharaman will be chairing the 6th GST council meeting on September 3rd and September 4th. Major rationalization in GST rates is expected.

"The rate rationalisation is likely to result in stronger revenue collections validated by historical trends with the institutional framework of fiscal federalism embedded in the Constitution guarantees status quo in State finances through revenue and tax devolution while enabling the Centre to pursue reforms simplifying tax structure reducing compliance burdens & enhancing efficiency," said Dr. Soumya Kanti Ghosh, Member, 16th Finance Commission & Group Chief Economic Advisor at State Bank of India.

It needs to be noted that during the time of GST launch in July 2017, the government assured states with a a 14% increase in their annual revenue for five years of the transition period from July 1, 2017 to June 30, 2022 will be protected.

Also, the states were guaranteed that their revenue shortfall, if any would be made good through a compensation cess levied on luxury goods and sin products such as liquor, cigarettes, other tobacco products, aerated water, automobiles, and coal.

Following this, the states have reported a total compensation of Rs 9.14 lakh crore, for protecting their tax revenues post implementation of GST for the entire transition period of five years.

"This amount was almost Rs 63,265 crores (at an aggregate basis) more than the projected amount that states were expected to get from their assured 14% increase," said Ghosh.

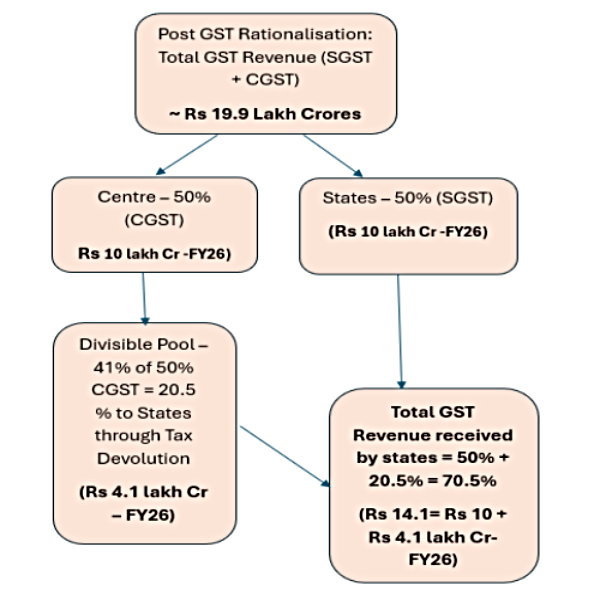

The SBI economist believes that even in FY26, the states will remain net gainers from GST collections, even under the proposed rate rationalization. This is because of the unique revenue-sharing architecture of the tax. First, GST is shared equally between the Centre and the States, with each

receiving 50% of the collections. Second, under the mechanism of tax devolution, 41% of the Centre's share flows back to the States. Taken together, this means that out of every Rs 100 of GST collected, states ultimately accrue nearly Rs 70.5 i.e., approximately 70% of total GST revenues.

"Our projections for FY26 indicate that states are expected to receive at least ~ Rs 10 lakh cr in SGST plus Rs 4.1 lakh crore through devolution thereby making them net gainers. The gains accrues even when we do not take the additional consumption boost due to rate rationalization (At 9.5% effective GST rate, this translates into a revenue gain of Rs 52000 crore; Rs 26000 crore each to Centre and States)," Ghosh added.

Furthermore, the SBI economist pointed out that past changes in GST rates did not necessarily weakened revenue collections between July 2018 and October 2019. Instead, the past rationalization of GST rates showed a temporary adjustment phase followed by stronger inflows.

"While an immediate reduction in rates can cause a short-term dip of around 3-4% month-on-month (roughly Rs 5,000 crore, or an annualized Rs 60,000 crore), revenues typically rebound with sustained growth of 5-6% per month," said Ghosh.

Hence, Ghosh added, this structure ensures that States are not fiscally disadvantaged by temporary moderation in revenues due to rationalization and abolition of compensation cess. The institutional framework of fiscal federalism embedded in the Constitution guarantees this outcome, maintaining the status quo in State finances while enabling the Centre to pursue reforms that simplify the tax structure, reduce compliance burdens & enhance efficiency.

Click it and Unblock the Notifications

Click it and Unblock the Notifications