BHEL Share Price Surges 2% on Signing Exclusive MoU for Hydrogen-Powered Trains; Stock Down 25% From Highs

Bharat Heavy Electricals Ltd.'s share price rose 2.17% intraday high on Monday after it secured a long-term exclusive deal. The state-owned engineering and manufacturing company has signed a 10-year exclusive MoU with a Singapore firm to collaborate on hydrogen fuel cell-based rolling stock for the Indian market. The announcement was made on Friday Sept 5th and BHEL Stock today is currently surging in today's trading session.

BHEL Share Price Today

Shares of BHEL opened at Rs. 214.50 slightly higher than Friday's close. Around 11:30 am today, BHEL shares jumped about 2.33% to Rs. 217.31 apiece. Over the past five days, the stock has added modest gains, while it has declined 3.39% in the past month. On a six-month view, BHEL shares rallied nearly 12%, although it remains down 7.75% so far this year. Currently, Bhel Shares are down 25.63% from its 52W High range.

Details of the MoU With Horizon Fuel Cell Technologies

BHEL (Bharat Heavy Electricals Limited) has signed an exclusive 10-year agreement with Horizon Fuel Cell Technologies, a company based in Singapore, to work together on hydrogen fuel cell-powered trains for India's domestic market.

Key Points Of the Agreement

The main purpose of the partnership is focused on building rolling stock (train engines and cars) that use hydrogen fuel cells for cleaner, modern rail transport.

As per the press release shared by the company this is an exclusive deal as only BHEL will work with Horizon for this type of train in India for the next 10 years.

This agreement is expected to help both companies enter a new market segment and promote hydrogen-powered trains in India. Target is the domestic Indian market; not international sales

Nuvama's Outlook On Industrial Stocks

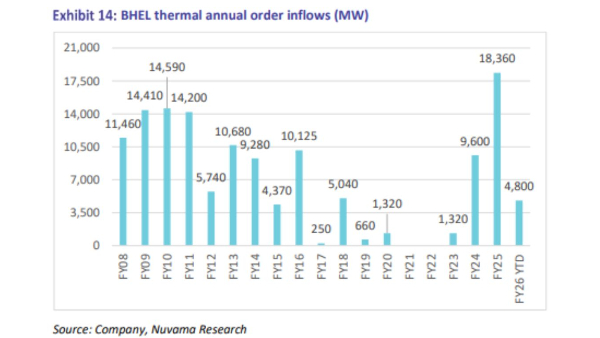

According to a report by Nuvama Institutional Equities dated August 22, India's industrial sector is showing strong momentum. Q1 FY26 order inflows for industrial companies surged 43% year-on-year to Rs. 1.3 trillion, while revenue rose 14% to Rs. 1.1 trillion, because of strong orders and execution in power generation (thermal and renewable), T&D, data centres, and electronics.

The report further highlighted that, "India's manufacturing sector contributes 17% to GDP (vis-a-vis services at 55%), making our country the sixth-largest manufacturing economy in the world, though contributing only 3.1% to the world GDP implying substantial headroom for growth."

Focusing on Bharat Heavy Electricals Ltd (BHEL), the PSU in its first quarter of FY26reported a net loss of Rs. 455.4 crore in Q1 FY26, compared to Rs. 211 crore in the same quarter last year, primarily due to higher expenses. However, revenue from operations was largely stable at Rs. 5,486.9 crore, up slightly from Rs. 5,484.9 crore a year ago.

BHEL Share Price Target: According to Geojit, "BHEL faces near-term earnings pressure due to rising costs and flat revenue, but strong order inflows and growth opportunities in Li-ion cells and renewable energy support its long-term potential. The brokerage maintains a HOLD rating with a revised target price of Rs. 229."

Disclaimer: The views and recommendations expressed are solely those of the individual analysts or entities and do not reflect the views of Goodreturns.in or Greynium Information Technologies Private Limited (together referred as "we"). We do not guarantee, endorse or take responsibility for the accuracy, completeness or reliability of any content, nor do we provide any investment advice or solicit the purchase or sale of securities. All information is provided for informational and educational purposes only and should be independently verified from licensed financial advisors before making any investment decisions.

Click it and Unblock the Notifications

Click it and Unblock the Notifications