What Is The Importance of 'Total Expense Ratio' In Mutual Funds?

Every time you are about to invest in a mutual fund, you are asked to read the scheme information document, which discloses all the scheme-related details including the 'total expense ratio' (TER). It usually is in a percentage form, which seems like a tiny portion. However, total expense ratio does impact your returns, so it should not be ignored or taken lightly.

What is TER

As per market regulator SEBI, mutual funds are permitted to charge certain operating expenses for managing a mutual fund scheme - such as sales & marketing/advertising expenses, administrative expenses, transaction costs, investment management fees, registrar fees, custodian fees, audit fees - as a percentage of the fund's daily net assets.

In short, total expense ratio is a measure of the cost of owning a mutual fund. It is typically deducted from the fund's net asset value (NAV) daily.

Importance of TER

The expense ratio is an important factor to consider when choosing a mutual fund, as it can have a significant impact on your investment returns. For example, a fund with an expense ratio of 1% will reduce your returns by 1% each year, even if the fund itself generates a 10% return.

Expense ratios can have a significant impact on your investment returns. Over time, even a small expense ratio can erode your returns. For example, an investor who invests Rs 10,000 in a fund with an expense ratio of 1% and earns an annual return of 8% would have Rs 16,381 after 10 years. However, if the fund had an expense ratio of 0.5%, the investor would have Rs 16,582 after 10 years. That's a difference of Rs 201.

When choosing a mutual fund, it is important to compare expense ratios. Even funds with similar investment objectives can have significantly different expense ratios. For example, the average expense ratio for a large cap growth fund is 1.1%, but there are funds with expense ratios as low as 0.15%.

There are a few things to keep in mind when evaluating a mutual fund's expense ratio.

- First, it is important to compare the expense ratio to other funds in the same category. For example, you would not want to invest in a growth fund with a higher expense ratio than a value fund, even if the growth fund has a higher historical return.

- Second, it is important to consider the fund's investment objectives. If you are investing for the long term, you may be willing to pay a higher expense ratio for a fund that has a proven track record of success. However, if you are investing for the short term, you may want to choose a fund with a lower expense ratio.

- Third, it is important to remember that the expense ratio is not the only factor that determines a fund's performance. You should also consider the fund's management team, investment style, and risk profile.

- Fourth, consider investing in a direct-sold mutual fund, as these funds typically have lower TERs than funds that are sold through brokers.

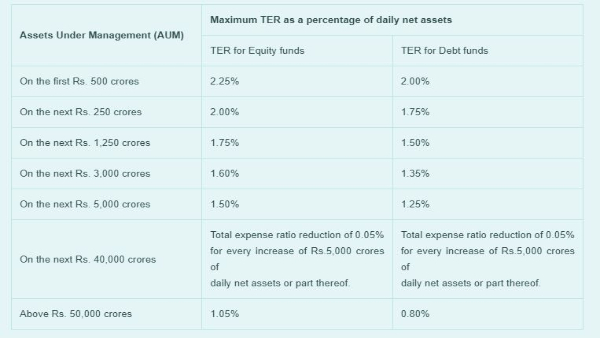

Currently, in India, the expense ratio is fungible, i.e. there is no limit on any particular type of allowed expense as long as the total expense ratio is within the prescribed limit. The regulatory limits of TER that can be incurred/charged to the fund by a Mutual Fund AMC have been specified and made effective from April 1, 2020.

(Source: Amfi)

In addition, mutual funds have been allowed to charge up to 30 bps more, if the new inflows from retail investors from beyond the top 30 cities (B30) cities are at least (a) 30% of gross new inflows in the scheme or (b) 15% of the average assets under management (year to date) of the scheme, whichever is higher. This is essential to encourage inflows into mutual funds from tier-2 and tier-3 cities.

Conclusion

TER has a direct bearing on a scheme's NAV - the lower the expense ratio of a scheme, the higher the NAV. Thus, TER is an important parameter when selecting a mutual fund scheme.

It is important to note that TERs are not always a reliable indicator of a fund's performance. Many other factors can affect a fund's performance, such as the skill of the fund manager and the overall market conditions. However, TERs can be a helpful tool when comparing different funds and choosing one that is right for you.

Click it and Unblock the Notifications

Click it and Unblock the Notifications