Defence PSU HAL Wins Mega Rs 62,370 crore Tejas Mk-1A Deal; CLSA Recommends BUY/SELL On Zero-Debt Stock

HAL Share Price Today: Shares of Hindustan Aeronautics Limited (HAL) ended their three-day losing streak to close in green on Thursday. HAL share price today, rebounded, after the Defence Ministry finalised Rs 62,370 crore deal with the defence public sector undertaking (defence PSU).

HAL will deliver 97 Tejas Mark-1A fighter jets, reported PTI on Thursday. The deal is expected to be a major milestone for the zero-debt PSU company and boost India's defence capability. In line with the announcement, brokerage CLSA has revised recommendation for HAL stock, reported CNBC TV 18.

HAL shares closed 1.11% higher at Rs 4,776 per share on BSE with market capitalisation of Rs 3,19,406.94. The stock had touched an intraday high mark of Rs 4827.95 per share and an intraday low mark of Rs 4713.80 per share.

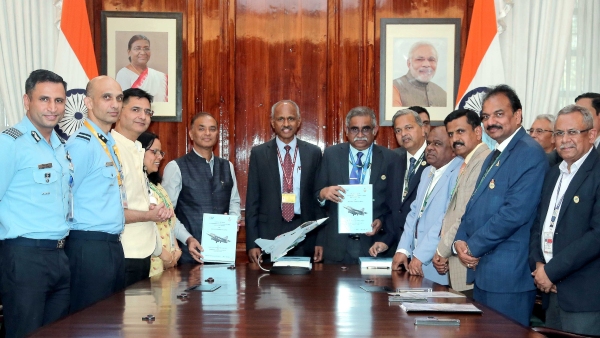

HAL Wins Mega Rs 62,370 Crore Tejas MK-1A Deal

The recent defence order is not just important for the defence PSU but also act as a major booster for the Indian Air Force. The order has come at a time when New Delhi is seeking to upgrade its home-grown defence capabilities in the aftermath of a deadly conflict with Pakistan.

HAL will provide around 97 LCA Mk1A aircraft including 68 fighter jets and 29 twin seaters with associated equipment for the IAF at Rs 62,370, announced MoD in a statement on Thursday.

"The advanced LCA Mk1A integrates UTTAM AESA #Radar, Swayam Raksha Kavach & control actuators, with 64%+ indigenous content and 67 new indigenous items. Supported by 105 suppliers, the project will generate 11,750 jobs/year over six years. Deliveries will start in 2027-28, boosting #IAF capability, #AtmanirbharBharat & India's defence preparedness," noted MoD in a statement posted on X.

CLSA Bullish On HAL

The first flight of the 13th LCA Mk1A aircraft is not just a big moment for Indian armed forces but also for Hindustan Aeronautics Limited. The development has helped HAL to exceed its target of 12 deliveries in FY26 and has also reduced concerns around potential order delays, CNBC TV 18 cited CLSA's note.

Given HAL's order pipeline and execution status and its growth outlook, CLSA has maintained its 'Outperform' rating on HAL and has fixed a target price of Rs 5,436 per share. The US-based conglomerate, General Electric, has committed to delivering 12 engines in 2025 and additional 20 in 2026. On time delivery of these engines will be crucial for HAL's order execution timeline.

Given the current scenario, HAL's order pipeline remains strong at $54 billion. The large fighter aircraft order for HAL in 2025 and its visibility on GE engine deals will significantly boost the Bengaluru-based PSU's business growth.

Click it and Unblock the Notifications

Click it and Unblock the Notifications