Crypto Trading in India Still Male-Dominated: New Data Shows Massive Gender Gap; What Behind the Trend

Over the past few years, the rise of digital assets in India has been explosive. Millions of first-time investors have entered the market, experimenting with crypto trading as an alternative investment option. Despite this growing adoption, a major setback in the digital asset space is the gender disparity.

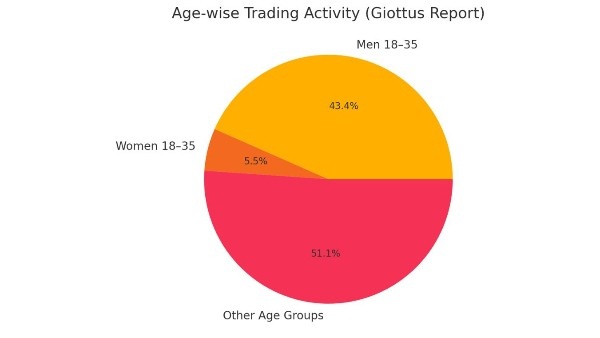

The crypto market in India is clearly male-dominated. According to new research data from Giottus, an FIU-registered crypto exchange, men aged 18-35 account for 43.4% of all crypto trading activity recorded between January and August 2025. In comparison, women in the same age group make up only 5.5% of trading participation.

Why Is There a Gender Gap in Crypto Trading?

The highly volatile nature of the market remains one big factor. The Giottus report says that women are far more cautious when it comes to using digital currency, and this reluctance stems from several factors, like higher caution toward risky assets and lack of awareness and financial literacy in some lots.

A Brief History of Crypto Trading

The story of crypto began in 2009 with the launch of Bitcoin, the first decentralised digital currency that successfully combined cryptographic concepts into a functional blockchain, which was the beginning of modern crypto trading.

In the early 2010s the first altcoins, such as Litecoin and Namecoin, were launched to provide improvements in speed and utility. Ethereum came into the picture in 2015 and took the industry by storm.

In 2017 Bitcoin went into its first major bull run, nearing $20,000, followed by a dramatic crash in 2018 where BTC lost around 80% of its value. However, during the Covid-19 pandemic, investor interest spiked again, which pushed Bitcoin to an all-time high of $69,000 in November 2021.

Cut to 2025, crypto markets again hit lifetime highs, with Bitcoin soaring to $126,000 before facing a sharp correction recently that dragged prices below $80,000.

As of today, Bitcoin is trading below $90,000, rebounding from the recent losses.

What Are Indian Investors Buying? Memecoins vs Stablecoins

In India younger men are now shifting their capital from equities into memecoins and fast-moving altcoins. Meanwhile, older men aged 36-60 continue to participate actively but focus majorly on established tokens. However, certain categories of women prefer the less risky stablecoins, says the Giottus report.

As per the broader portfolio data, memecoins account for 34.2% of investor portfolios. While stablecoins make up 26%, and the blue-chip altcoins such as XRP and TRX form 13.6%.

There are some regional differences as well; while investors from Kerala & Tamil Nadu have a higher preference for stable, low-risk assets, investors from Gujarat & Chandigarh were reported to have larger exposure to memecoins.

While the hype around crypto trading is moving a large part of the market, many Indian investors are simultaneously looking for stability.

Giottus CEO Vikram Subburaj said, "Yes, memecoins get most of the attention, but what is truly exciting is the steady interest we're seeing in blue-chip altcoins and stable assets. It shows that India's crypto market is finally putting down strong roots. As more people join in and as regulatory clarity improves, I believe our digital-asset ecosystem will grow into a mature, data-driven investment space. We're learning to balance speed with stability, and that's a sign of a market evolving in the right direction."

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications